This week’s letter begins with an overview of reflexivity. Many works exist on this topic, with “The Alchemy of Finance” summarizing it well. Written by investor George Soros, it concludes that markets are often wrong, and biases validate themselves by influencing prices and the fundamentals they should reflect.

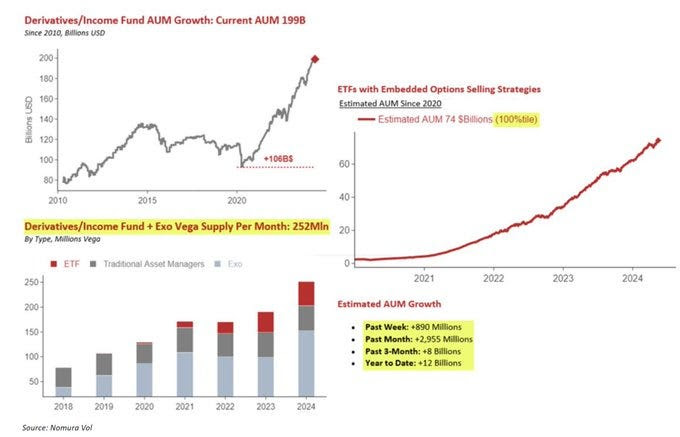

Namely, reflexivity is this feedback loop between participants’ understanding and the situations they’re participating in. Sometimes, these feedbacks manifest far-from-equilibrium prices. Think of the connection between lending and collateral value, selling stock to finance growth in the dot-com boom, leaning on cheap money to make longer-duration bets on promising ideas, or the success of volatility trades increasing the crowd in volatility investments, be this dispersion or options selling ETFs.

Perception begets reality, with these far-from-equilibrium conditions reinforced until expectations are so far-fetched they become unsustainable. Sometimes, the corrections become something more, with self-reinforcing trends initiating the opposite way.

Enron creatively hid debt from its balance sheets, guaranteeing it with its stock. When the stock fell, it revealed financial misdeeds, contributing to a broader market downtrend, bankruptcies, and corporate scandals.

FTX brought itself and some peers down when withdrawals revealed a billions-large gap between liabilities and assets.

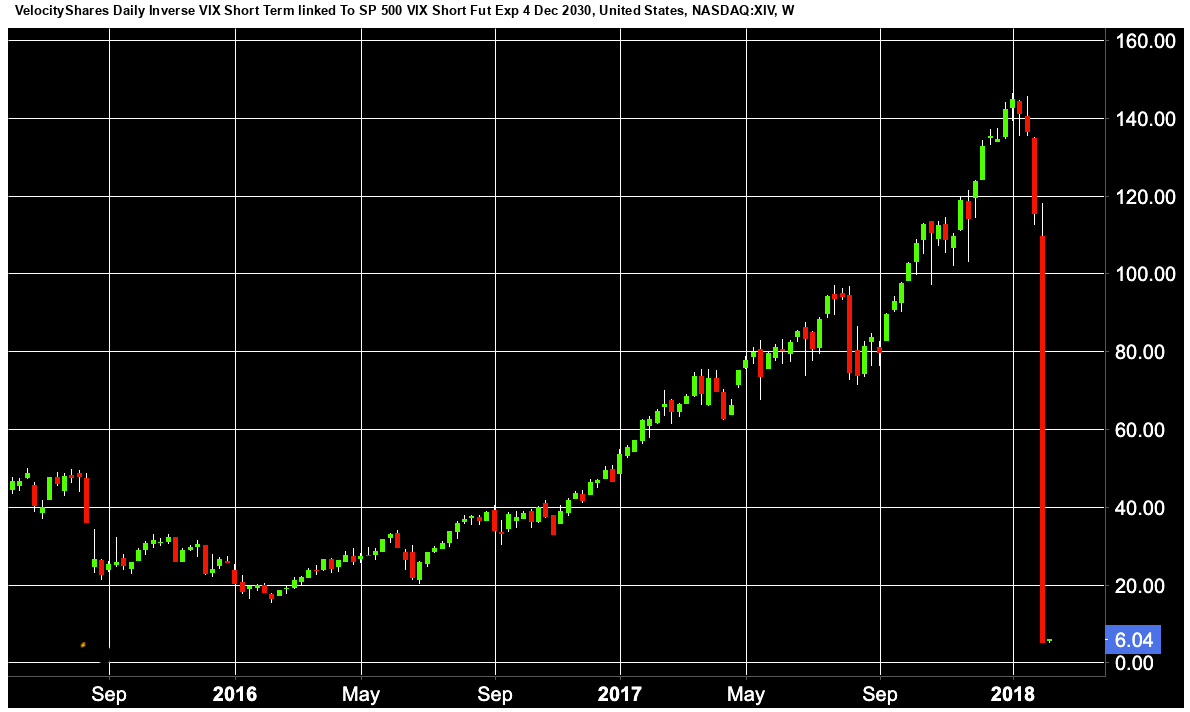

Volmageddon climaxed with the demise of products like the VelocityShares Daily Inverse VIX Short Term Exchange-Traded Note (ETN: XIV) after a sharp jump in volatility sparked a doom loop; to remain neutral, issuers rebalanced, buying large amounts of VIX futures, which propelled volatility even higher and sent products like XIV even lower.

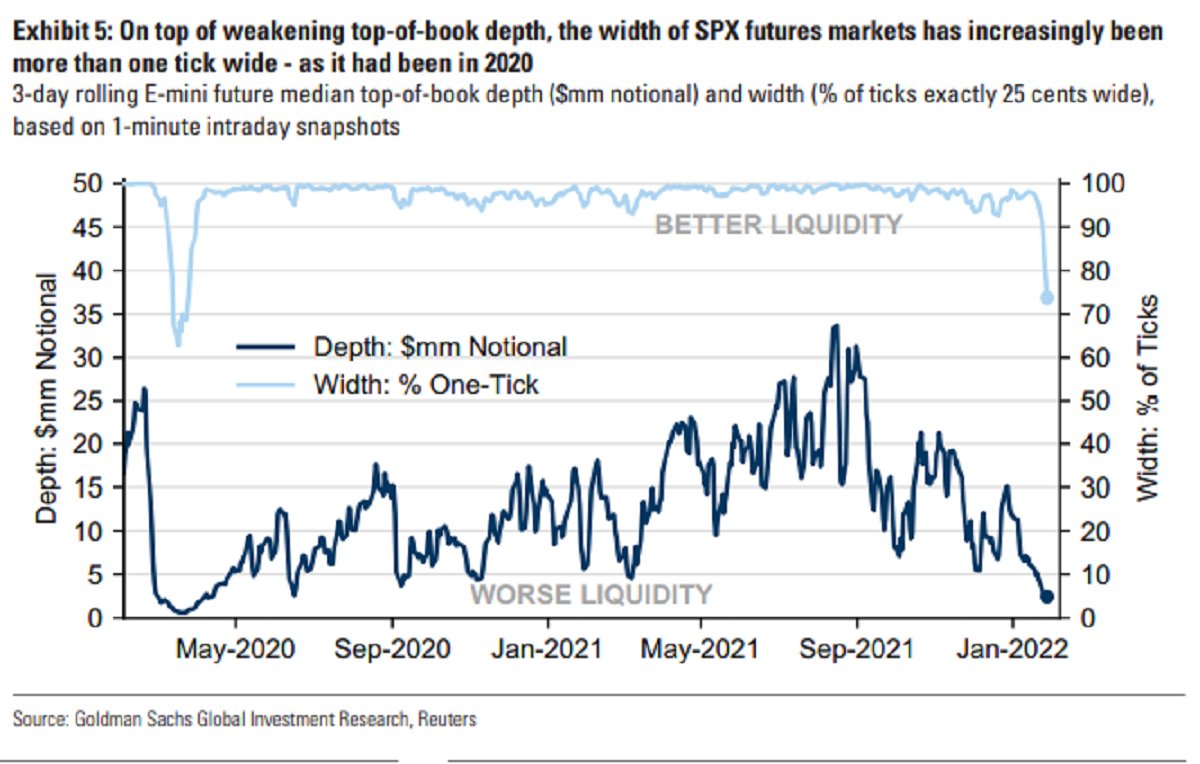

The expansion of such trades increases liquidity, sometimes making assets appear more liquid and money-like stores of wealth. This may also stimulate economic growth. Likewise, the contraction or closing of these trades can lead to a sudden reduction in liquidity, negatively impacting the economy and market stability.

“The Alchemy of Finance” identifies a recurring asymmetric market pattern of slow rises and abrupt falls. Additionally, if market prices accurately reflected fundamentals, there would be no opportunity to make additional money; just invest in index funds.

Further, we continue to see interventions to stabilize markets, and they encourage further distortion and misdirection of capital. Often, such interventions are blamed for benefitting wealthy investors most and increasing inequality. As explained in works like “The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis,” monetary authorities and regulators’ interventions reinforce scenarios of deteriorating economic growth, more frequent crises and less equality and social cohesion.

We’re getting off track, but the point is that the conclusions and approaches outlined in “The Alchemy of Finance” are captivating. Soros sought to understand markets from within without formal training, access to unique information, or his being math savvy; instead, he attempted to connect deeply with markets, assuming they felt like he did and he could sense their mood changes.

“We must recognize that thinking forms part of reality instead of being separate from it,” he explains. “I assumed that the market felt the same way as I did, and by keeping myself detached from other personal feelings, I could sense changes in its mood, … mak[ing] a conscious effort to find investment theses that were at odds with the prevailing opinion.”

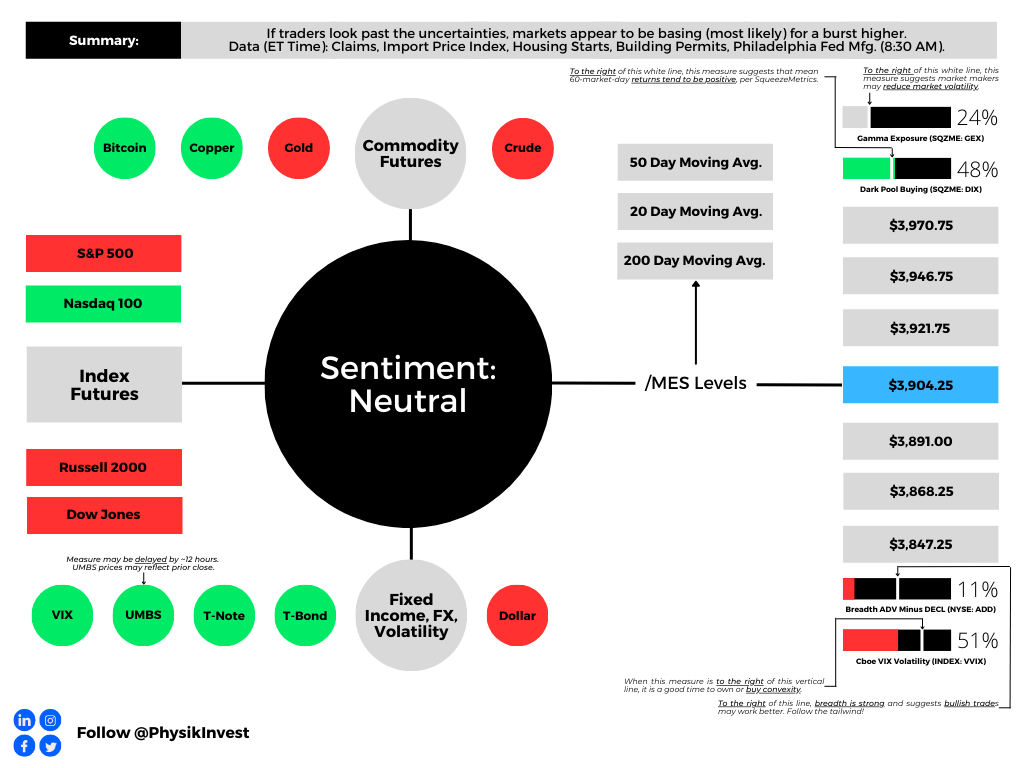

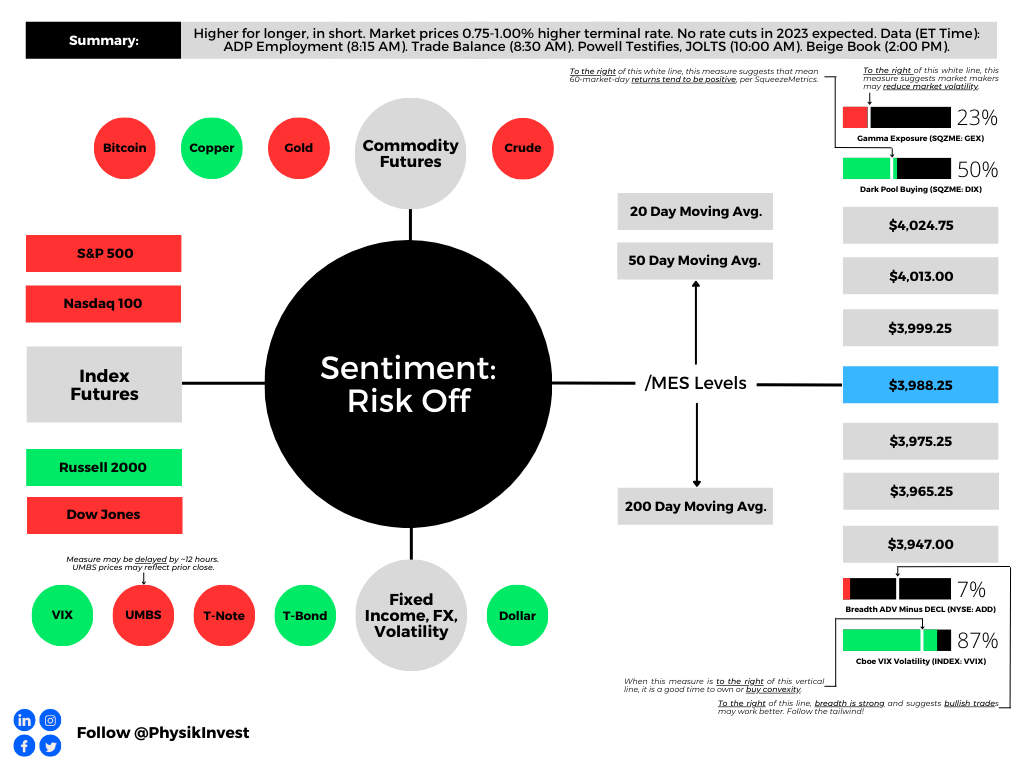

We apply this understanding of the market’s mood in our best way here. Our long-winded analyses of everything from technicals to positioning and, increasingly, fundamentals and macroeconomic themes give us a holistic understanding of what’s at stake, whether self-reinforcing trends exist, and whether to adjust how we express ourselves.

Let’s get into it.

The Great Rotation

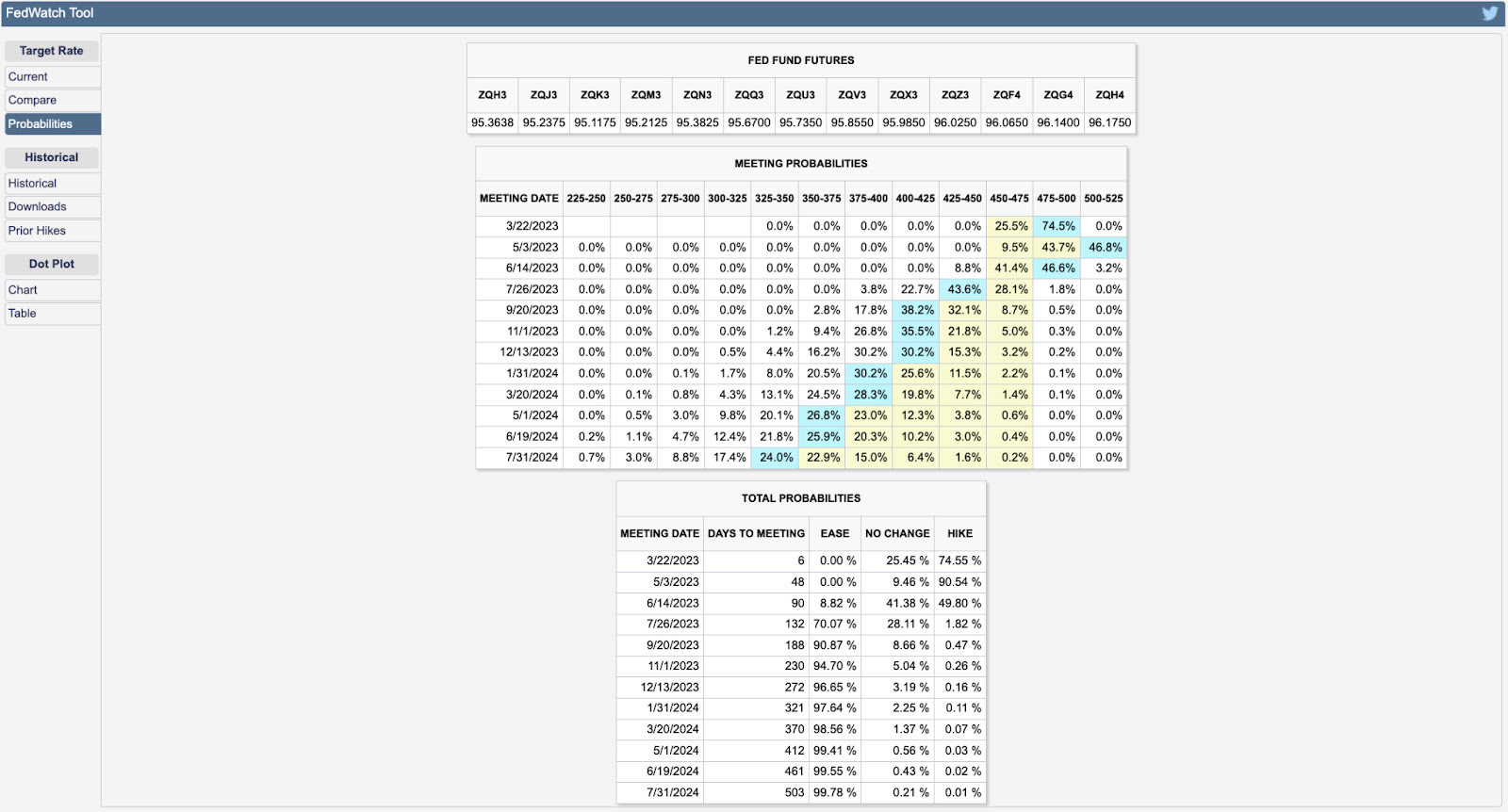

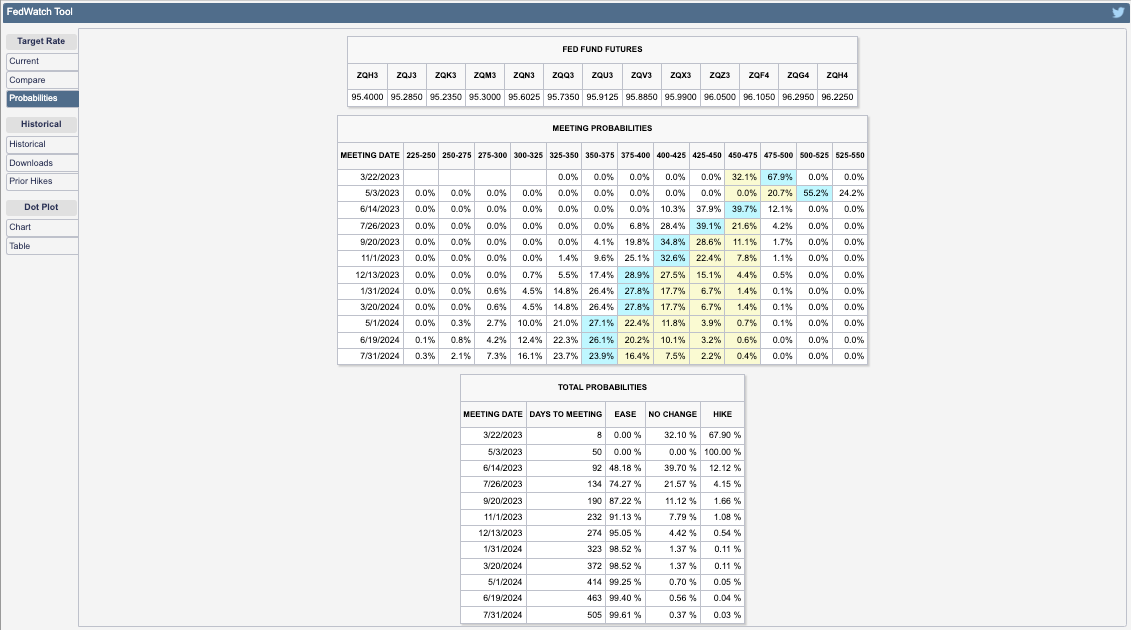

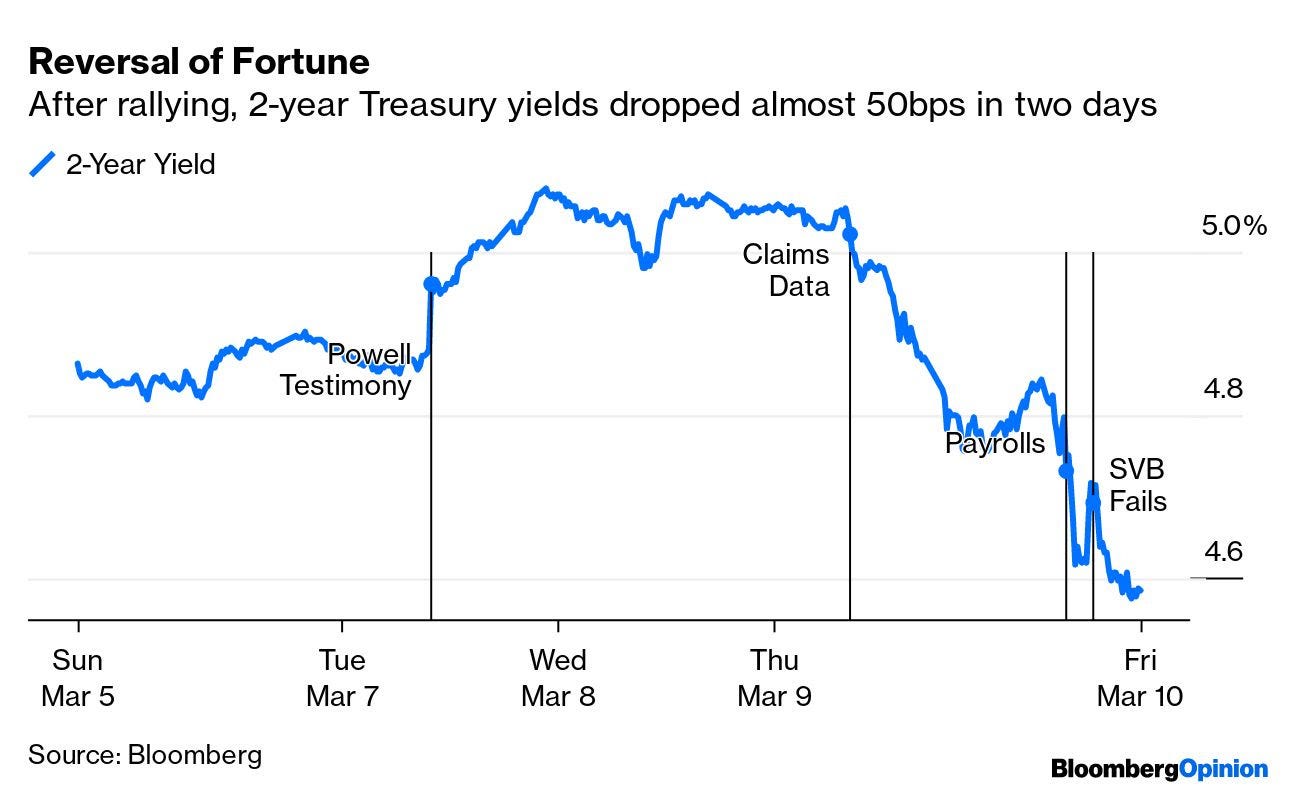

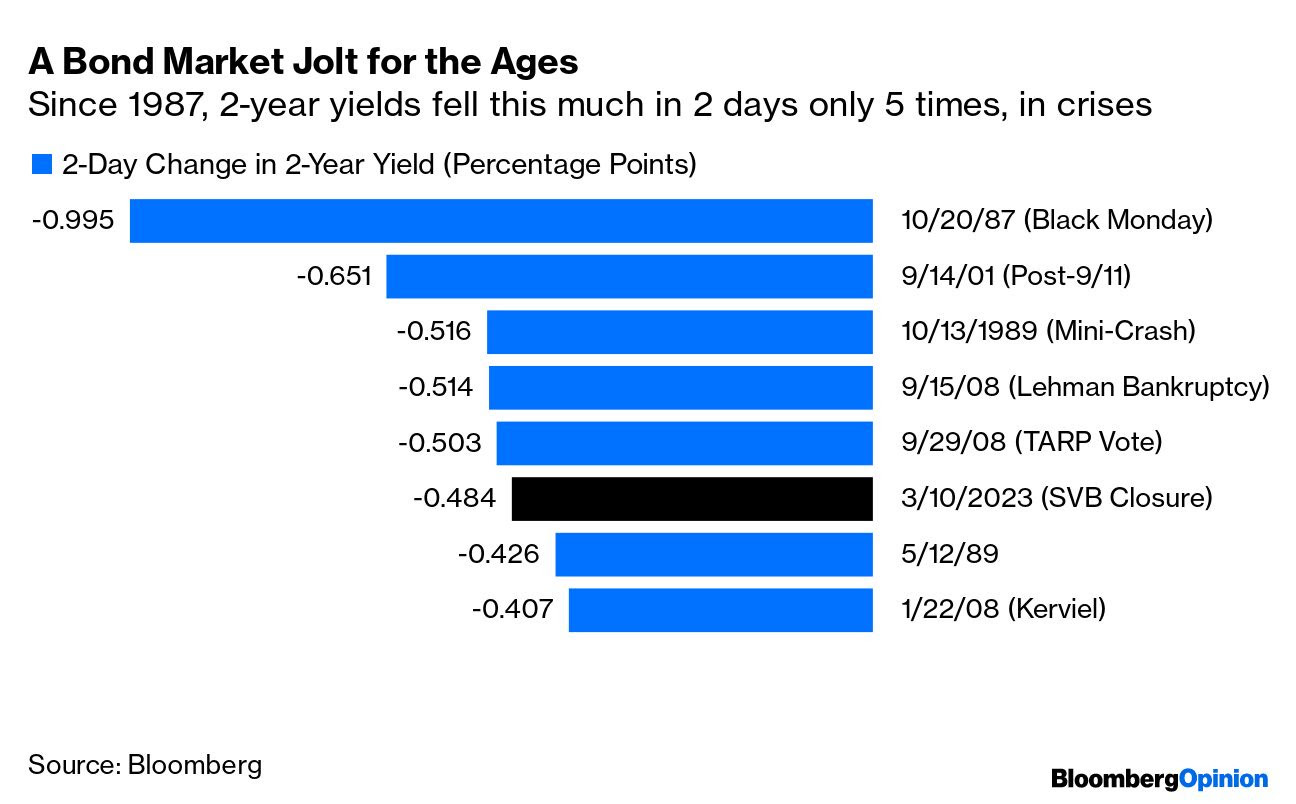

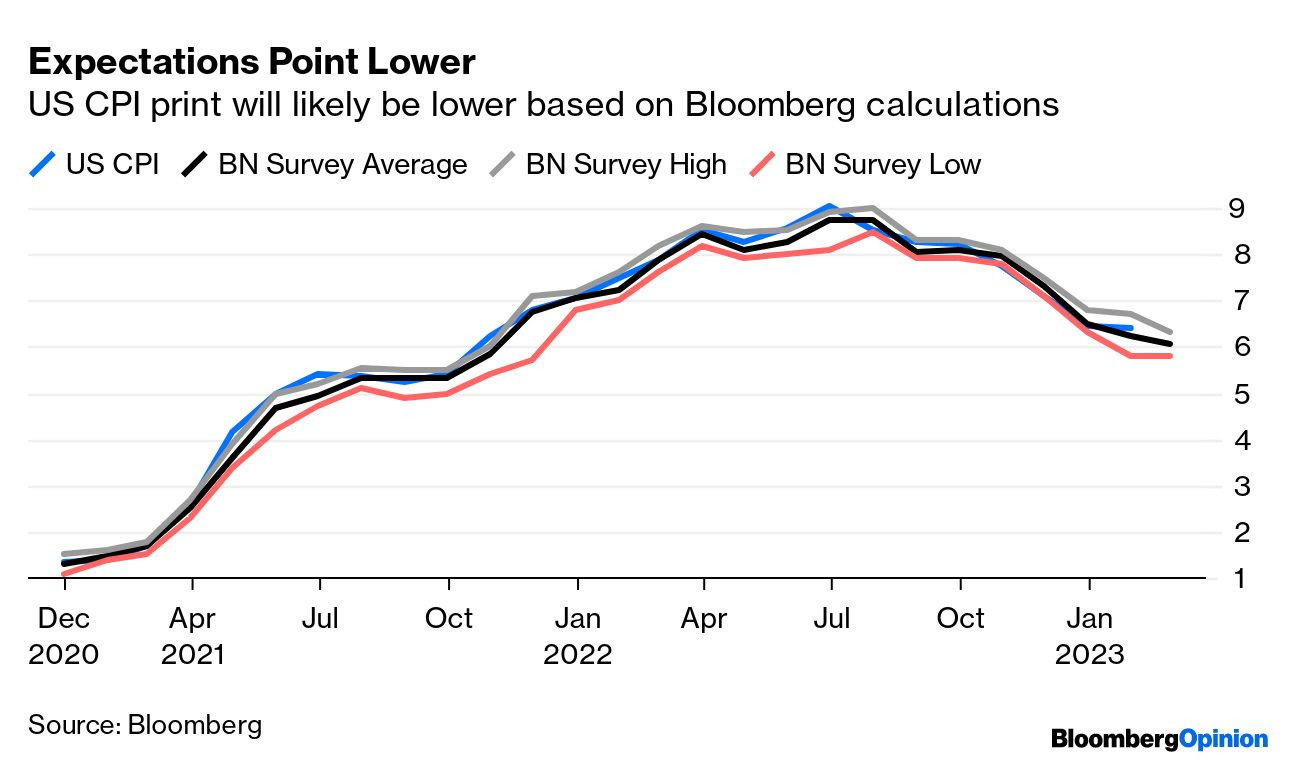

Last Thursday, an update on consumer prices showed US inflation cooling to its slowest pace since 2021. Accordingly, traders began pricing the news and buying bonds in anticipation the Federal Reserve may cut its benchmark rate by ~0.75% this year.

Optimism about lower interest rates prompted investors to shift from the previously favored large-cap tech, AI, and Mag-7 stocks into riskier market areas and safe-haven assets like gold, reflecting concerns about a potential dovish mistake. The Russell 2000 (INDEX: RUT), an index of smaller companies, outperformed the Nasdaq 100 (INDEX: NDX) by one of the most significant margins in the last decade. Despite the S&P 500 (INDEX: SPX) declining by nearly 1%, almost 400 components recorded gains.

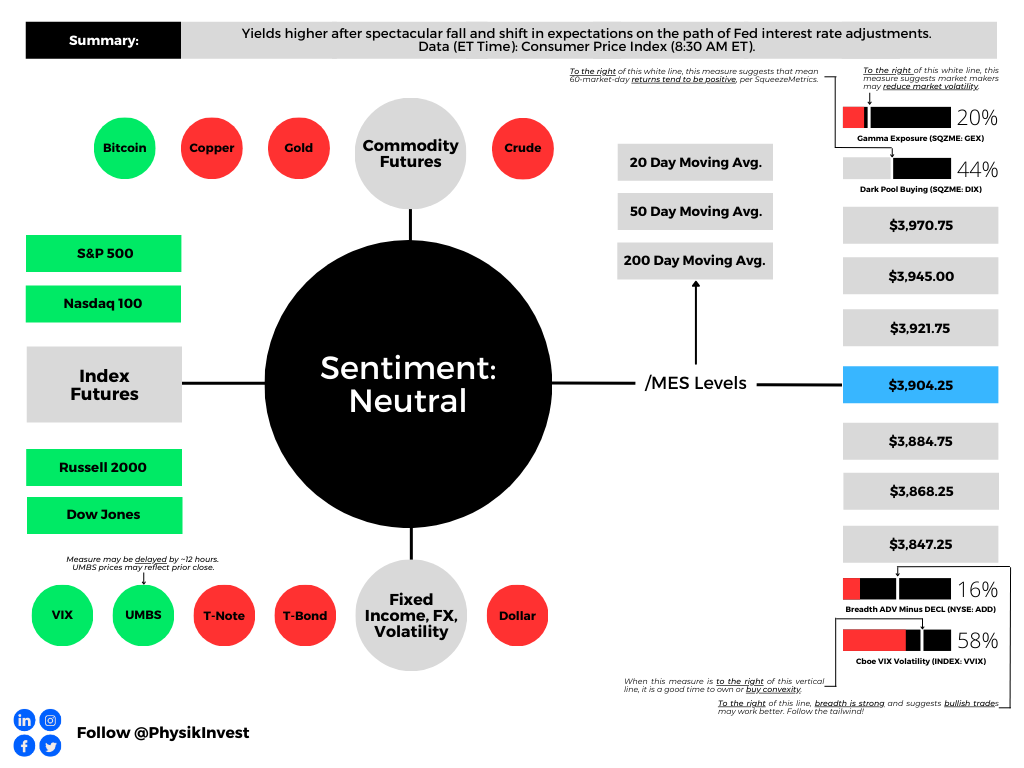

With these underlying divergences, committing capital to bearish positions is challenging. Breadth strengthened with more volume flowing into rising stocks than falling ones. This wouldn’t happen in a sell-everything scenario, explaining the hesitation to sell.

The outsized movement observed isn’t surprising as it aligns with the narrative we shared earlier this year.

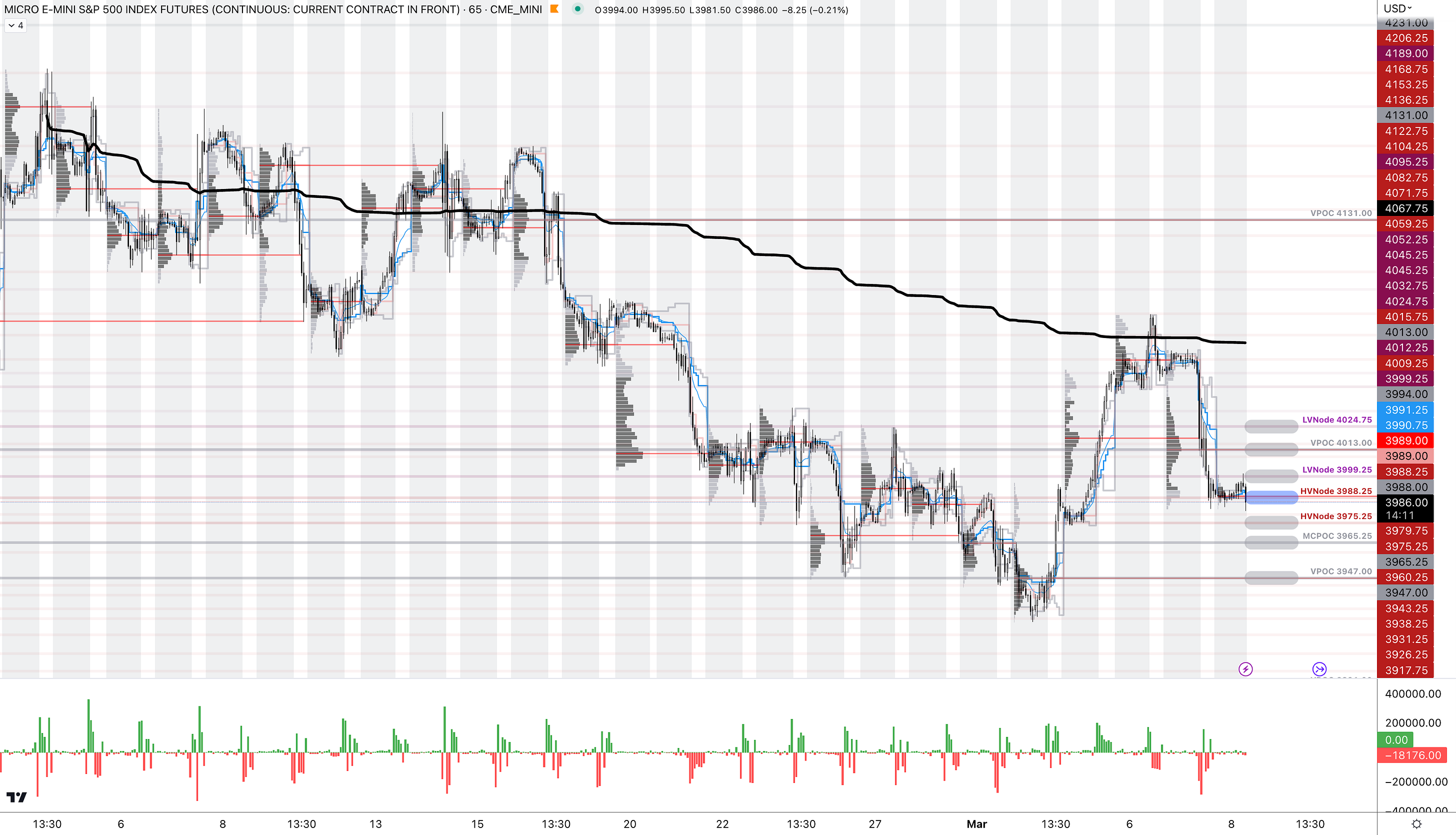

While individual stocks are experiencing significant volatility, indexes like the S&P 500, which represent these stocks, show more restrained movement. For example, after Thursday’s sell-off, despite its large constituents like Nvidia Corporation (NASDAQ: NVDA) weakening, the S&P 500 firmed.

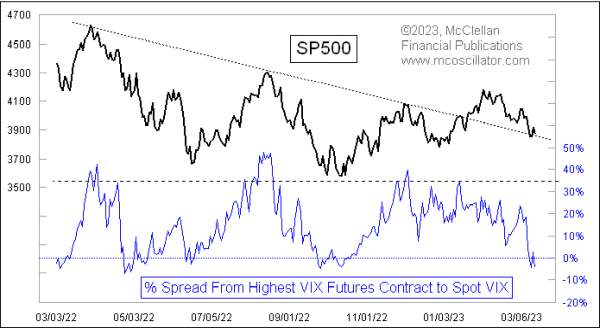

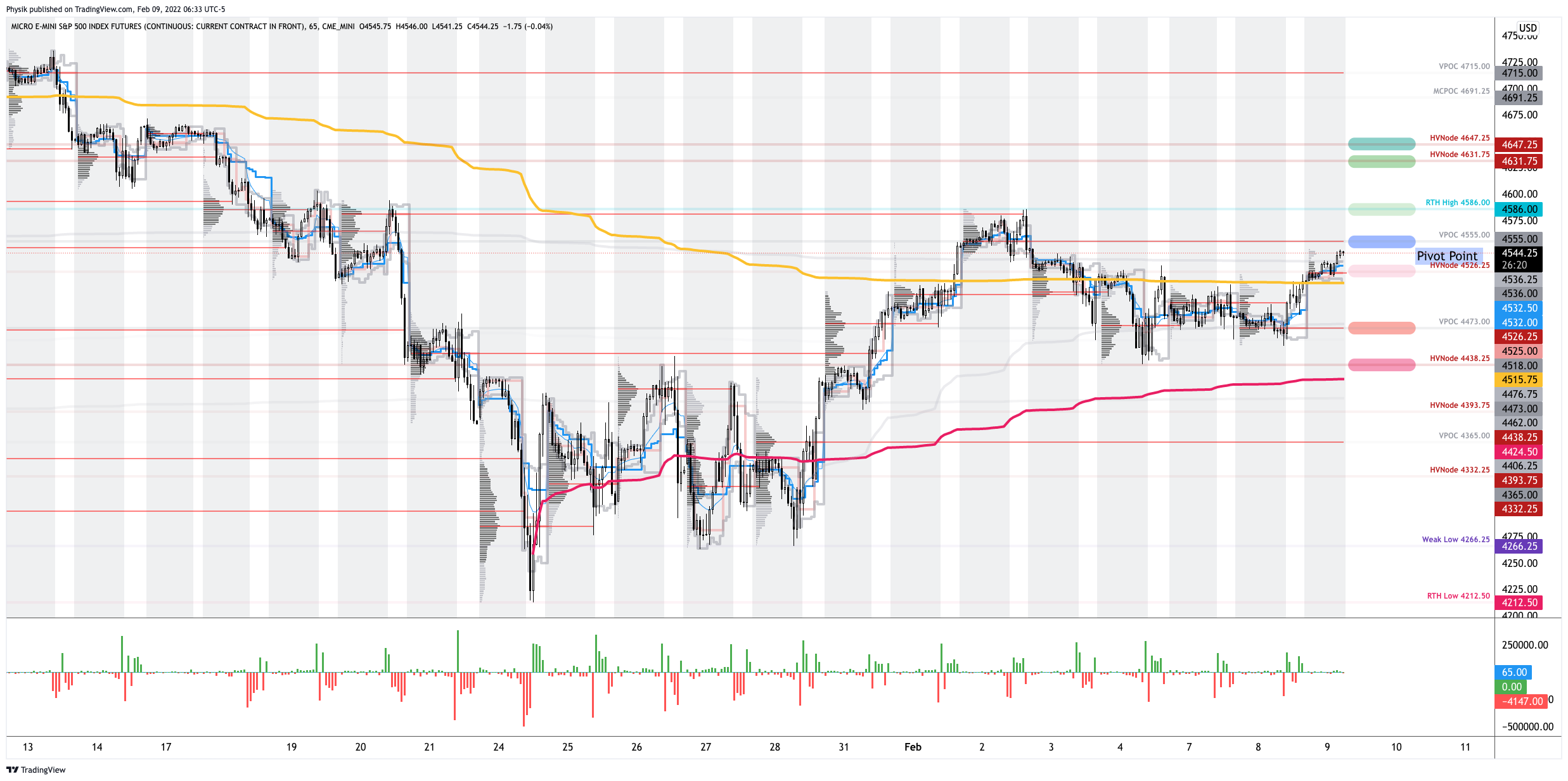

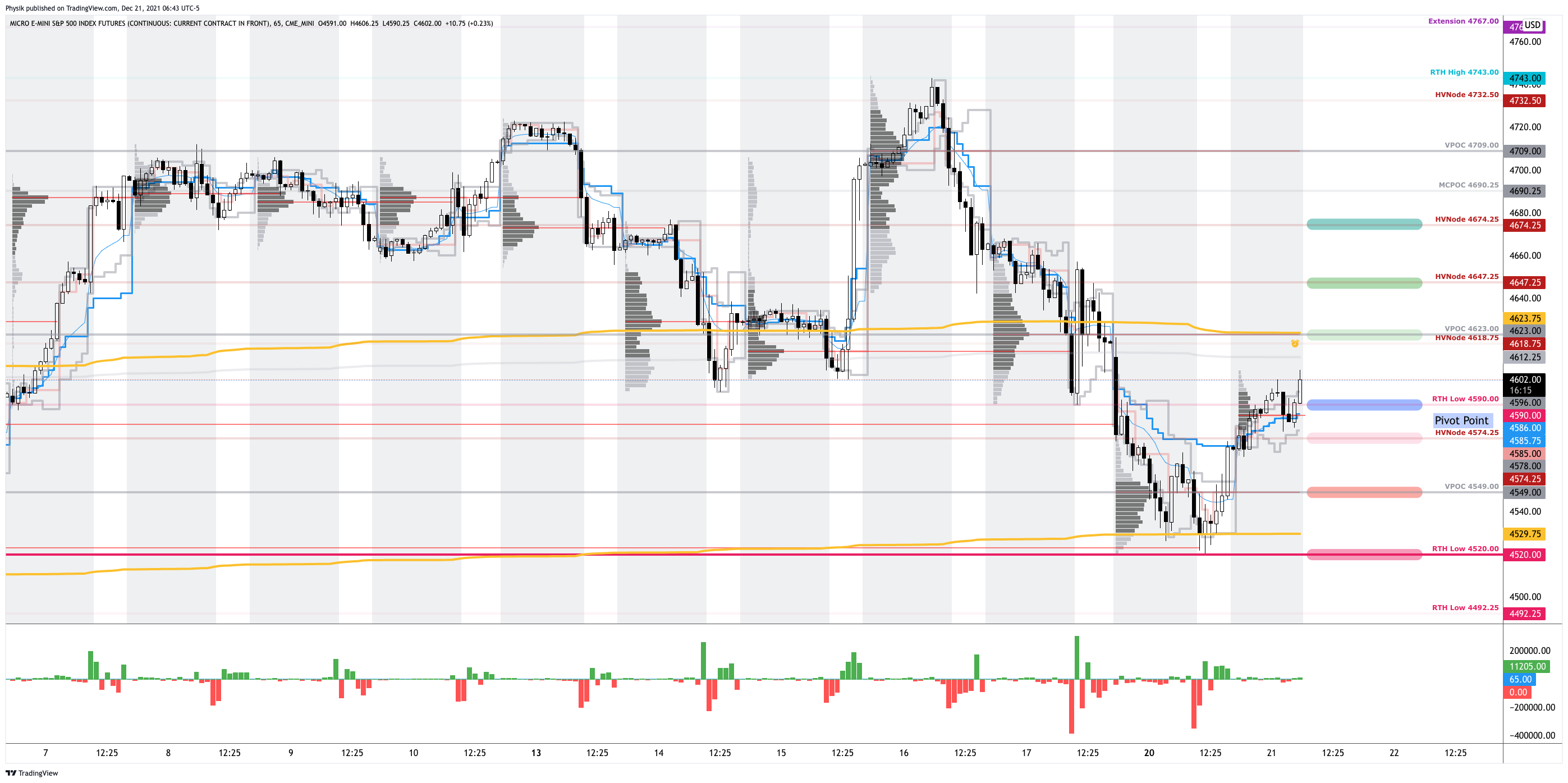

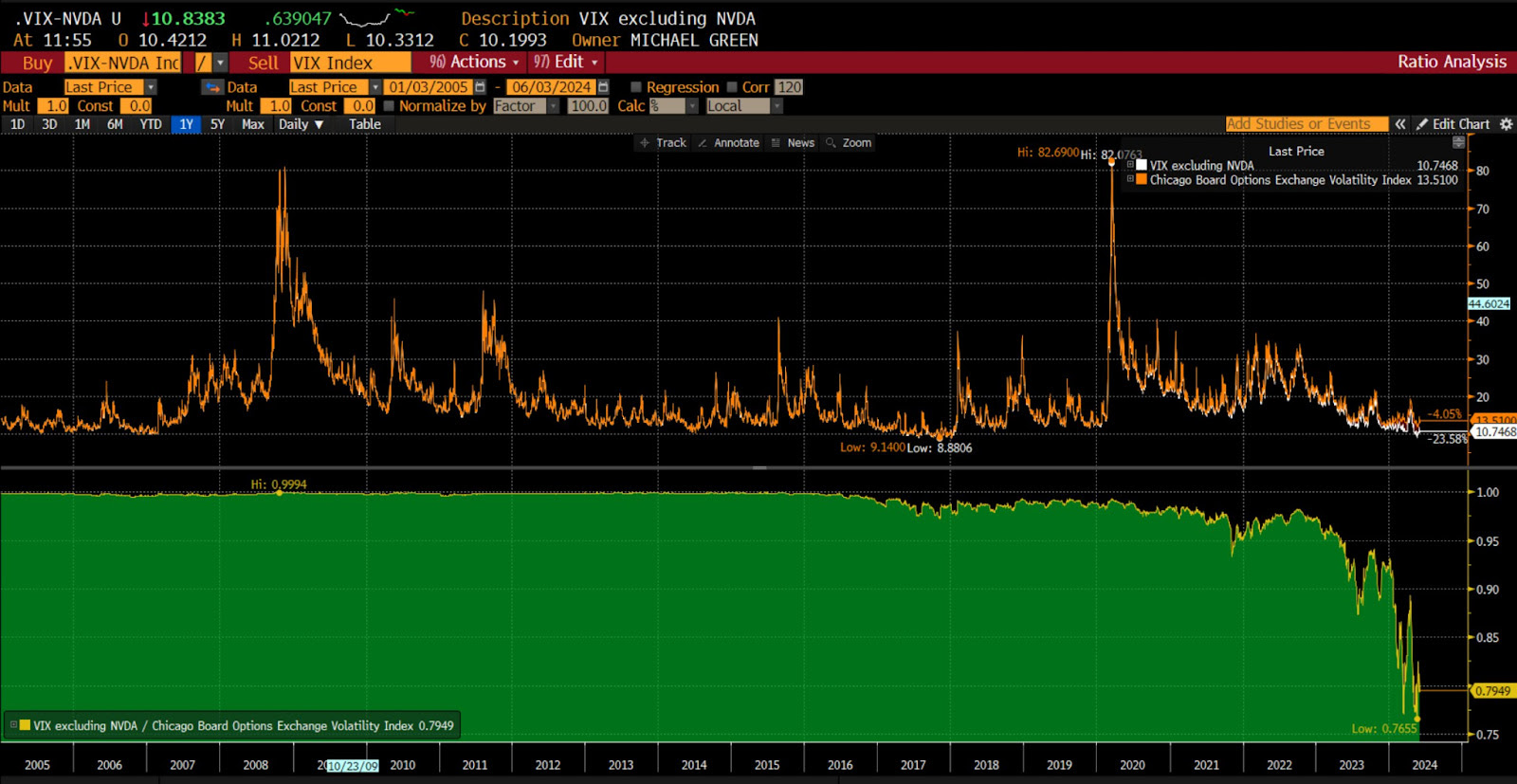

Here’s a chart to illustrate.

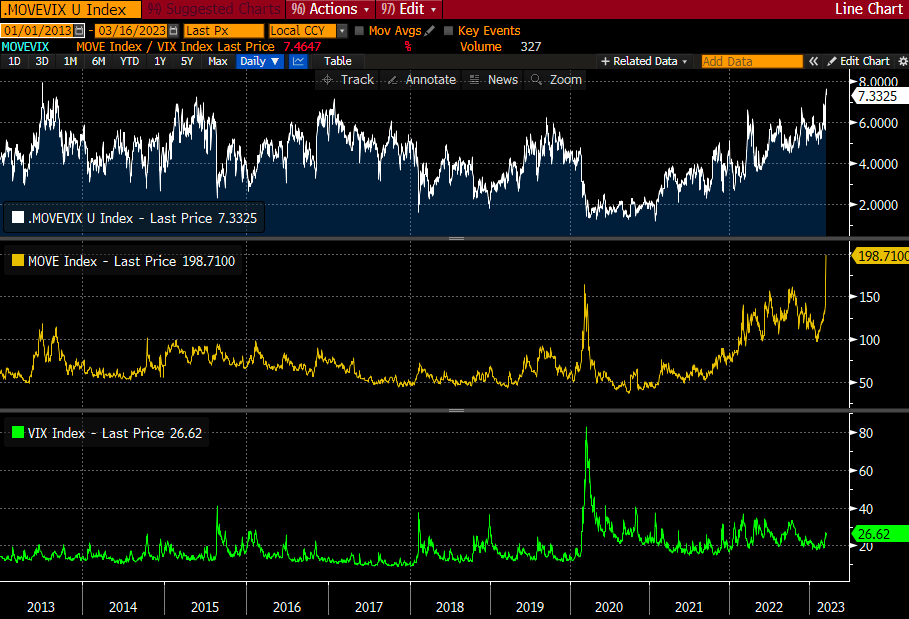

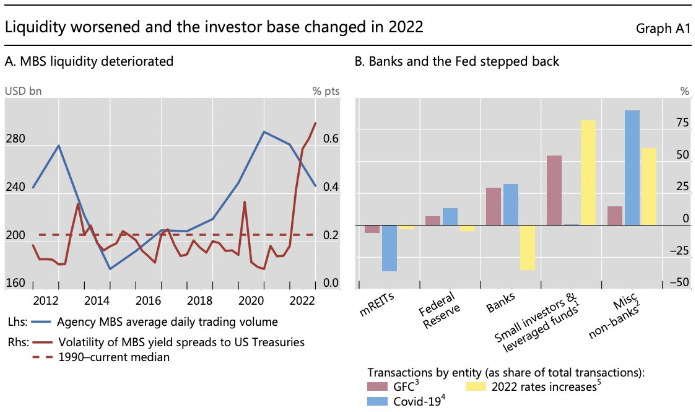

Among the culprits, investors have concentrated on selling options or volatility (the all-encompassing term) on indexes, and some of this is used to fund volatility in components, a trade (considered an investment by some) known as dispersion.

The trade is doing well in this environment, with Cboe’s S&P 500 Dispersion Index (INDEX: DSPX) jumping to a one-year high. Dropping realized volatility (i.e., volatility calculated using historical price data) and a widening spread between stock and index implied volatility (i.e., expectations of future volatility derived from options prices) validate this trade’s success, reports Mandy Xu, the Vice President and Head of Derivatives Market Intelligence at Cboe Global Markets (BATS: CBOE).

“The market has been broken up into two groups: 1. Nvidia and Magnificent 7; and 2. The other 493. The correlation between those two groups has been low, which has pressured S&P 500 correlation,” explained Chris Murphy, a derivatives strategy co-head at Susquehanna. “When looking at S&P stocks on an equal-weighted basis, the outsized impact of the MAG7 as a group and NVDA specifically is neutralized.”

Understanding correlation is critical to grasping the pricing dynamics between index options and their components and trading volatility dispersion. When counterparties (our all-encompassing term for the dealers, banks, or market makers who may be on the other side) fill their customers’ options sales in the index, they may hedge by buying the index as its price falls and selling when it rises, with all other conditions remaining the same. Consequently, trading ranges may narrow, with realized volatility also falling.

To explain visually, see immediately below. Movement benefits the counterparty’s position. Hedging may result in trading against the market, selling strength, and buying weakness.

This effect may be less pronounced or absent in single stocks, which do not experience the same level of this supposed volatility selling; instead, there is more buying, and the opposite occurs. Movement is a detriment to the counterparty’s position, with all else equal. Hedging may result in trading with the market, buying strength, and selling weakness. This can reinforce momentum and give trends a lease on their life; hedging can help sustain and extend market movements rather than neutralize them.

Together, as counterparties align the index with its underlying basket through arbitrage constraints, its volatility is suppressed, and the components can continue to exhibit their unique volatility—the only possible outcome is a decline in correlation. If the index is pinned and one of the larger constituents moves considerably, the dispersion trader may make good money in such a scenario.

We now see large stocks starting to turn and lesser-weighted constituents in the S&P 500 firming up, picking up the slack. For instance, Nvidia traded markedly higher immediately after its last earnings report, and the S&P 500 was unfazed. Something is giving, and those constraints we talked about keep things intact.

The rotation, in and of itself, is healthy, giving legs to and broadening the equity market rally. It’s just that it’s happening with the most-loved stocks being severely overbought.

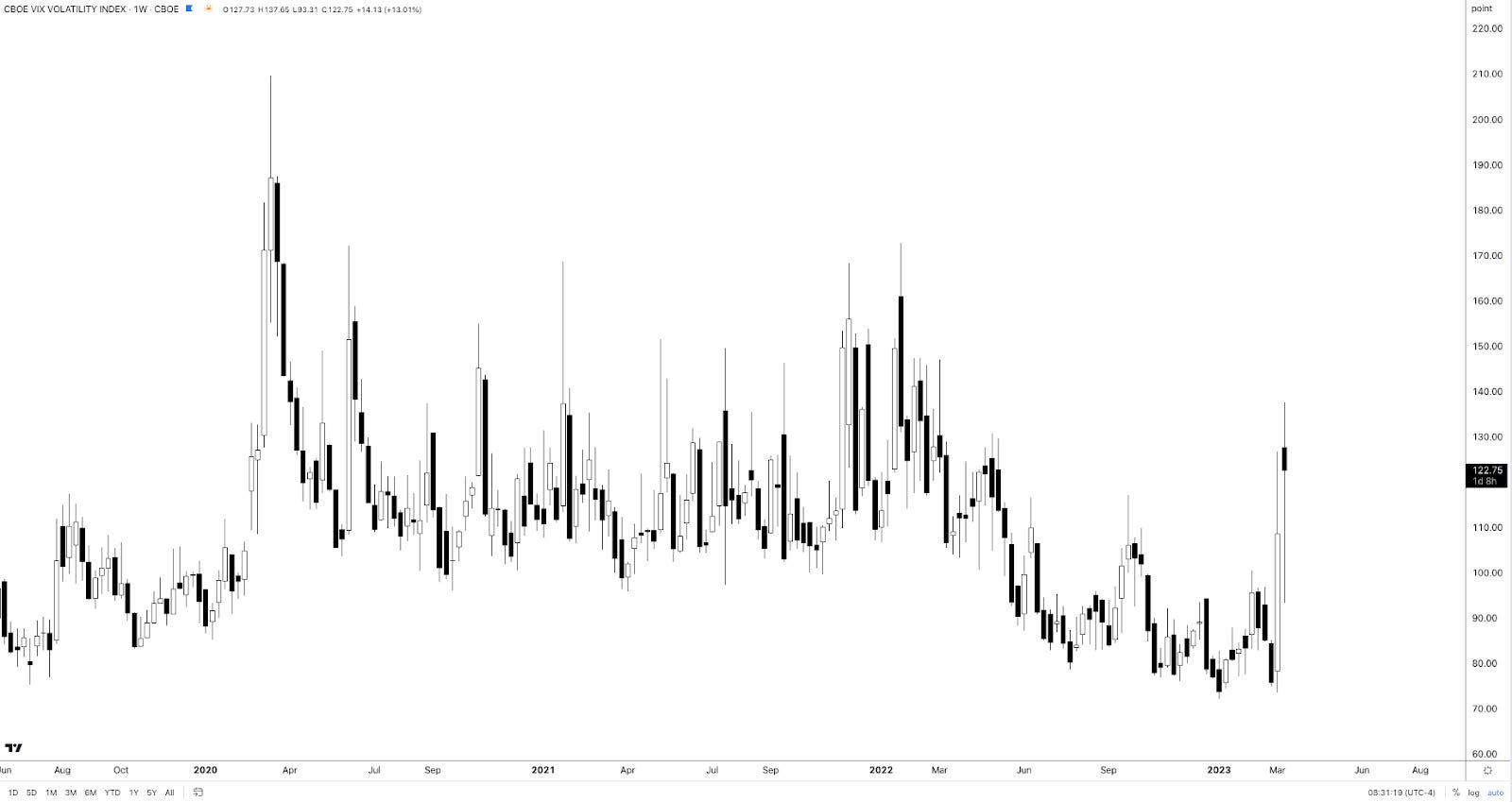

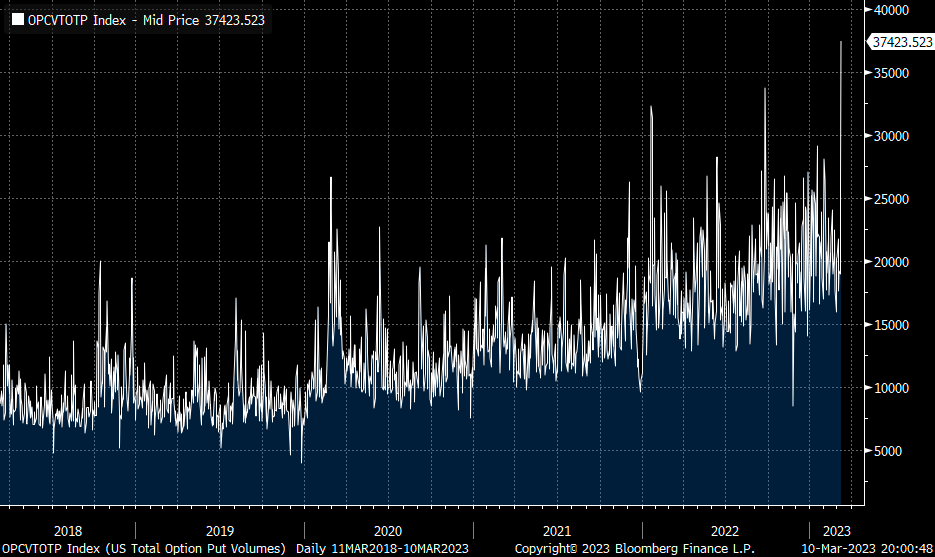

Should interruptions continue across large-cap equities, souring speculation on further upside, a broader turn and outflows may manifest. The market’s gradual shift into a higher implied volatility environment, notwithstanding direction, may aid in any such unsettling, feeding into a higher realized volatility.

Building on this point, we observe a shift in S&P 500 call options before last Thursday’s steep decline. Implied volatility rose with the S&P 500. SpotGamma indicates this is partly the result of demand for SPX call options as traders seek synthetic exposure to the upside in the place of stock. This “SPX up, SPX vol up” pattern is unusual and typically happens near the short-term tops.

SpotGamma adds that the pressure on individual stocks that followed last Thursday stemmed from significant selling of longer-dated calls in the tech sector, a last-in, first-out (LIFO) phenomenon. In other words, those late to the party are the first out!

The counterparts on the other side of this trading potentially (re)hedge this by selling stock.

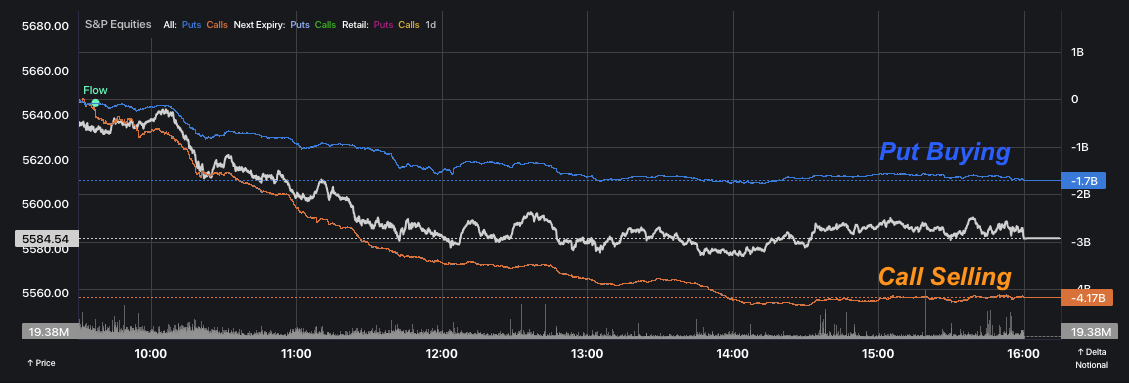

However, with call selling, the chances of sustained follow-through are significantly lower. Put buying, which was less prevalent, changes this dynamic.

In the case of a prolonged downturn, equity put buying is the key indicator we would watch for, along with deteriorating market internals such as breadth, as analyzed earlier. We want to see traders committing more money to the downside at lower prices, and increasingly so, as prices drop and the range expands downward. That’s what market and volume profiles can help with!

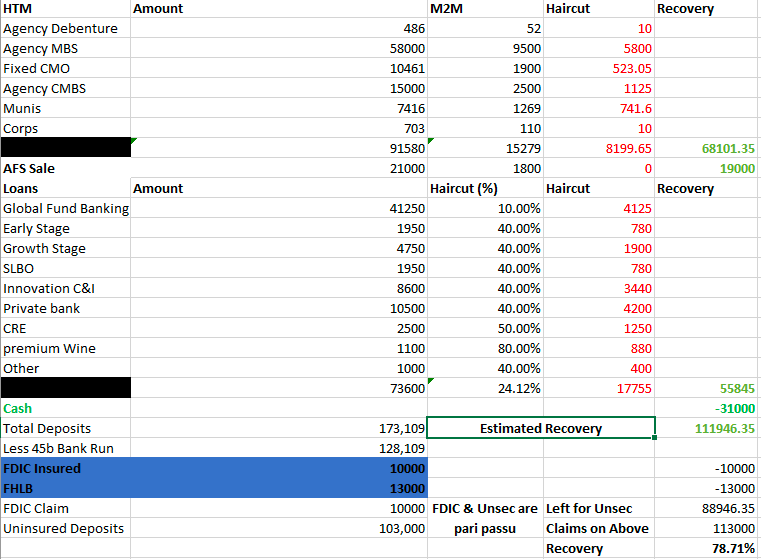

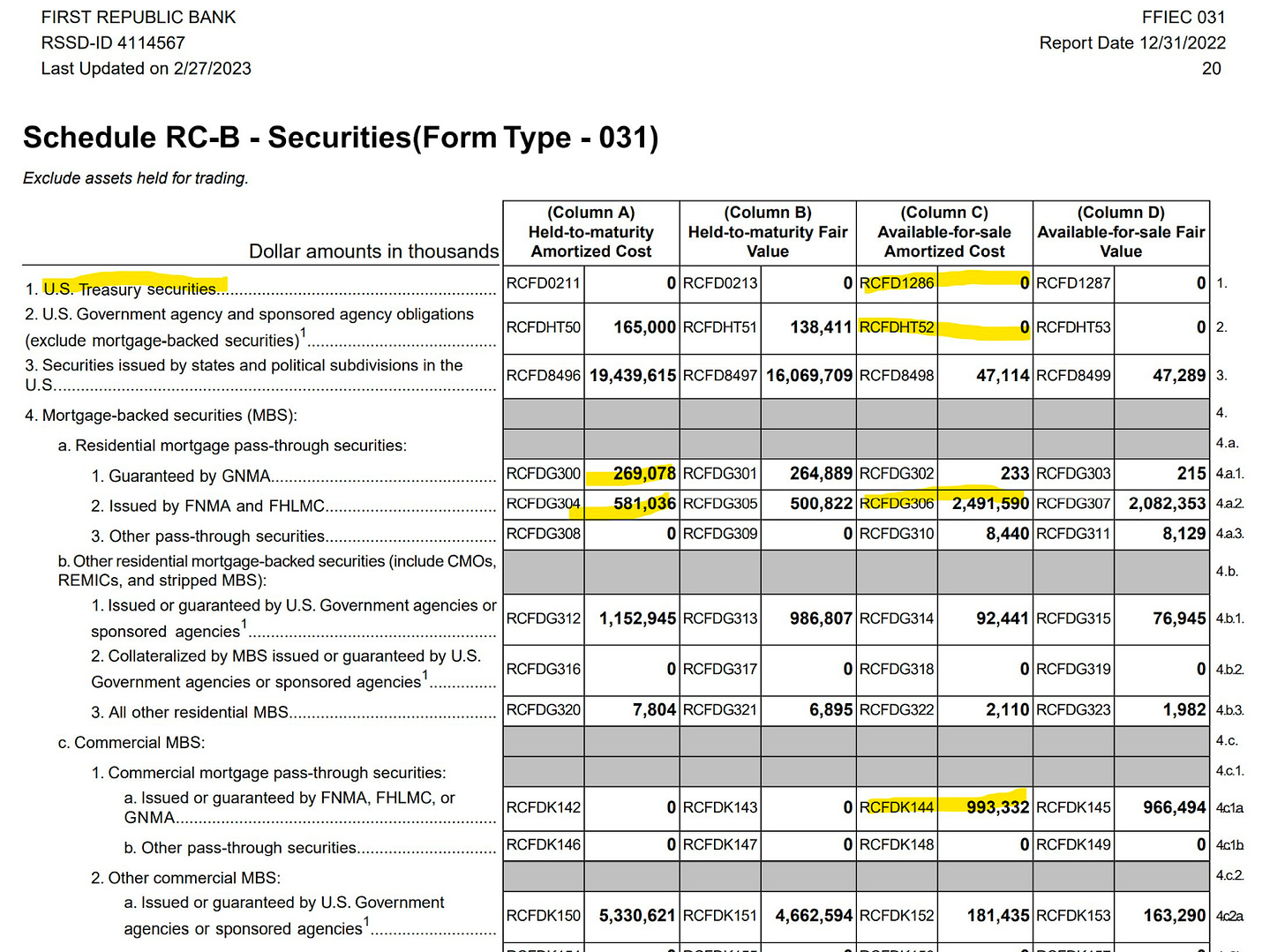

The fundamentals don’t necessarily support the case for some disastrous downside, though.

A dovish Fed can be good for risk as it’s seen as preemptive, BNP Paribas (OTC: BNPQY) shares. Or, a dovish Fed could suggest a coming deceleration. In any case, long-term interest rates will be least sensitive to any change, a negative implication for capital formation, growth, and equity returns.

The Summer Of George

Kai Volatility founder Cem Karsan uses this Summer of George Seinfeld reference to describe the current market. During the summer months, there is insufficient liquidity to overwhelm the market’s current position.

We know the SPX volatility risk premium is near its highs this year. The Cboe, itself, shows the implied-realized volatility spread widening to 4.5% (96th percentile high).

Implied volatility is low, but not cheap. Consequently, short-leaning volatility trades mentioned in this document remain attractive.

At the same time, however, there’s still a ton of volatility protecting investors against downsides owned below the market.

To quote QVR Advisors, there’s “too much supply of front month call selling and too much buying demand for longer-dated puts.”

“This trade flow is contributing to a large and growing structural dislocation which is not compensating ‘insurance sellers’ (i.e., near-dated call and put writers) and is overcharging in implied volatility terms, buyers of insurance (i.e., long-dated puts).”

Taken together, the implications are staggering. With calm and falling realized volatility, there may be some counterparty re-hedging. This may consist of buying stocks and futures and supporting markets where they are.

Let’s break down some of the trades to understand better.

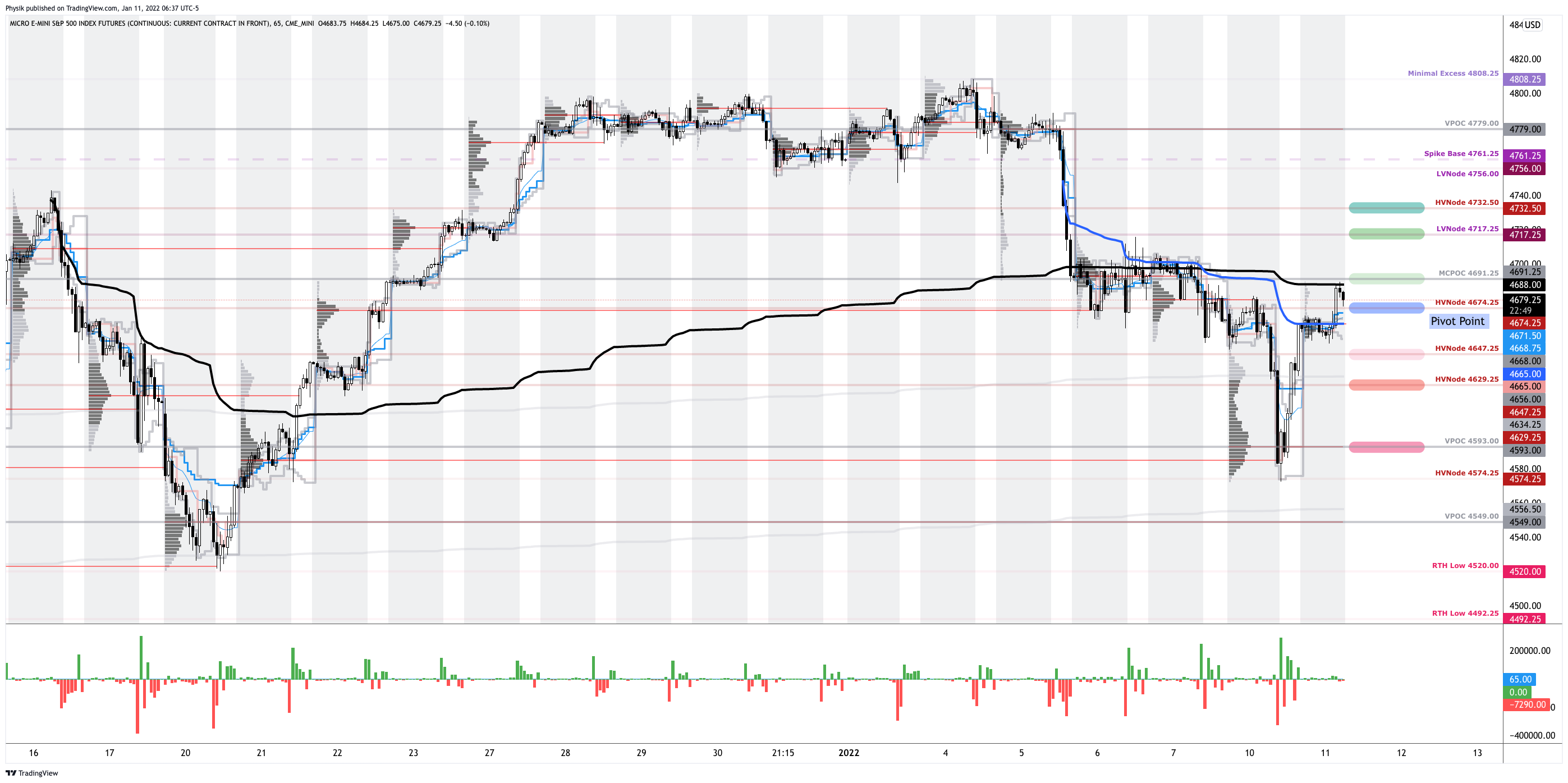

Consider yourself a customer who owns 100 shares of the SPRD S&P 500 ETF Trust (NYSE: SPY). You’re traveling to Europe and want to hedge your position against the downside. So, you wake up one morning, go online, and tell your broker you want to buy one at-the-money 50 delta SPY put option.

The delta is terminology for how that option’s price will change based on a $1 change in the underlying. In this case, for every $1 move up/down, the option will change in value by $0.50. Delta is also used to estimate the likelihood of an option expiring in the money. For example, a delta of 0.5 suggests there is approximately a 50% chance the option will expire in the money. There’s also gamma, the second derivative of how the option’s price changes with underlying changes, but we won’t discuss that further.

With your 100 shares hedged, if the market goes down, you don’t mind. You’re hedged, after all!

Naively, we’ll say this trade wasn’t paired up against another investor’s; instead, some mysterious counterparty will warehouse this risk. These mysterious persons want nothing to do with the directional risk of your trade. They’ll hedge by selling 50 SPY shares (i.e., 100 × 0.50). Again, we’re naive here and don’t consider their potential to offset this risk with other positions they may have.

You check your phone after a while and find that SPY hasn’t moved much. Your 50 delta put is now 20 delta. Bummer! You shrug, turn off your phone, and hit the beach.

What happened to that mysterious counterparty on the other side of this trade, though? They bought back 30 SPY shares, supporting the market and reinforcing the trend!

Though this is a naive take, it may help.

Reality Is Path-Dependent

Your and the counterparty’s actions partly shaped the SPY’s price movement. You bought puts, setting off a chain of events. The counterparty hedged, the market didn’t move, and the hedge was unwound. This only serves to support the SPY further.

“There’s skew in the market, which ultimately forces a buyback of stock by dealers, market makers, banks, etc., every day, and it accelerates into expirations,” Karsan elaborates.

“When the market’s up, there’s a buyback and a momentum re-leveraging, … forcing more buying.”

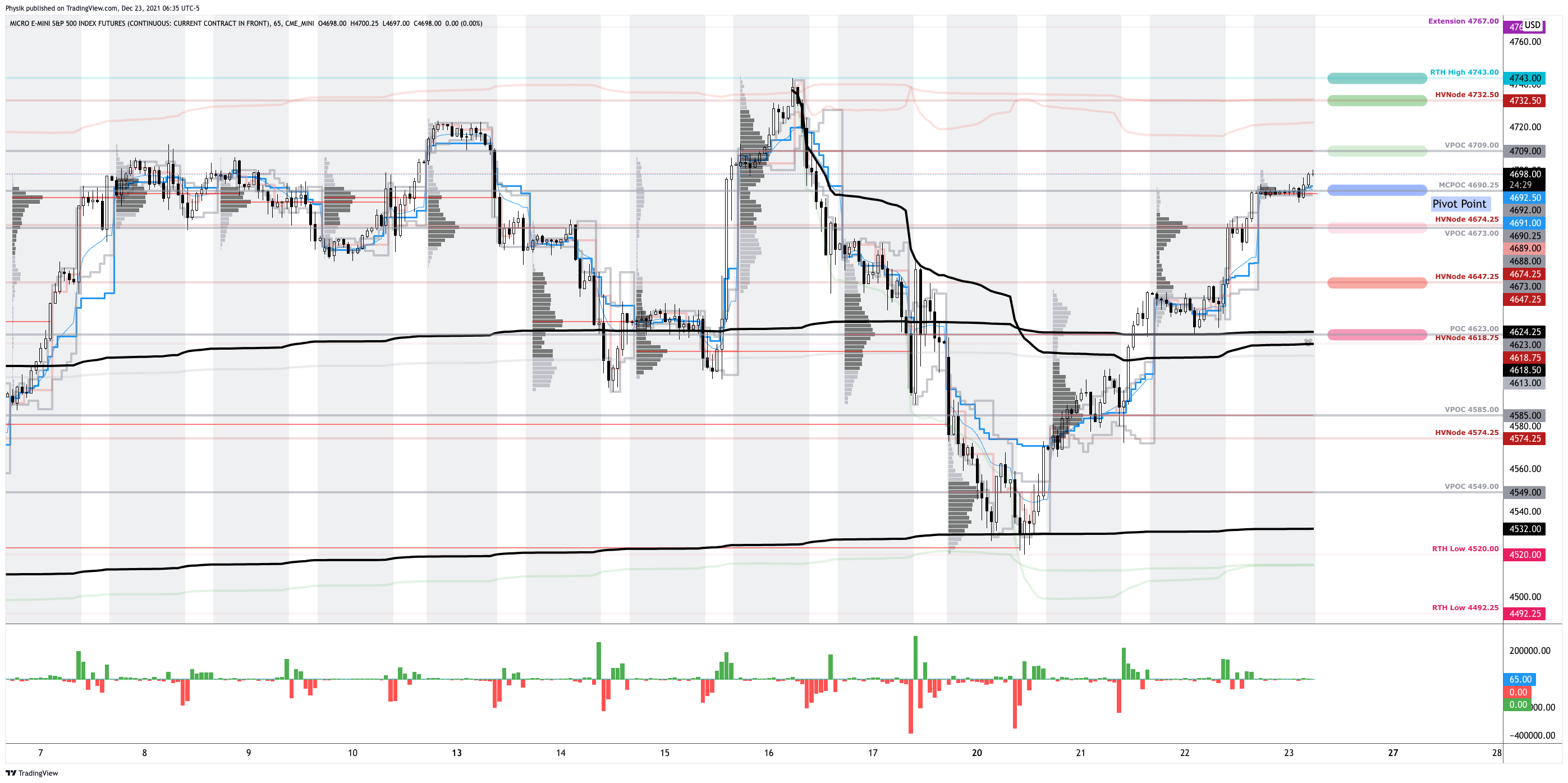

As we approach the end of summer, things change. Among other things, elections are coming, and there will be some hedging of that. With months to go, broad market hedges against a sudden downturn have appeared generally inexpensive, with three-month puts protecting against a drop in the S&P 500 near their lows. See the dark blue line in the graphic below as an example!

“The high dispersion of stocks has contributed to weighing on VIX,” shares Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence. “If the equity market breath improves then that may weigh on volatility, while a pullback in mega-cap tech stocks could see both correlation and index volatility rise.”

In fact, excluding NVDA, the VIX hit traded into the 9s, on par with 2017 lows.

SpotGamma adds that we are in the second longest stretch without an SPX 1-day 2% move up/down; traders aren’t committing capital to bets on big moves, either.

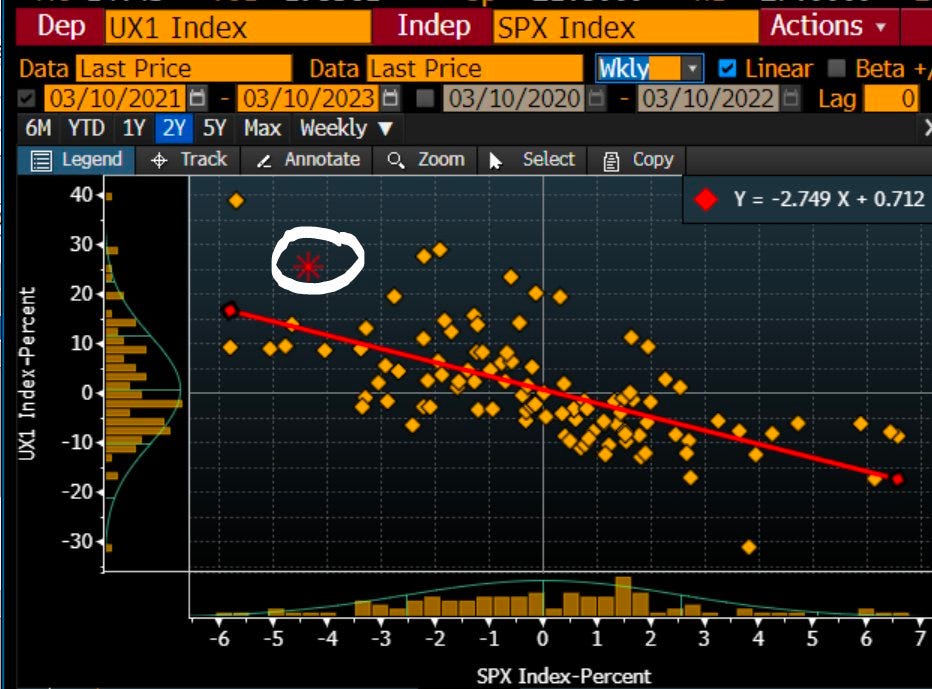

We see this in spot-vol beta, which refers to the relationship between the market (which we refer to as the “spot” here) and changes in its volatility over time or volatility’s sensitivity to market trading.

This spot-vol beta has been depressed.

In observance, Nomura Cross-Asset Macro Strategist Charlie McEligott states there’s limited potential for volatility to decrease further, particularly with the SPX 1-month implied correlation at historically low levels.

To that point, “the historically low spot-vol beta we are seeing now will eventually be followed by historically high spot-vol beta,” the Ambrus Group’s co-CIO anticipates.

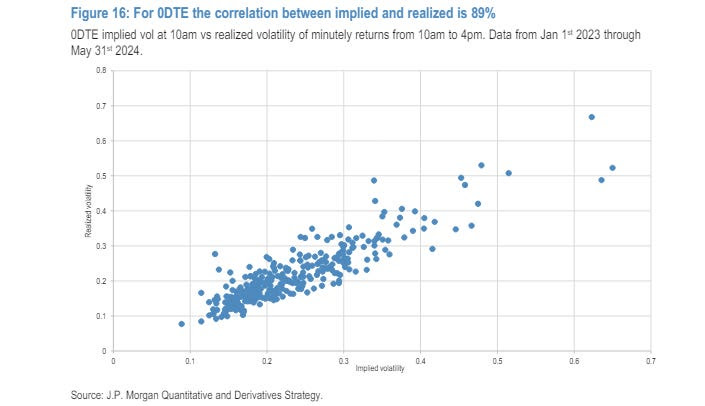

The case is less so valid with more actively traded shorter-dated options. According to Simplify Asset Management’s Michael Green, the sensitivity remains. You just have to look elsewhere.

It makes sense why.

Shorter-dated options are less exposed to changes in implied volatility; instead, they expose one more directly to movement or realized volatility. They can be more attractive to hedge with but can cause problems and amplify wild swings in rare cases.

If news shocks the market one way, movements may exaggerate when traders scramble to adjust their risk, as discussed below.

Though that’s usually not a worry, as Cboe puts, according to Karsan, a dwindling supply of margin puts, especially those with high convexity and far out-of-the-money, would be the indicator to watch for impending exaggerated movement. These options, particularly if shorter-dated, are crucial during market stress, serving as indicators and drivers of potential crashes when traded in large sizes (e.g., 5,000-10,000 0-DTE options bought on the offer to hedge).

As a counterparty, you may also use similarly dated options to hedge yourself, bolstering a reflexive loop!

Again, the reality is path-dependent! The path leading to this point—low correlations and reduced availability of those protective options—sets the stage for increased volatility.

Here, we wish to emphasize the convexity component—gamma or the rate at which the delta changes with the underlying asset’s price—rather than the likelihood of the underlying asset reaching the options’ strike prices. Just because an option turns expensive doesn’t mean it is likely to pay at expiry; instead, it may have value because that’s precisely what traders need to trim their margin requirements during volatile markets.

“Implied vol is about liquidity. It isn’t about fear or greed,” writes Capital Flows Research.

“Implied vol is about liquidity on specific parts of the distribution of returns on an asset. Remember, even the outright price of an asset is pricing a distribution of outcomes, not a single destination. Options make this even more explicit by having various strikes and expirations with differing premiums and discounts.”

History shows a minor catalyst can lead to a big unwind. Take what happened with index options a day before XIV crash day.

“Going into the close the last hour, we saw nickel, ten, and five-cent options trade up to about $0.50 and $0.70,” Karsan elaborates. “They really started to pop in the last hour.”

“And then, the next day, we opened up, and they were worth $10.00. You often don’t see them go from a nickel to $0.50. If you do, don’t sell them. Buy them, which is the next trade.”

New rules surrounding the collateral traders must post to trade can only amplify a bad situation, “potentially leading to premature and forced hedging as volatility increases,” The Ambrus Group writes.

“Because everyone has to put down more capital, you have to disallow people from trading down there in a way that you don’t have to now,” JJ Kinahan, president of Tastytrade, says.

The opposite can happen when markets move quickly higher. Take the options activity and price action in the Russell 2000 over the last week. Volatility skew, or the difference in implied volatility across different strike options, steepened accordingly.

Typically, options with farther-away strike prices have higher implied volatility than options with closer strike prices. When the skew steepens, the disparity in implied volatility between these various strike prices widens.

Depending on the steepening, we may have insight into the type of impending velocity and trade accordingly.

For instance, the implied volatility of out-of-the-money (OTM) calls, which offer protection against market upturns, rises significantly compared to at-the-money (ATM) calls and downside protection (puts). This steepening volatility skew indicates heightened enthusiasm among investors regarding potentially large upward market movements.

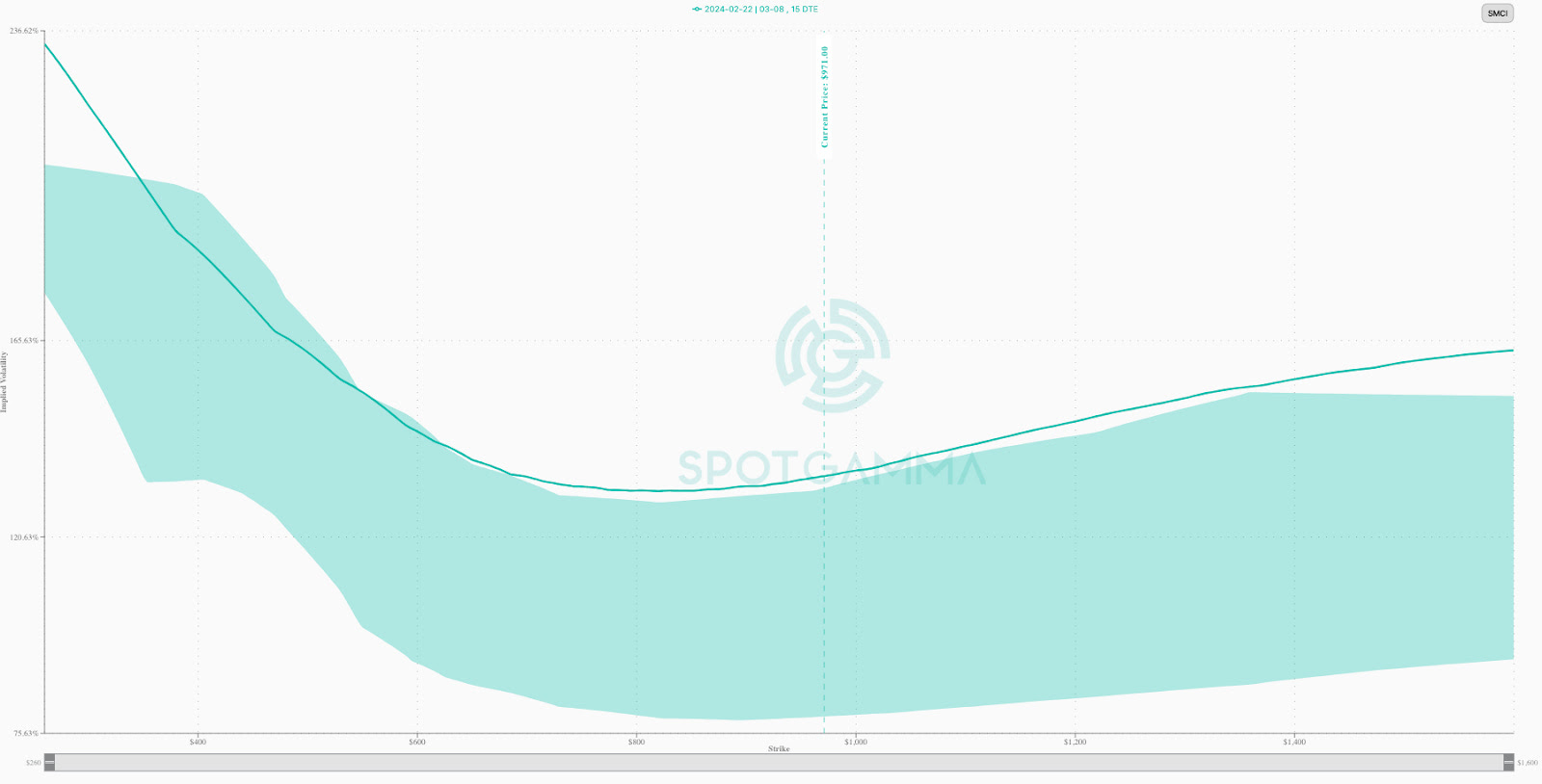

The steepening call volatility skew below results from distant call options pricing higher implied volatility than usual due to investor demand. Beyond helping understand the market’s thinking and mood, it can serve as a catalyst, with call options buying into a price rise further accelerating movement indirectly by how the other side hedges this risk (i.e., they buy stock to hedge).

This action is apparent elsewhere, too, in the S&P 500 (as can be seen via the SPX cross-sectional skew graphic from Cboe above), where it’s proving quite sensitive, as well as single stocks like NVDA and Super Micro Computer Inc (NASDAQ: SMCI). We provided examples this year where steepening call skew helped reduce the cost of trades we used to capture the upside. In one case, we removed SMCI butterfly and ratio spreads for tens of thousands of percent in profit (e.g., $0.00 → $10.00)!

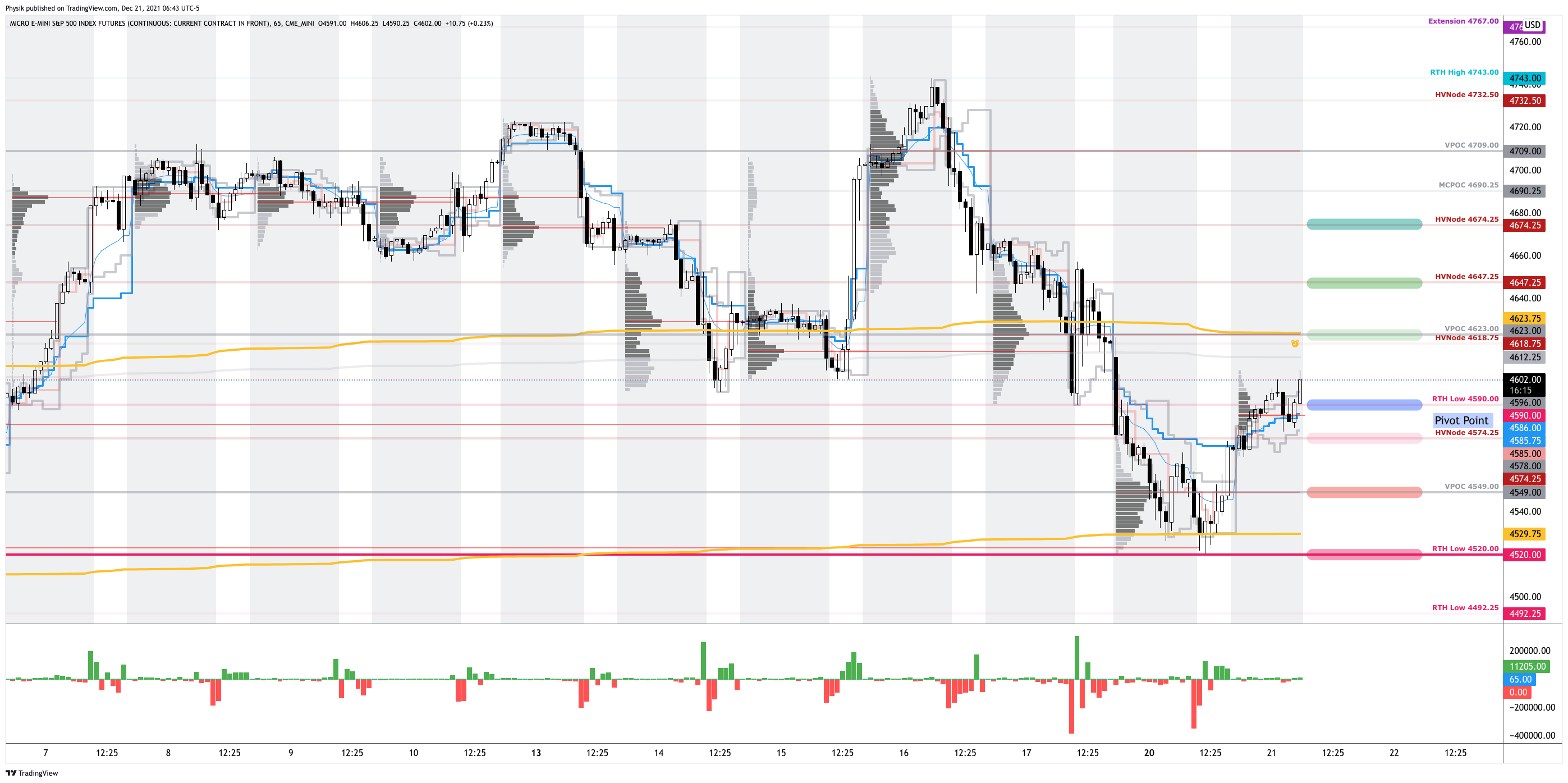

Market Tremors

This week’s market tremors are affecting some of the most loved areas of the market, and a flattening skew (e.g., green line versus grey line below) alludes to further potential for pressure.

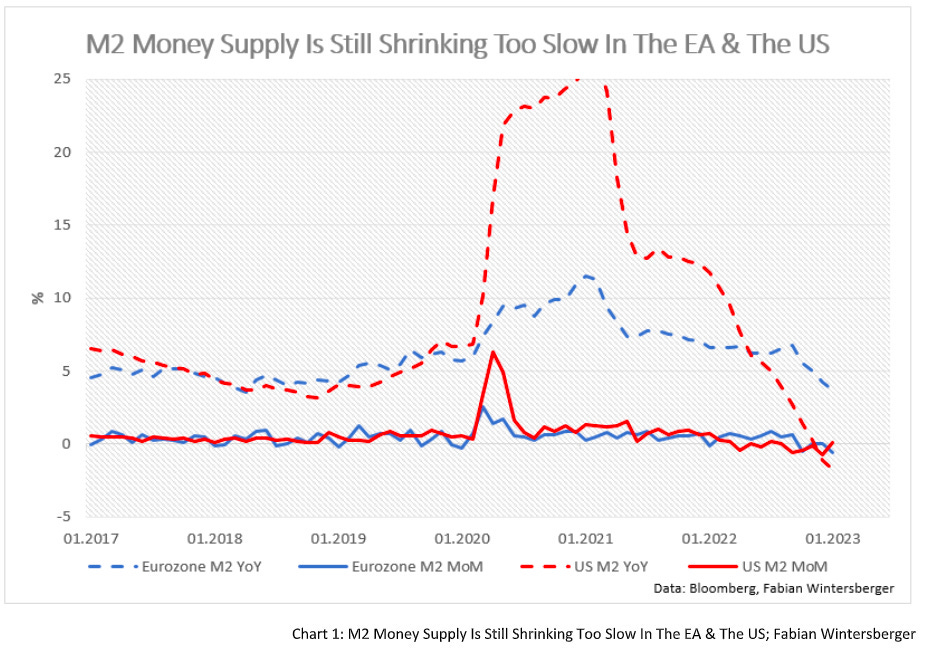

In the long term, a few things stick out, including high interest rates and a stronger dollar, which create macroeconomic problems.

A few explain it better than we do. Higher US interest rates relative to other economies can result in outflows and stress. Just look to places like Japan, where there’s been a lot of currency volatility. If the dollar’s strength continues, it could lead to crises elsewhere, creating a ripple effect and priming potential volatility at home.

“A US Dollar devaluation will then be a tailwind to S&P 500 earnings, which would be positive for stock prices,” Fallacy Alarm summarizes. “However, an unwinding carry trade also causes deleveraging, which is typically not good for asset prices.”

May this upset popular trading activities and catapult something minor into something more?

Sure, and the current low correlation and implied volatility mean that any considerable market disruption could have a substantial impact. Still, markets are intact and likely to stay so.

“If we continue to grind higher, options will get cheaper and cheaper on their own accord. Not to mention all the vol selling that’s getting them to a point which is even cheaper, at some point,” Karsan adds. “And the acceleration generally in those things becomes on the upside, the realized volatility on the upside gets to be just too big relative to the implied, which means it becomes profitable for entities to come in and start buying vol at these lower levels. Add to that, the vol supply is likely to dissipate a bit as we get into September, October, and November. Why? We have an election sitting there.”

So, as the market moves higher, it transitions into this lower implied volatility, reflected in broad measures like the VIX. If the VIX remains steady or higher, “that indicates that fixed-strike volatility is increasing, and if this persists, … it can unsettle volatility and create a situation where dealers themselves … begin to reduce their volatility exposure,” naturally buoying markets as previously outlined. If there is greater demand for calls, counterparties may hedge through purchases of the underlying asset, a positive.

If The Music’s Playing, Get Up And Dance

With volatility at its lower bound, at which it can stay given its bimodality, it makes sense to look at markets through a more optimistic lens. A lot is working in its favor, and if near-term declines are marginal and not upsetting to the status quo, it may set the stage for a rally through elections.

Accordingly, how do we make positive returns in rising markets and minimize losses or gains in flat-to-down markets as we have now? That’s the goal, right?

For the anxious and must-trade types, short-dated (e.g., 50- or 100-point-wide and 0-1 DTE) butterflies in the NDX worked well on sideways days. Here, we’ve tried to double and triple our initial risk but can easily hit more in benign markets. For the passive types, calendars may do just as well should the realized volatility keep where it is or fall relative to what is implied.

In anticipation of this week’s controlled retracement, we initiated wide (e.g., up to 2,000-point-wide) broken-wing butterflies and ratio spreads on the put side in the NDX, reducing their cost basis, if any, with the credits from the short-dated fly trades, among others. Into weakness, those spreads now price a few thousand percent higher, and we’re monetizing them, intending to use the credit to finance trades that capture upside potentially or to reduce our stock cost basis.

Regarding hedging potential outliers, BNP Paribas says VIX calls and call spreads remain compelling low premium tail hedges.

“And I think this is one of the arguments for going with VIX calls, not that we’ve seen anything explosive yet this year, but if we do see some of these things unwind, you’re going to get a kicker there where you might see the VIX cruise very quickly up to 45, and it probably won’t stay there unless there’s a real good fundamental reason for that to happen,” explains Michael Purves, the CEO and founder of Tallbacken Capital Advisors. Josh Silva, managing partner and CIO at Passaic Partners, adds, that “when there is a liquidation, it’ll be hard, it’ll be fast and it’ll be dramatic.”

“Typically, the market after that is pretty awesome.”

Disclaimer

By reading our content, you agree to be bound by the terms and conditions outlined in this disclaimer. Consume our content only if you agree to the terms and conditions below.

Physik Invest is not registered with the US Securities and Exchange Commission or any other securities regulatory authority. Our content is for informational purposes only and should not be considered investment advice or a recommendation to buy or sell any security or other investment. The information provided is not tailored to your financial situation or investment objectives.

We do not guarantee any information’s accuracy, completeness, or timeliness. Please do not rely solely on our content to make investment decisions or undertake any investment strategy. Trading is risky, and investors can lose all or more than their initial investment. Hypothetical performance results have limitations and may not reflect actual trading results. Other factors related to the markets and specific trading programs can adversely affect actual trading results. We recommend seeking independent financial advice from a licensed professional before making investment decisions.

We don’t make any claims, representations, or warranties about the accuracy, completeness, timeliness, or reliability of any information we provide. We are not liable for any loss or damage caused by reliance on any information we provide. We are not liable for direct, indirect, incidental, consequential, or damages from the information provided. We do not have a professional relationship with you and are not your financial advisor. We do not provide personalized investment advice.

Our content is provided without warranties, is the property of our company, and is protected by copyright and other intellectual property laws. You may not be able to reproduce, distribute, or use any content provided through our services without our prior written consent. Please email renato@physikinvest for consent.

We reserve the right to modify these terms and conditions at any time. Following any such modification, your continued consumption of our content means you accept the modified terms. This disclaimer is governed by the laws of the jurisdiction in which our company is located.