Market Commentary

In sync with bonds, equity index futures were sideways to lower. Commodities were mixed. Volatility expanded lightly.

- Ahead is jobless claims data and more.

- Many companies surpass expectations.

- Positioned for sideways trade, balance.

What Happened: U.S. stock index futures auctioned sideways to lower overnight alongside news that among the S&P 500 companies that have disclosed their corporate results, 84% have posted earnings that surpassed expectations.

Ahead is jobless claims and Philadelphia Fed manufacturing (8:30 AM ET) data, Fed speak (9:00 AM ET), as well as existing home sales and leading economic indicators (10:00 AM ET) updates.

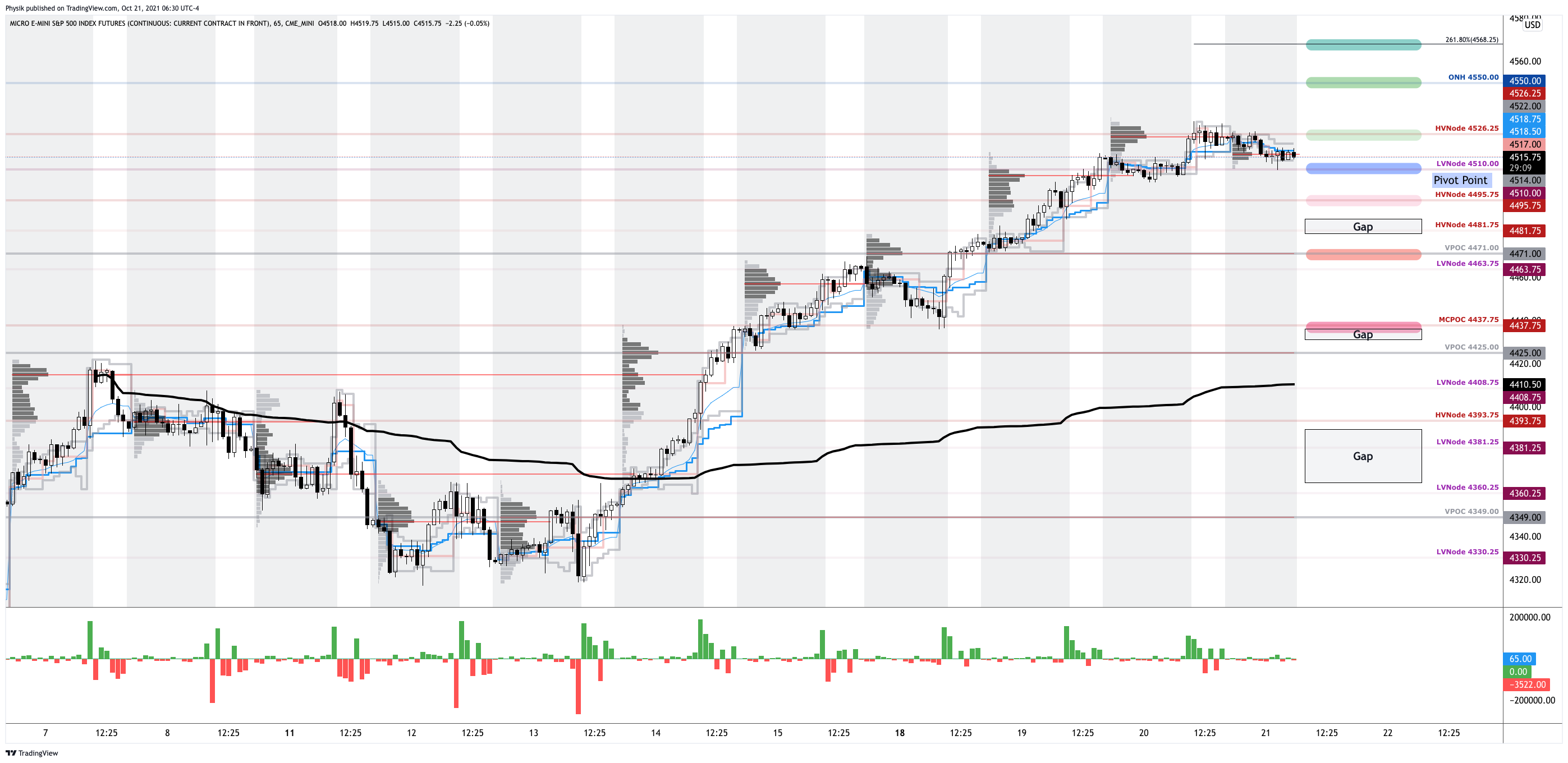

What To Expect: As of 6:30 AM ET, Thursday’s regular session (9:30 AM – 4:00 PM EST) in the S&P 500 will likely open on a light gap, just inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, in the face of strong intraday breadth and divergent market liquidity metrics, equity indices – specifically the S&P 500 – had a tough time expanding the range to the upside, leaving a ledge, or flattened area on the intraday profile.

This activity comes after prior sessions left behind numerous gaps and emotional, multiple-distribution profile structures.

Thursday’s gap in range, below value, sets up indices for what is called the cave-fill process.

It’s highly likely that participants will look to revisit, repair, and strengthen areas of low volume (LVNodes).

Zooming out, we see that though the Nasdaq 100 firmed this week, it did not recover as much ground as its peers, the S&P 500 and Dow Jones Industrial Average.

Given where the indices are in relation to their anchored volume-weighted average price levels (VWAPs), the average buyer, since the all-time high, holds a winning position.

Sideways-to-higher trade, above the upward sloping trendline, as well as the 50.00% and 61.8% retracements, keeps in play a recovery of the all-time high in the S&P 500, Nasdaq 100, and Russell 2000, like the Dow Jones Industrial Average.

Further, the aforementioned trade is happening in the context of improving breadth amidst a seasonally bullish cycle of contributions, rebalancing, and earnings, as well as the risks associated with a taper in asset purchases and a hike in rates.

In terms of positioning, the CBOE Volatility Index (INDEX: VIX) was slightly higher, after the October 20 expiration, while the VIX futures term structure shows a bit of demand coming in at the front end of the curve.

These conditions – coupled with the long-gamma environment and suppression in realized volatility as the S&P 500 trades around $4,510.00, a figure in the vicinity of what options modeling platform SpotGamma calls a Call Wall (i.e., level at which positive options gamma, essentially delta sensitivity to the underlying price, is highest) – point to increased odds of near-term equity market stability, and some potential for back-filling.

Should participants increase their interest in options strikes that are higher in price and further out in time, they may be able to overcome the stickiness of the $4,500.00 S&P 500 area (the direct result of associated hedging pressures, and the like).

Moreover, for today, participants may make use of the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,510.00 low volume area (LVNode) pivot puts in play the $4,526.25 high volume area (HVNode). Initiative trade beyond the $4,526.25 HVNode could reach as high as the $4,550.00 overnight high (ONH) and $4,568.25 Fibonacci extension, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,510.00 LVNode puts in play the $4,495.75 HVNode. Initiative trade beyond the $4,495.75 HVNode could reach as low as the $4,471.00 untested point of control (VPOC) and $4,437.75 micro composite point of control (MCPOC), or lower.

Click here to load today’s updated real-time key levels into the web-based TradingView charting platform. Please note that all levels are derived using the 65-minute timeframe.

Definitions

Cave-Fill Process: Widened the area deemed favorable to transact at by an increased share of participants. This is a good development.

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Gamma: Gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

Significance Of Prior ATHs, ATLs: Prices often encounter resistance (support) at prior highs (lows) due to the supply (demand) of old business. These areas take time to resolve. Breaking and establishing value (i.e., trading more than 30-minutes beyond this level) portends continuation.

Balance (Two-Timeframe Or Bracket): Rotational trade that denotes current prices offer favorable entry and exit. Balance-areas make it easy to spot a change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend).

Modus operandi is responsive trade (i.e., fade the edges), rather than initiative trade (i.e., play the break).

Ledges: Flattened area on the profile which suggests responsive participants are in control, or initiative participants lack the confidence to continue the discovery process. The ledge will either hold and force participants to liquidate (cover) their positions, or crack and offer support (resistance).

More On Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

News And Analysis

COVID-19 Impacts: A market-implied probability of default perspective.

The Pfizer-BioNTech booster shot restores full coronavirus protections.

Evergrande shares plunging as deal talks end, sales sink nearly 100%.

China’s common prosperity agenda is risky near-term, okay long-term.

Consumer gut on inflation is wrong. That’s a Federal Reserve problem.

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.