Notice: Given travel commitments, commentaries will be suspended until January 3, 2022.

As an aside, I’m sincerely honored to have you as a subscriber.

This newsletter began as a tool to hold myself accountable for objectively assessing dominant narratives and market-generated information.

Since launching, this commentary has grown. Content and engagement have improved.

Now, with many of the 200 or so of you that are reading this actively, I have spoken with via email, and the like, regarding trader development, among many other things.

When it comes to markets, at the end of the day, whether you’re at a bank (as some of you are) or at home, we’re all alone. The implications of this are staggering.

How are we to objectively assess and act on what the market is signaling to us with no framework or community to work off of?

That’s the problem and I hope to make a bigger impact, going forward.

Wishing you good health and success next year and beyond!

Best,

Renato

What Happened

In the face of a “stealth correction,” and an “off-loading of risk” by professionals, the S&P 500 remains strong further bolstered by options selling and volatility compression.

This is as less heavily-weighted constituents remain volatile; with hedging pressures sticky at the index level, the only reconciliation can be a decline in correlation.

As liquidity remains “holiday-thinned,” so to speak, coming into Friday’s weighty “Quarterlys” options expiration, positioning metrics suggest indices ought to stick at higher prices.

Thereafter, expect increased movement.

Moreover, ahead is data on trade in goods (8:30 AM ET) and pending home sales (10:00 AM ET).

What To Expect

Given the persistence of responses to technical levels, weaker-handed participants (which seldom bear the wherewithal to defend retests) carry a heavier hand in recent price discovery.

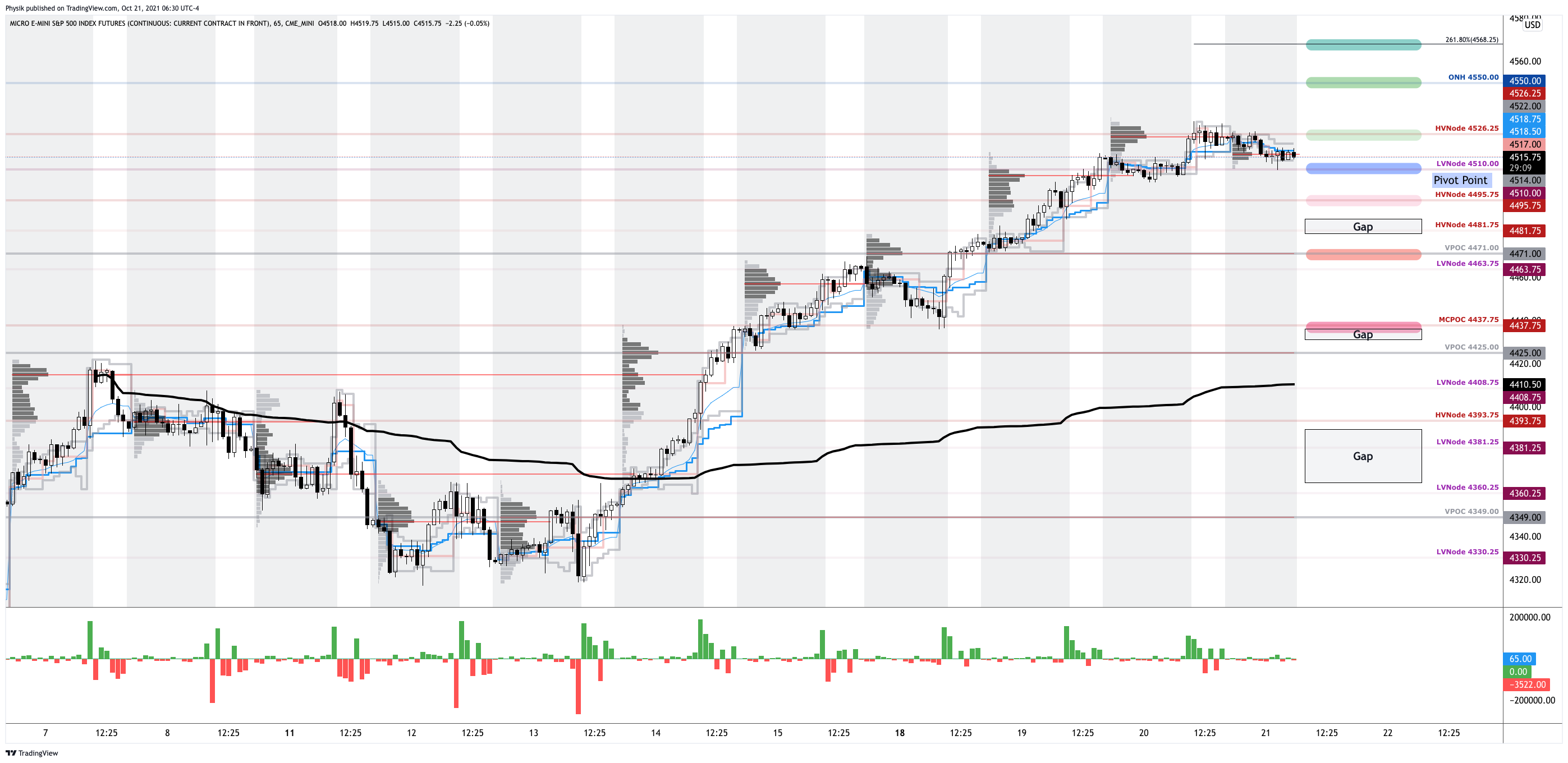

Via volume profile analysis, we see a plethora of low-volume pockets – voids, if you will – that likely hold virgin tests. Successful penetration often portends follow-through as the participants that were most active at those levels (quickly run for the exits when wrong).

Context: In the face of market internals that look weaker than at any time since March of last year, the S&P 500 remains strong, relative to its counterparts.

As alluded to in a prior section, the commitment of capital on lower volatility is upping the dealers’ addition of liquidity, which supports high prices but may limit further price discovery.

Why? When a position’s delta rises with stock or index price rises, gamma – the expected change in delta given movement in the underlying – is added to delta.

According to SpotGamma, “[a]s participants keep adding to their bets at $4,800.00, the dealer only takes on more exposure to positive gamma.”

So, with liquidity “holiday-thinned,” so to speak, and participants’ concentration of activity in near-the-money options strikes, coming into this week’s “Quarterlys” options expiration, indices are to remain pinned.

After Friday, the market is more susceptible to fundamental forces as, according to SpotGamma, there will be “a decrease in sticky gamma hedging.”

Couple current options positioning and buying pressure – via short sales or liquidity provision on the market-making side – metrics suggest middling returns 1-month out, or so.

Moreover, the expectation is that positive fundamental forces and dealers’ covering of hedges to remaining “put-heavy” positioning bolster seasonally-aligned price rise in January.

In anticipation of higher prices, low cost, complex options structures like call-side calendars, butterflies, and ratio spreads are still top of mind.

After a fast move higher over the past week or so, with positioning metrics as they are, it does not make sense to commit massive debits to static or variable long-delta trades. Cost matters.

Expectations: As of 6:30 AM ET, Wednesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Spike Rules In Play: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike). The spike base is $4,776.00. Below bearish (change in tone). Above bullish (status quo).

In the best case, the S&P 500 trades sideways or higher; activity above the $4,781.75 high volume area (HVNode) puts in play the $4,798.00 minimal excess. Initiative trade beyond the minimal excess could reach as high as the $4,805.50 and $4,815.00 extension, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,781.75 HVNode puts in play the $4,770.50 regular trade low (RTH Low). Initiative trade beyond the RTH Low could reach as low as the $4,732.50 HVNode and $4,717.25 low volume area (LVNode), or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

What People Are Saying

Definitions

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor, helping develop insights around impactful options market dynamics.

Disclaimer

At this time, Physik Invest does not carry the right to provide advice. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.