The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Overnight, equity index futures auctioned higher alongside progress in cease-fire talks between Russia and Ukraine.

Geopolitical improvements could play into the Federal Reserve’s (Fed) pivot toward more aggressive, front-loaded interest-rate hikes.

Ahead is data on the Case-Shiller and FHFA national house price indexes (9:00 AM ET), consumer confidence, as well as job opens and quits (10:00 AM ET).

Later, the Fed’s Patrick Harker speaks at 10:45 AM ET, followed by the Atlanta Fed’s Raphael Bostic (6:30 PM ET).

What To Expect

Fundamental: In Monday’s commentary, we discussed the Fed’s intention to tighten policy and yield curve inversions, the implications of quantitative tightening (QT), and other things.

In a nutshell, the gap between shorter and longer yields is smaller, and, in some cases, the shorter yield is above that of the longer yield––the consequence of suppressed yields lifting, now, after the Fed’s historic bond-buying spree and balance sheet growth over the past years.

As Bloomberg’s John Authers explains, “an inverted yield curve is regarded as an alarm for a central bank — it’s taken as the bond market saying that this can go no further, and makes it hard for the Fed or any other central bank to proceed with a tightening.”

There is the “argument that something will break before the central bank gets [inflation back down to 2%].”

Though curve inversions often preceded economic slowings, we pointed to the 5-30 curve, yesterday, specifically, which has provided false positives in the past.

This time things truly are different as, without the Fed’s QE, the fair value of the 2s10s spread could be in the 150bp-200bp range, according to statements by Richard Bernstein Advisors’ Michael Contopoulos says on the potential for steepening via QT.

“Though the Fed is likely to maintain a sizeable balance sheet, thereby keeping yields relatively anchored versus what would be expected had they never bought bonds, there is clearly scope for yields to increase in the long end over coming quarters. Whether or not this happens with ever-higher 2y yields, time will tell, but for now, we would search for other indicators of recession.”

Correlation isn’t causation, Authers ends. Markets are reflections of investor psychology and expectations about the future.

“Just as the Fed now admits that it has been behind the curve, so investors have also been slow on the uptake, and may now be over-compensating. That suggests that a curve inversion here should be treated with some caution.”

Positioning: Alongside participants’ heavy sale of puts and some call buying, implied volatility metrics compressed markedly, and this bolstered a near-vertical price rise in the equity market.

Heading into the end-of-week large quarterly options expiration, comparing buying and options positioning metrics, the returns distribution is skewed positive.

However, the skew is nothing like what it was in the weeks prior, before the early March reversal period. Caution new buyers.

As SpotGamma explains, “All else equal, it’s likely the SPX levels out in the $4,600.00 area over the coming sessions as the factors of time and volatility trend toward zero for highly short-dated options exposure concentrated in the end-of-month expiry,” at those higher prices.

“When the gamma of these options increases, as a result, counterparties add liquidity (i.e., sell [buy] more into strength [weakness] against increasing [decreasing] positive delta exposure).”

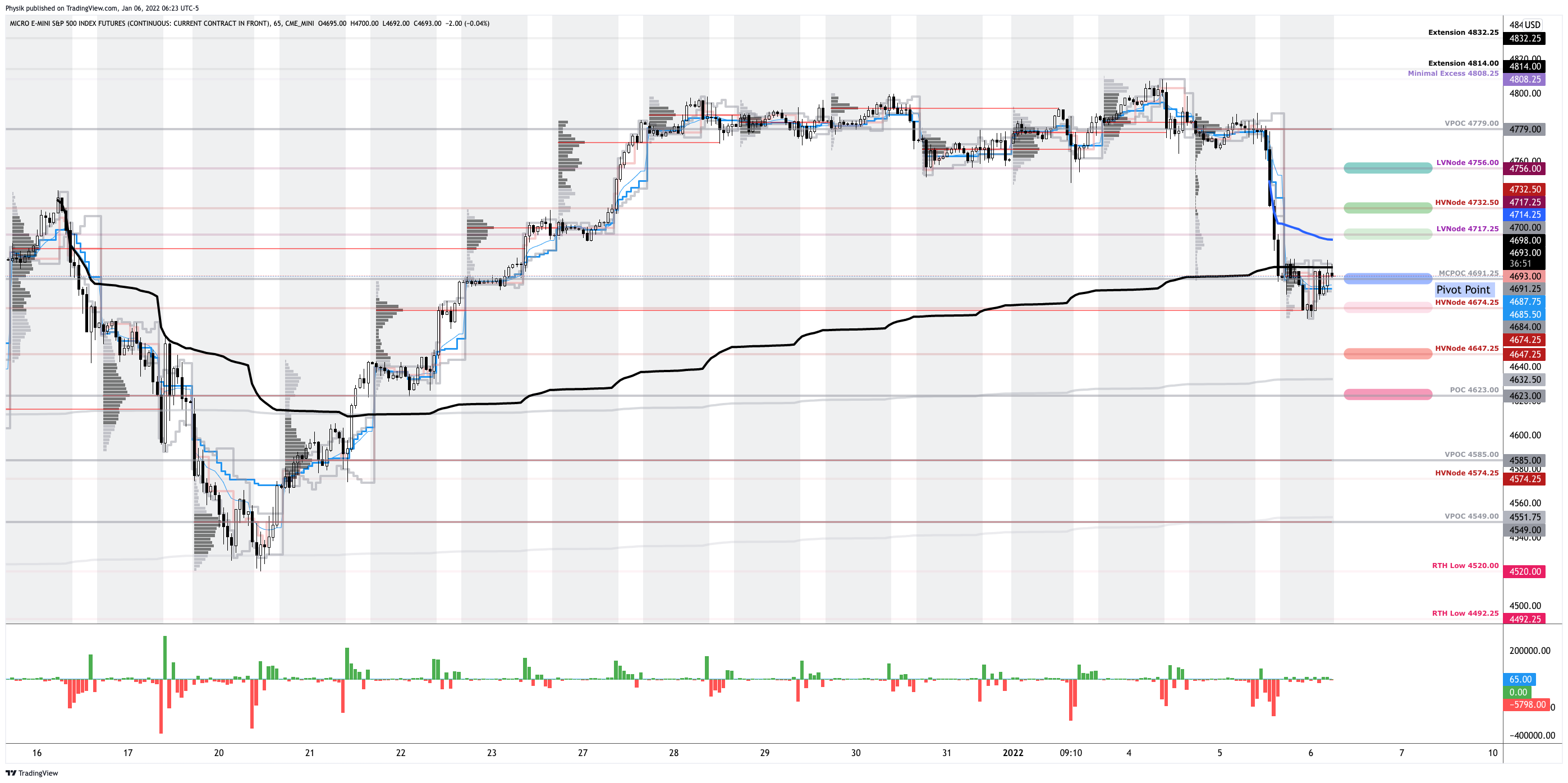

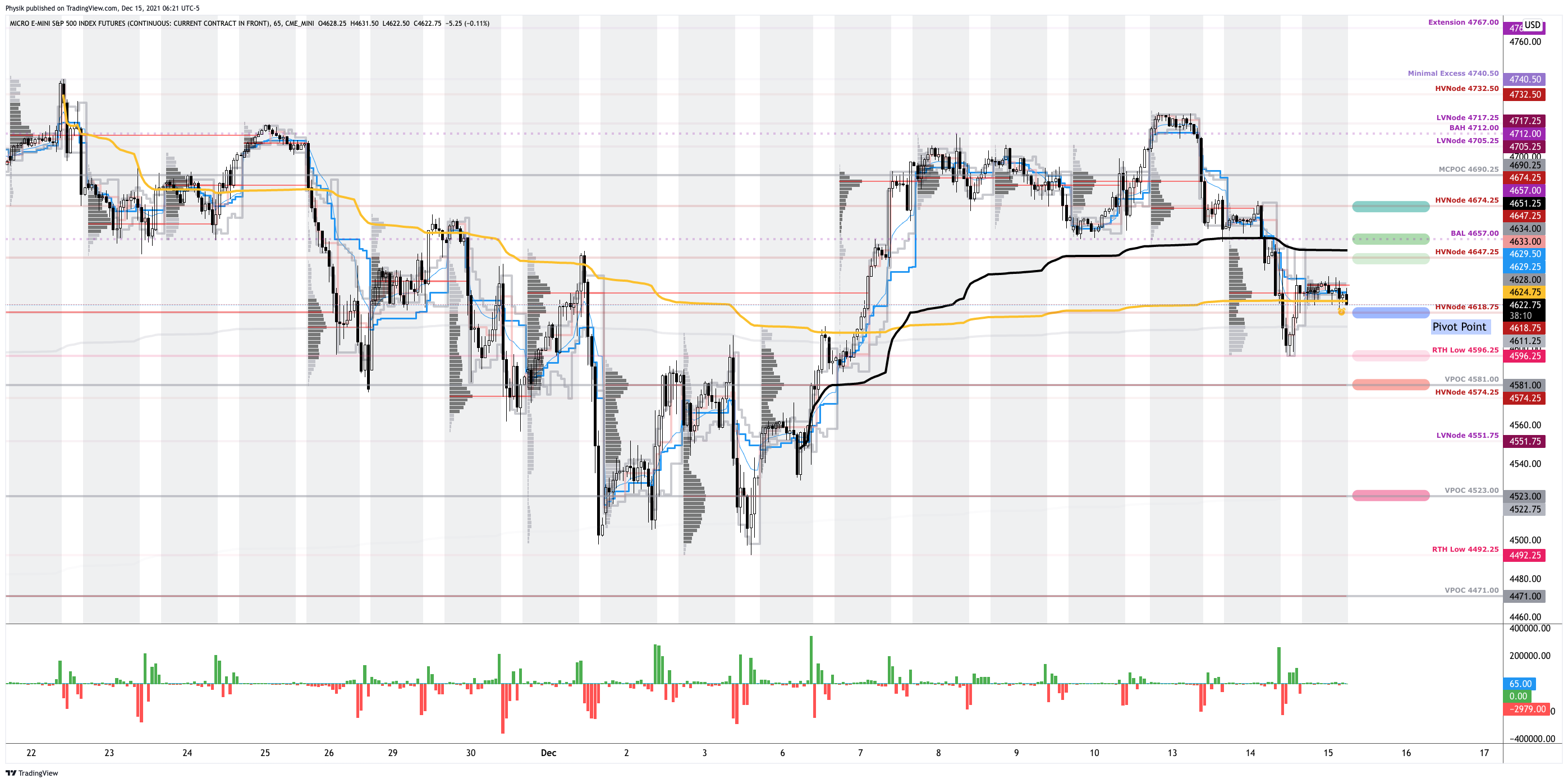

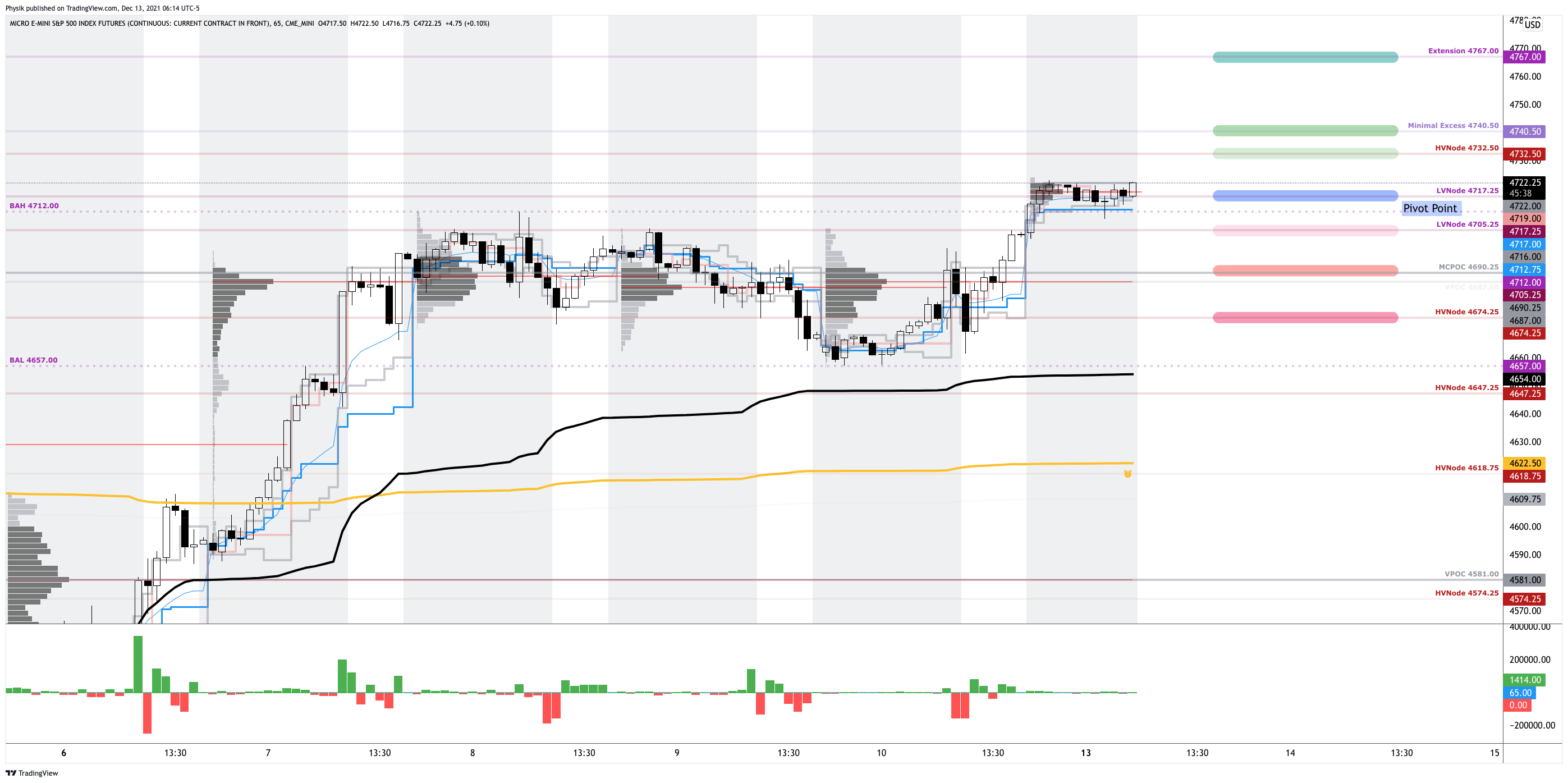

Technical: As of 6:30 AM ET, Tuesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the upper part of a positively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Gap Scenarios: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator. Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

In the best case, the S&P 500 trades higher; activity above the $4,592.75 overnight high (ONH) puts in play the $4,611.75 low volume area (LVNode). Initiative trade beyond the LVNode could reach as high as the $4,618.75 and $4,631.75 high volume area (HVNode), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,592.75 ONH puts in play the $4,574.25 HVNode. Initiative trade beyond the HVNode could reach as low as the $4,546.00 spike base and $4,533.00 untested point of control (VPOC), or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.