Abstract

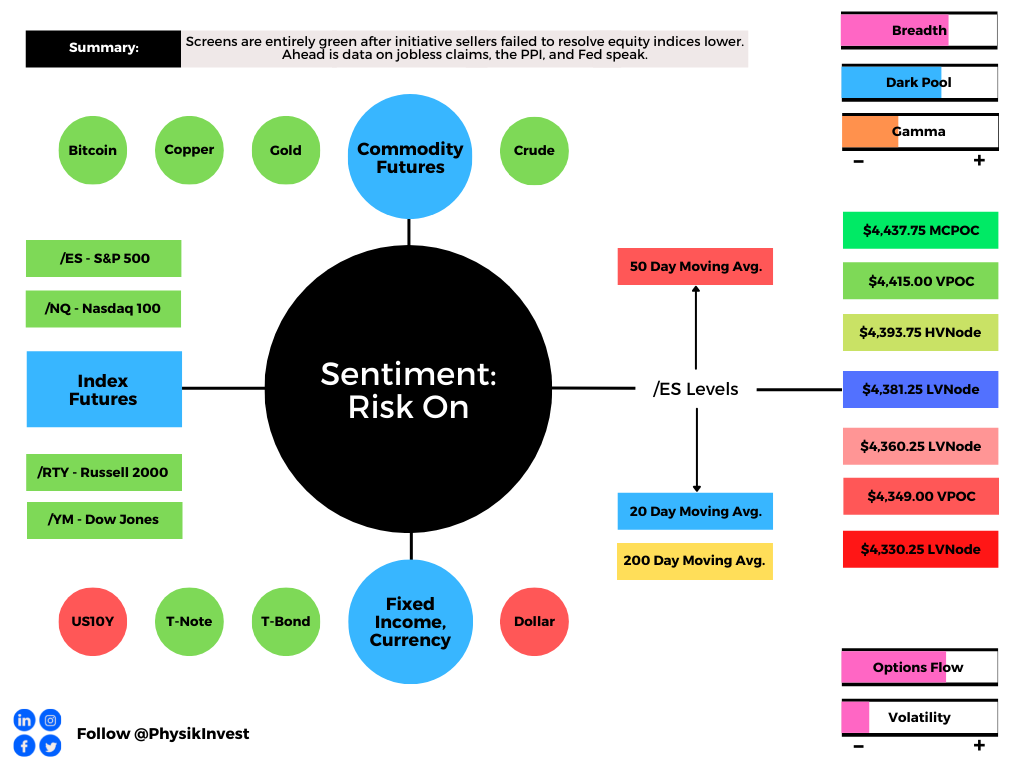

Equity index futures mixed. Commodities mixed. Bonds sideways to lower. Volatility expanded.

Ahead is a light day of economic releases, in the face of fundamental narratives and positioning metrics that support intraday price stability.

What Happened

Overnight, equity index futures auctioned sideways as participants sought to position themselves for guidance on monetary policy, later this week.

Ahead is data on homeownership rates (10:00 AM ET).

What To Expect

Action: On divergent intraday breadth and supportive market liquidity metrics, the worst-case outcome occurred, evidenced by the S&P 500’s acceptance of prices within Friday’s late-day spike, out of balance.

Intent: As also evidenced by the overlap of value areas, the acceptance of prices, within Friday’s late-day spike, out of balance, marks a potential willingness to continue sideways.

Validation: Sideways trade, above the $4,590.00 balance area high (BAH), validates the market’s prevailing intent to base ahead of the Federal Open Market Committee (FOMC) decision, later this week.

Consideration: Weak structure left behind prior initiative trade adds to technical instability.

To elaborate, for instance, Monday’s trade found responsive buyers at the $4,587.00 untested point of control (VPOC). This level likely was only known by participants who act on visual cues.

These technically-driven participants are generally thought to not be able to defend retests. Therefore, these participants ought to quickly liquidate, if proven wrong, on a break of the BAH.

Context: Ample liquidity, peak growth, inflation, strong seasonality and buybacks, as well as monetary and fiscal policy uncertainties, and single-stock volatility.

Based on this context, Moody’s Corporation (NYSE: MCO) forecasts a peak; “The Dow Jones Industrial Average has peaked and will gradually decline during the next year. Risks are heavily weighted to the upside, but peak growth, inflation uncertainty around fiscal policy, and the Fed tapering could weigh on equity markets.”

In terms of positioning, the CBOE Volatility Index (INDEX: VIX) was higher, while demand came in across the VIX futures term structure, suggesting participants are inclined to hedge against near-term equity market instability.

Such a situation, in addition to the long-gamma environment (in which counterparties hedge their warehoused options risk by buying underlying into weakness and selling into strength), has the effect of making it difficult to resolve directionally.

The reason is, there are two knowns; as volatility contracts, (1) options will slide down their term structure (vanna) and (2) skew decays (charm).

When this happens, we expect to see supportive flows when the dealers cover their short equity/futures hedges. With volatility bid, the effect of vanna and charm is dulled. It is likely that participants see more robust movement after the FOMC announcement, later this week.

In a separate note on volatility in stocks like Tesla Inc (NASDAQ: TSLA), SpotGamma says the following: “These rampant moves are appearing to be more widespread, and we believe this invokes instability that usually ends badly.”

Expectations: As of 6:30 AM ET, Monday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the top part of a negatively skewed overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Balance-Break Scenarios: A change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend) occurred. We monitor for continued acceptance outside of the balance area. Rejection (i.e., a move below the balance area high) portends a move to the opposite end of the balance, lower.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,590.00 BAH puts in play the $4,619.50 overnight high (ONH). Initiative trade beyond the ONH could reach as high as the $4,639.00 and $4,664.75 Fibonacci figures, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,590.00 BAH puts in play the $4,574.25 high volume area (HVNode). Initiative trade beyond the HVNode could reach as low as the $4,551.75 low volume area (LVNode), and $4,526.25 HVNode, or lower.

Click here to load today’s updated key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

What People Are Saying

Definitions

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Gamma: Gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

Vanna: The rate at which the delta of an option changes with respect to volatility.

Charm: The rate at which the delta of an option changes with respect to time.

Options: If an option buyer was short (long) stock, he or she would buy a call (put) to hedge upside (downside) exposure. Option buyers can also use options as an efficient way to gain directional exposure.

Value-Area Placement: Perception of value unchanged if value overlapping (i.e., inside day). Perception of value has changed if value not overlapping (i.e., outside day). Delay trade in the former case.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor, developing insights around impactful options market dynamics.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.