The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Overnight, equity index futures auctioned sideways-to-lower ahead of an earnings season that’s set to accelerate.

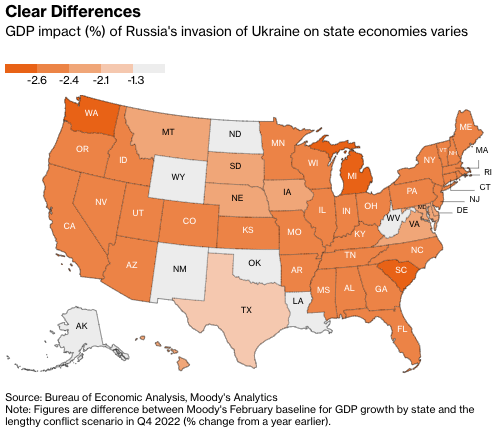

Concerns that remain include the implications of China’s response to COVID-19, the resolution of the tension between Russia and Ukraine (and the rest of the world for that matter), as well as the intent, by policymakers, to accelerate a pivot to normalization (i.e., rate hikes and beyond).

With a larger part of the market moving in sync (as talked about more in the “Technical” section), many strategists suggest the outlook for equities is continuing to worsen and positioning is likely to compound further volatility.

Ahead is data on durable goods and core capital equipment orders (8:30 AM ET), the S&P Case-Shiller U.S. home price index and FHFA U.S. home price index (9:00 AM ET), as well as consumer confidence index and new home sales (10:00 AM ET).

What To Expect

Fundamental: “With defensive stocks now expensive and offering little absolute upside, the S&P 500 appears ready to join the ongoing bear market,” Morgan Stanley (NYSE: MS) says.

“The market has been so picked over at this point, it’s not clear where the next rotation lies. In our experience, when that happens, it usually means the overall index is about to fall sharply with almost all stocks falling in unison.”

Adding, Bank of America’s global EPS model predicts negative growth by year-end.

Positioning: Monday’s bottoming at $4,200.00, near intraday lows, came as participants sold puts, and the hedging of the consequent volatility compression, thereafter, bolstered a price rise.

At this juncture, though positioning appears (a tad) stretched and prices are nearing a lower bound, there may be room for volatility to expand, further.

Per SpotGamma’s Delta Tilt indicator, which “reflects the market approaching a maximum put threshold, [there’s] potential for further hedging that may result in sharp rallies and declines with volatility climaxing around early May (FOMC and potential for Russian Default).”

This is as options counterparts themselves have hedges (i.e., protective puts) that reduce hedging requirements, so to speak, when underlyings trade down to certain levels.

SpotGamma explains:

“Using this logic, when the downside puts gain value, they may reduce the need to delta hedge. In turn, dealers may be able to advantageously reduce delta hedging (sell less), and supply markets with more liquidity (buy more stock). This could serve to reduce volatility.”

So, in summary, participants are pretty well-hedged. Should they begin to monetize protection, that may lower counterparty exposure to positive delta, thus fueling a price rise.

Whether that price has legs is dependent on improvement in the fundamental situation.

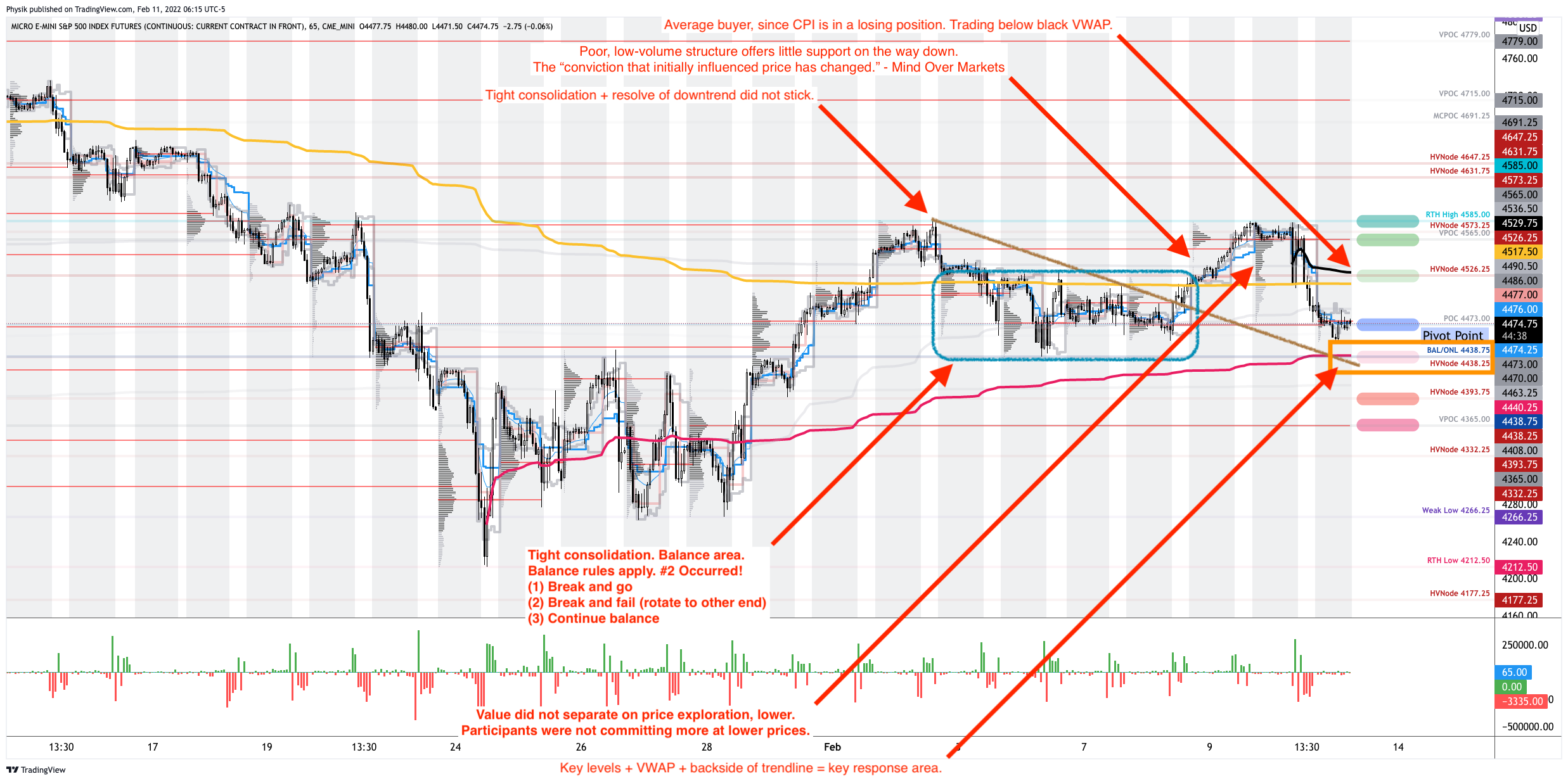

Technical: As of 7:00 AM ET, Tuesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the lower part of a negatively skewed overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

In the best case, the S&P 500 trades higher; activity above the $4,272.00 high volume area (HVNode) puts in play the $4,303.75 overnight high (ONH). Initiative trade beyond the ONH could reach as high as the $4,337.00 untested point of control (VPOC) and $4,393.75 HVNode, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,272.00 HVNode puts in play the $4,233.00 VPOC. Initiative trade beyond the VPOC could reach as low as the $4,195.25 regular trade low (RTH Low) and $4,129.50 overnight low (ONL), or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Considerations: The market is weak and all major indexes covered by this newsletter are trading below their 20-, 50-, and 200-day simple moving averages.

Additionally, all indexes are below their volume-weighted average prices anchored from the start of this year (or their respective peaks). Further, AVWAPs are a metric highly regarded by chief investment officers (CIOs), among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

The modus operandi is to sell into a flat-to-declining AVWAP. So long as prices are below the below AVWAPs, sellers remain in control and rally attempts are to likely fail, all else equal.

Another important note to make is the market’s poor breadth (via VOLD and ADD). Previously, there were divergences; rate-sensitive areas of the market were sold while more value was bid. Last week, there was a change in tone. All areas of the market were sold, heavily.

This suggests the potential for a broader sell-off (and this is supported by the U.S. Equity ETF flows graphic included, above).

What People Are Saying

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.