In their Daily Observation, dated January 4, 2000, Bridgewater Associates argued each decade was inclined to be more dissimilar to the preceding one.

“Most people who experienced consistent reinforcement for ten years were inclined to believe that this would continue indefinitely,” the authors Ray Dalio et al. said, pointing to the situation that preceded stock investors’ disappointment in the 1970s, akin to present perceptions. Investors took untimely risks that proved costly. By the late 1970s, influenced by the trauma of inflation, they shifted towards hedge assets.

The report underscored a significant point: “Thirty years of prosperity and peace created a faith that our problems will be resolved.” Does this sound familiar? Dalio speculates we will soon test the resilience of the existing order and the containment, or lack thereof, of international conflicts.

Let’s take a step back. What has transpired?

Over many decades, policymakers orchestrated a “growth engine,” nurturing innovation and globalization, inadvertently widening the wealth gap. The urgency to fix disparities, heightened by a pandemic, suggests the next decade will unfold differently, marked by rolling crises.

Inflation & protectionism & conflict, oh my!

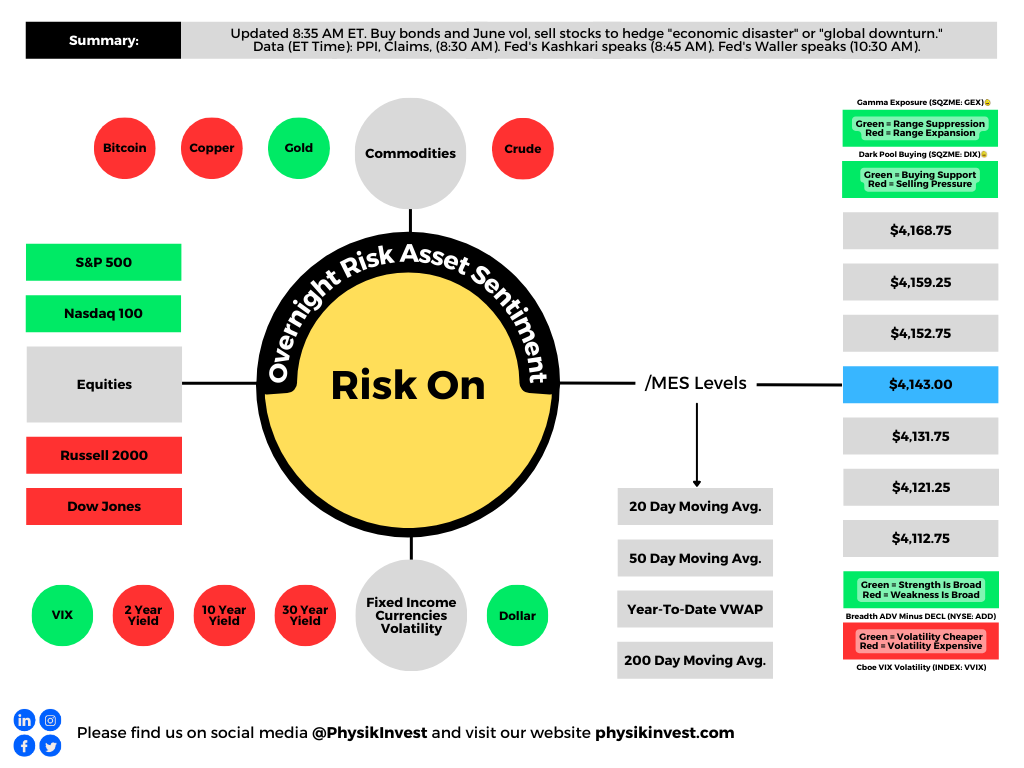

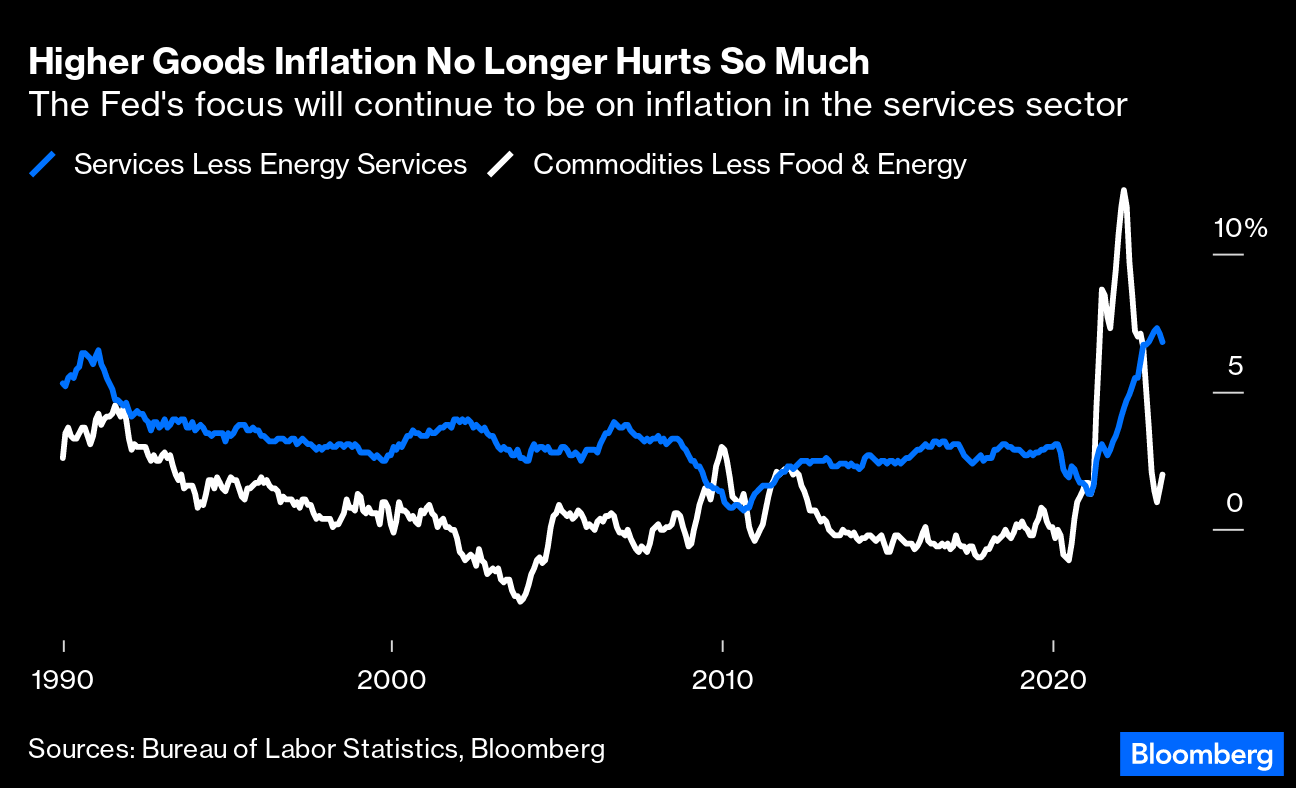

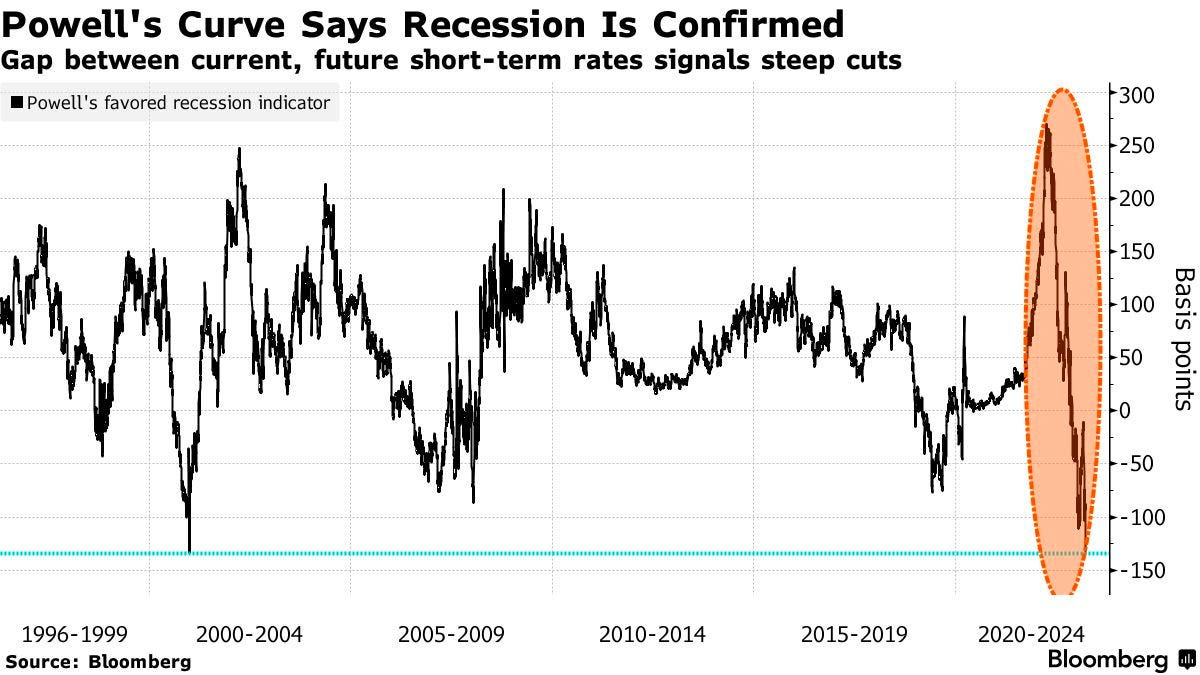

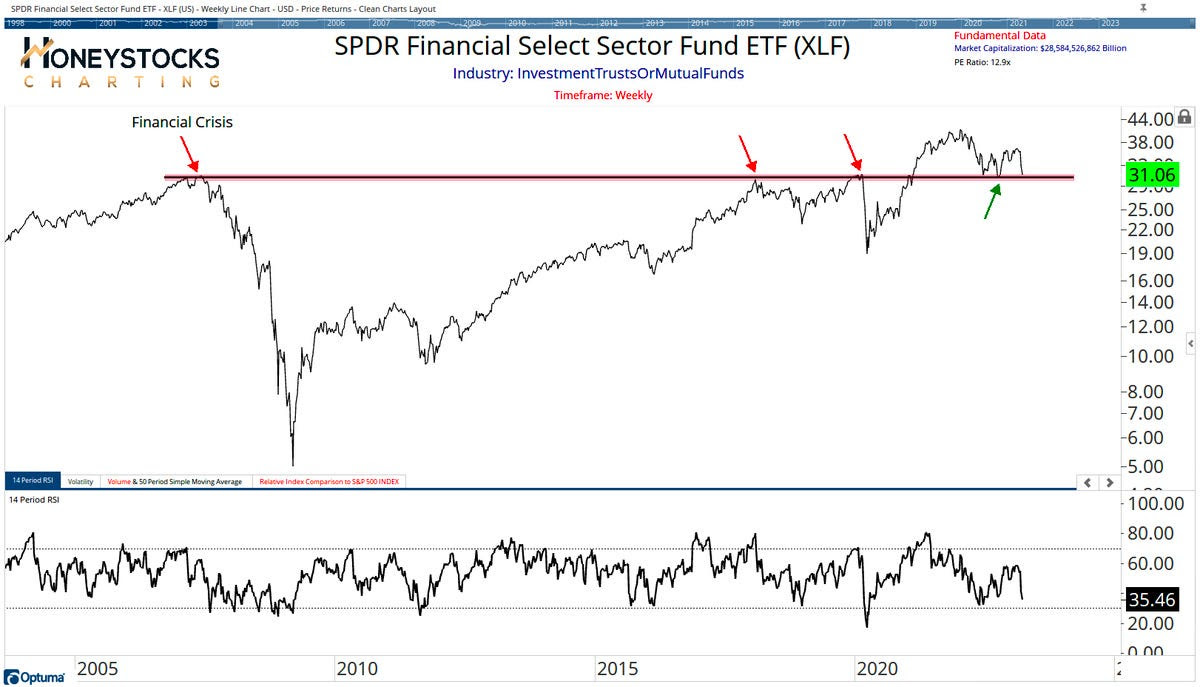

This secular narrative is meticulously explored in our “Climbing A Wall Of Worry” letter. Resolving supply-chain disruptions and commodity deflation helped alleviate overall inflation concerns in the short term. Fiscal boosts, low unemployment, and wage inflation bolstered economic resilience. Pundits are now invoking terms like “soft-landing” and “Goldilocks,” capturing the current sentiment.

“The picture that market prices are now painting is for inflation to fall to central banks’ targets, for real growth to be moderate, and for central banks to lower interest rates fairly quickly—so the markets are now reflecting a Goldilocks economy,” Dalio says himself.

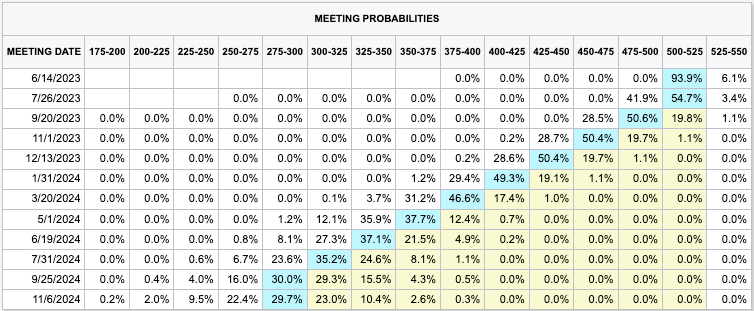

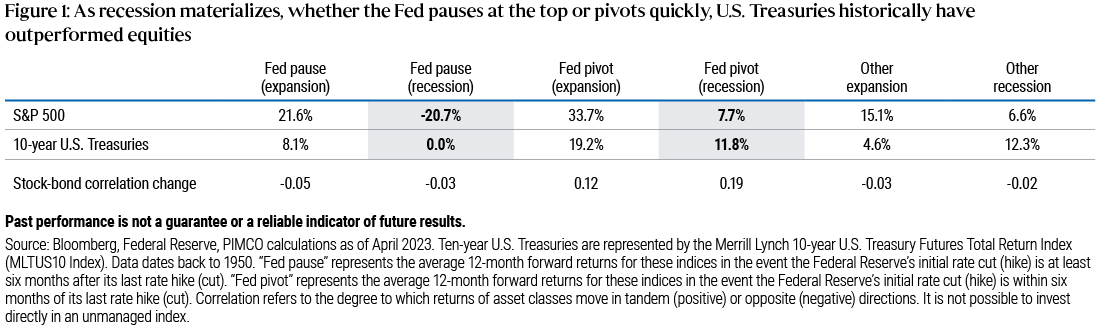

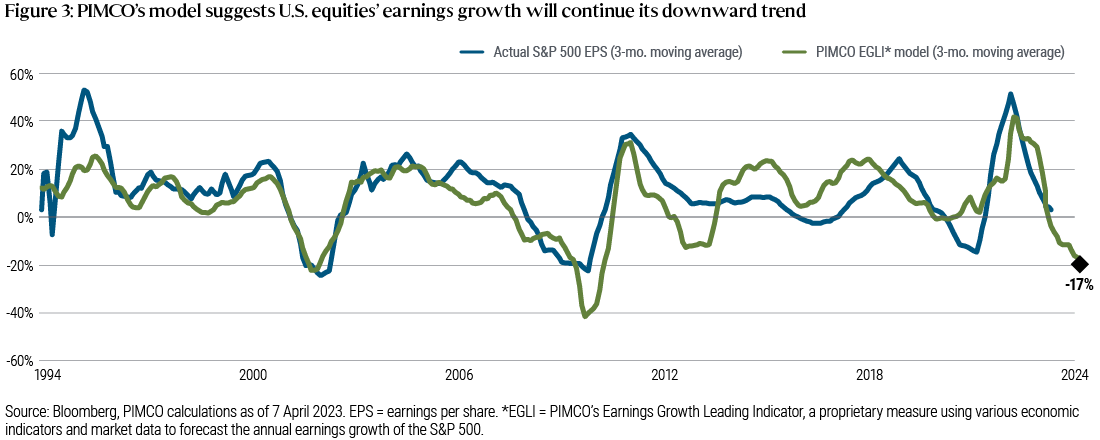

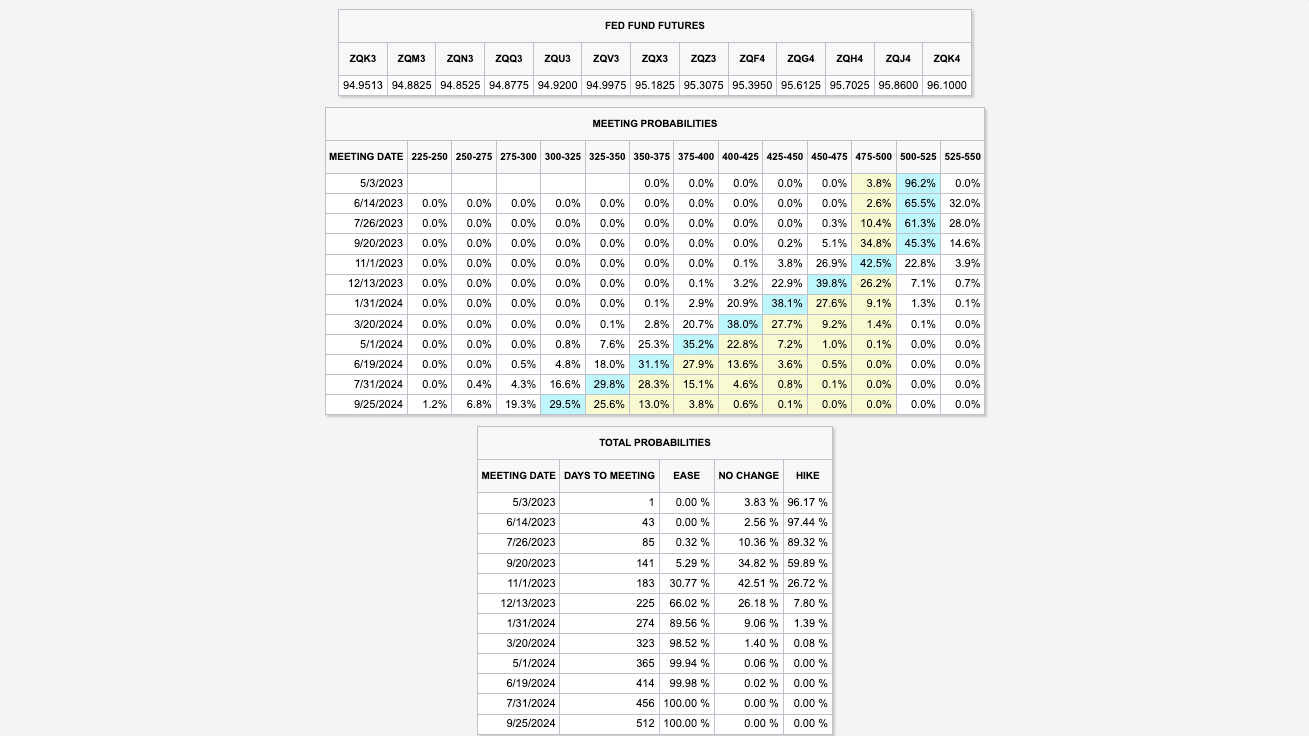

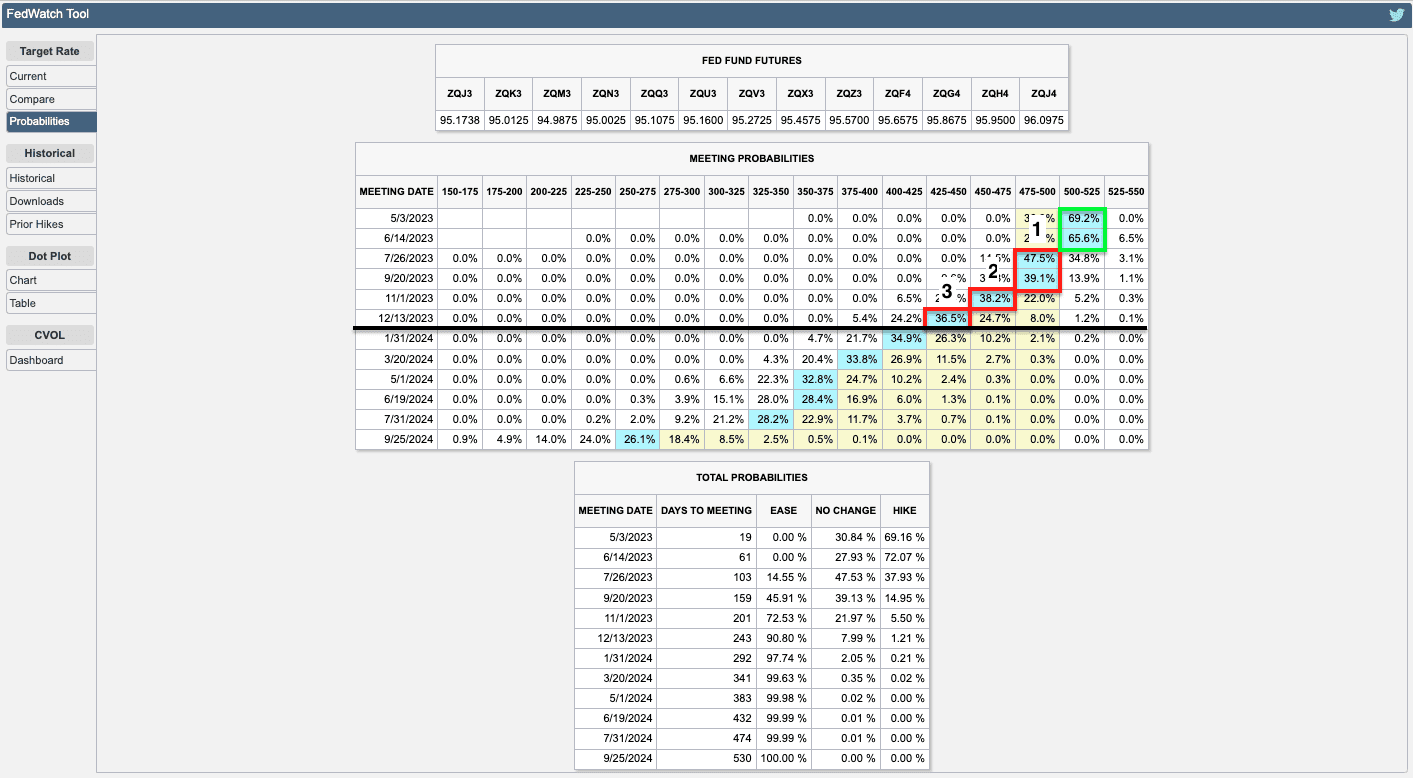

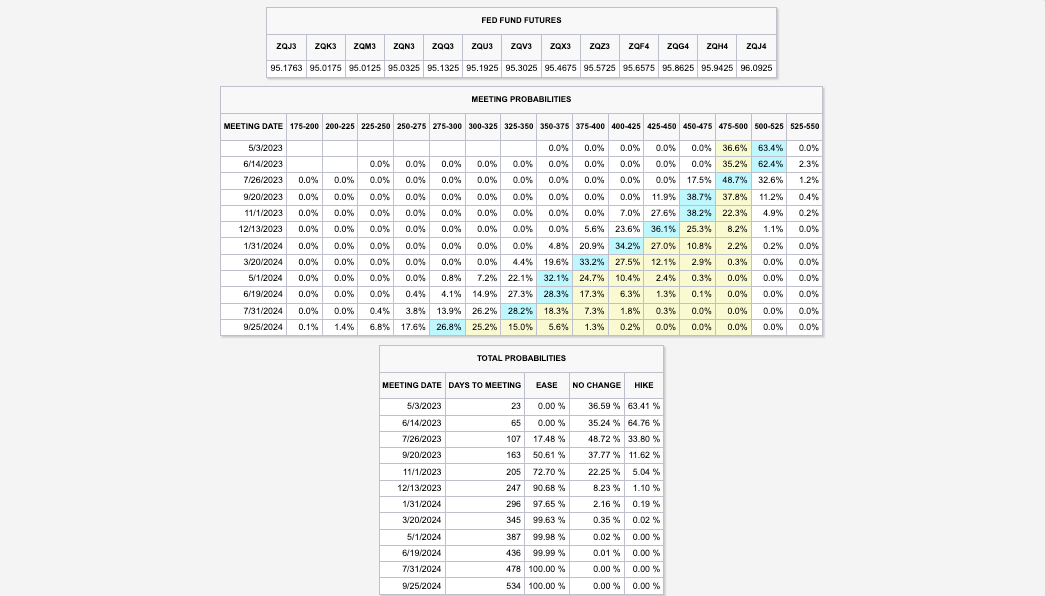

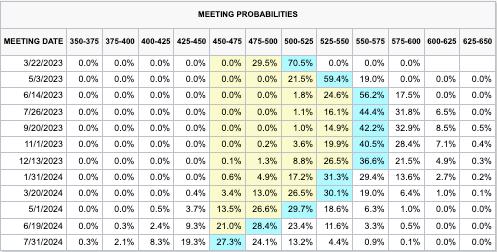

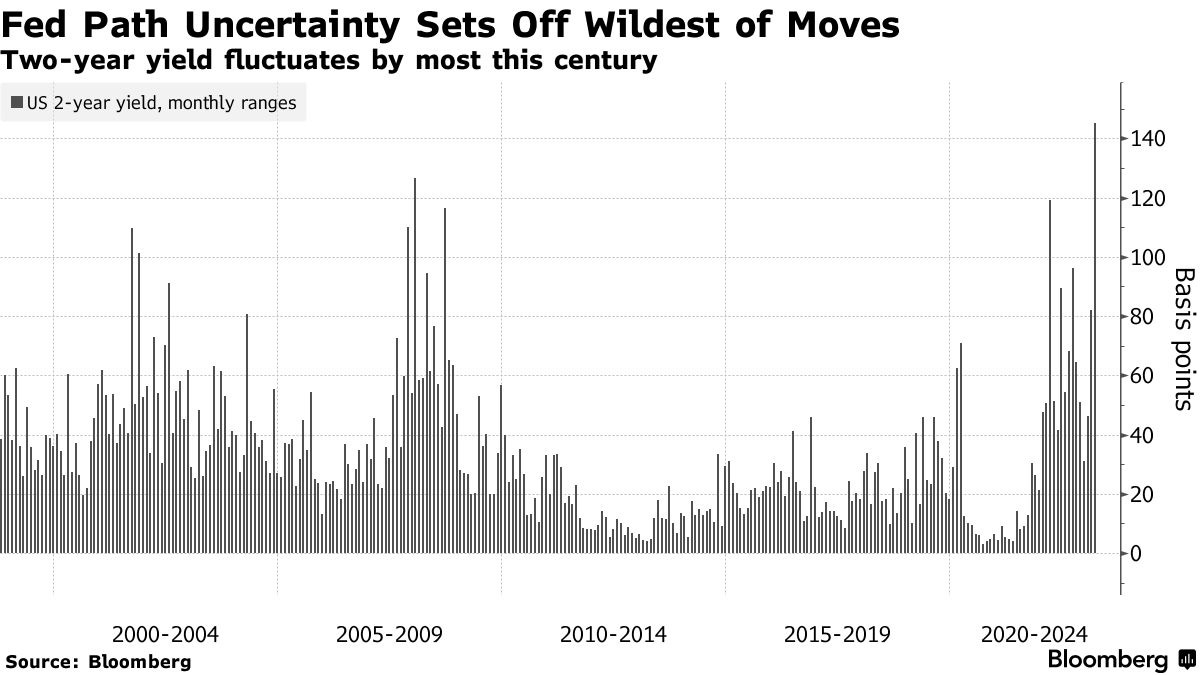

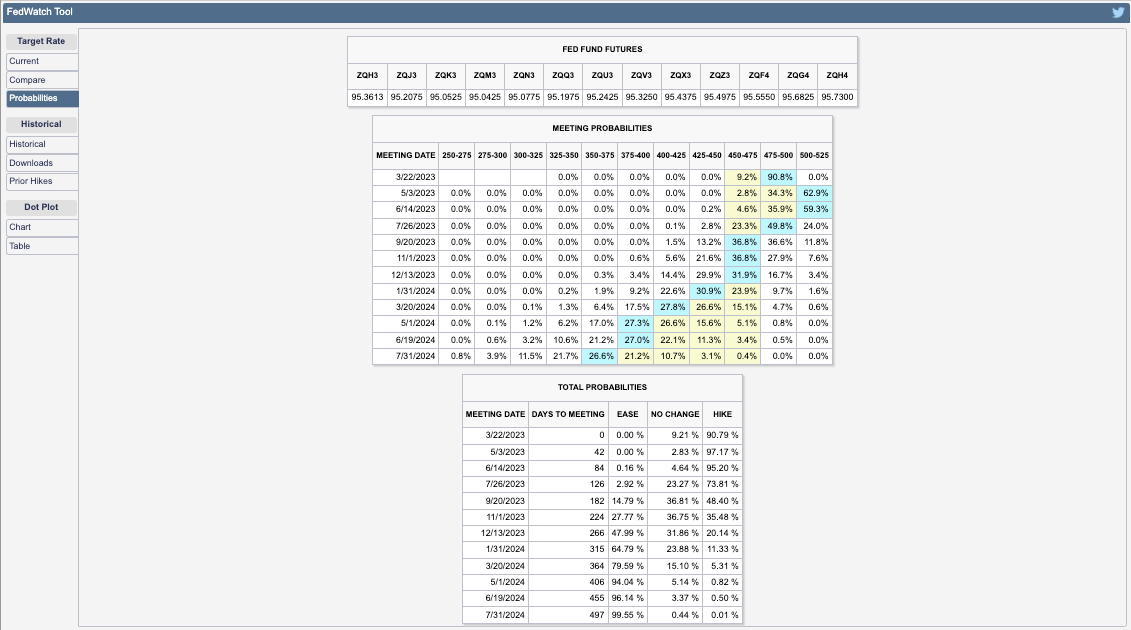

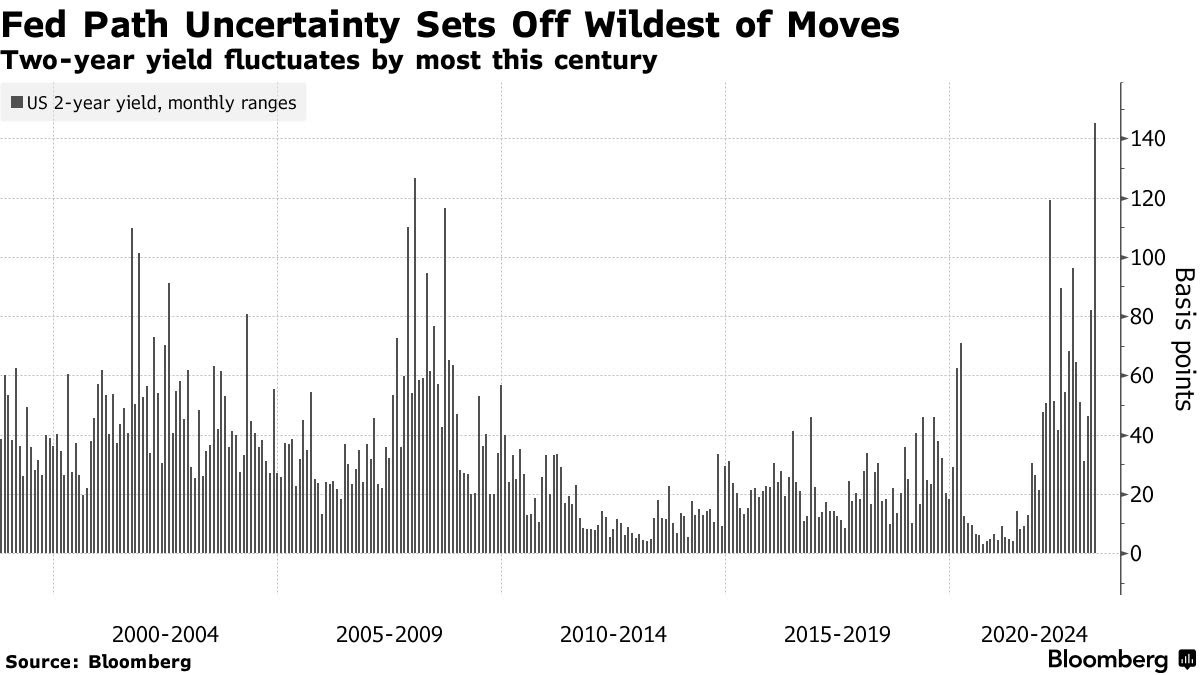

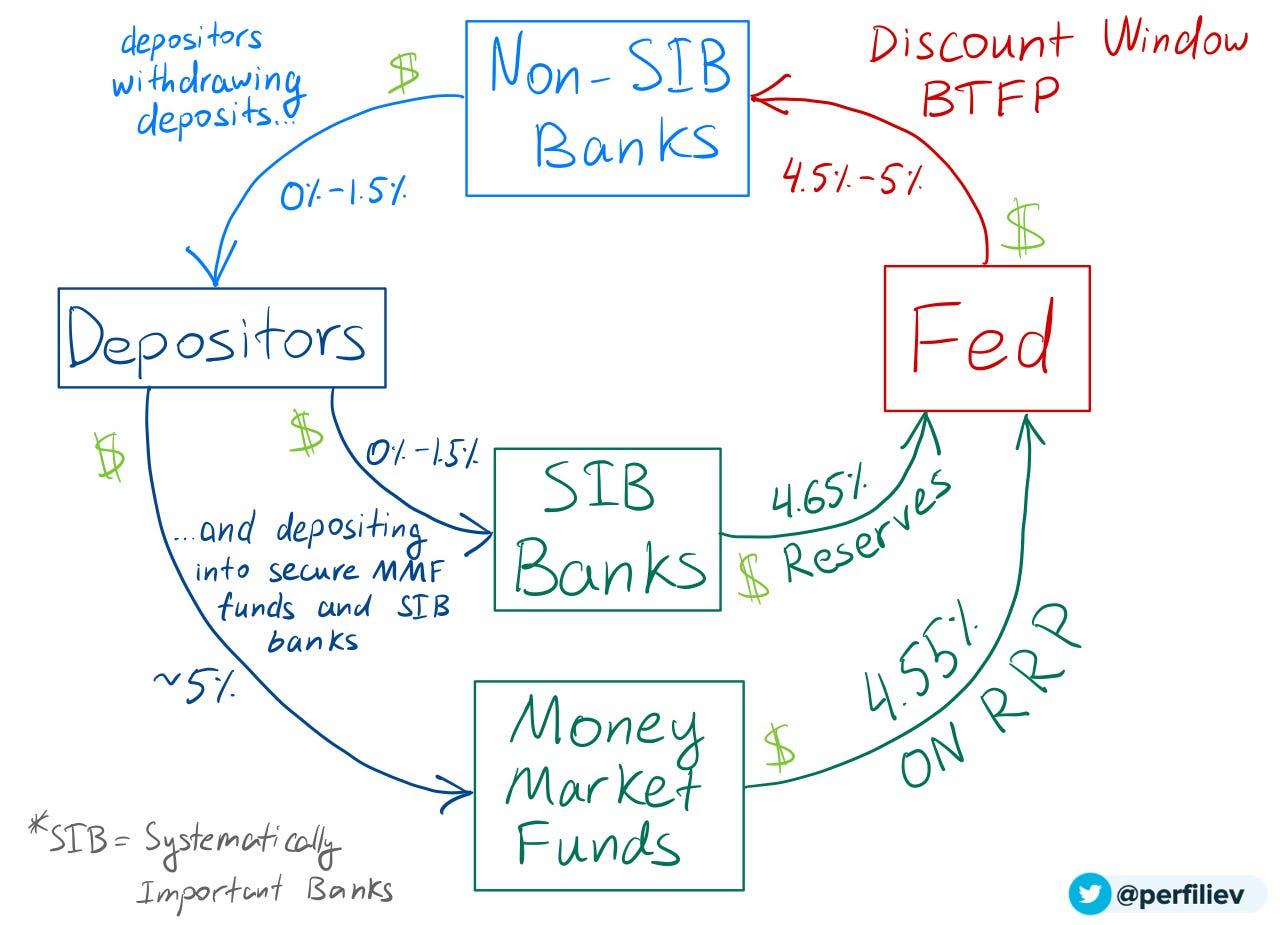

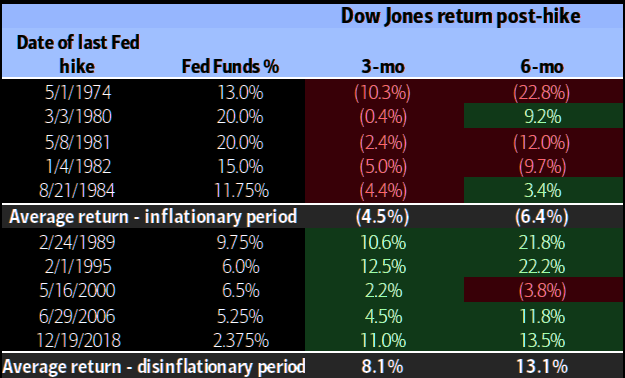

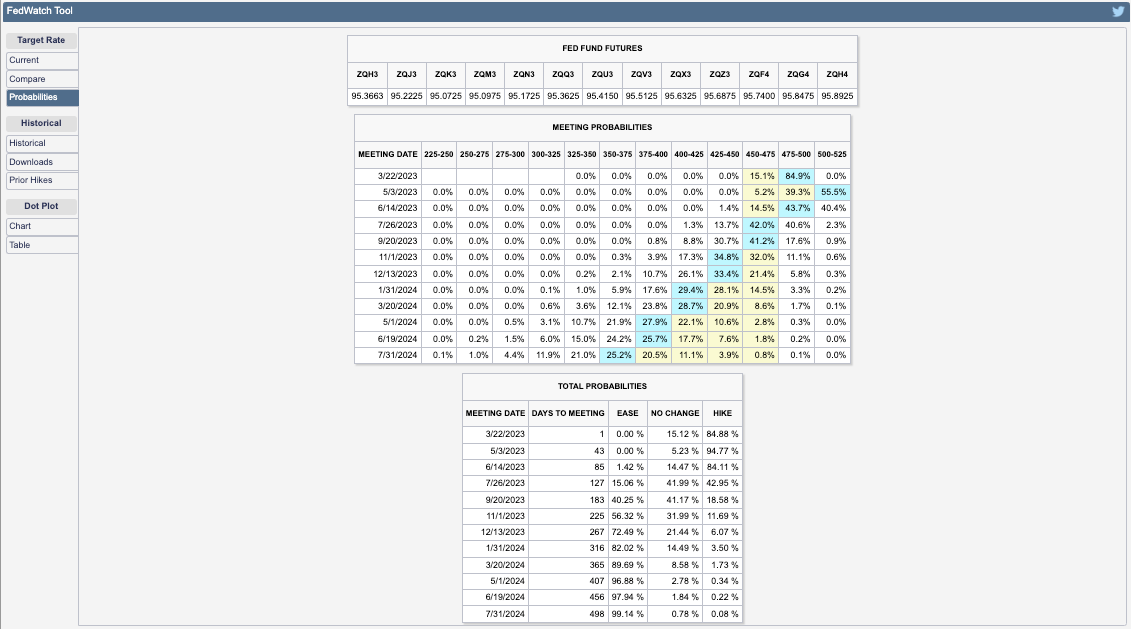

The economic outlook for 2024 seems less impressive despite lingering market support from previous stimulations. Market prices indicate five cuts, reducing the target rate range from 525-550 to 400-425 basis points. Federal Reserve Governor Christopher Waller, who generally holds hawkish views, concurs that “the FOMC will be able to lower the target range for the federal funds rate this year.” However, he cautions against anticipating as many cuts, asserting that, despite noisy data, current policy is appropriate and should persist in exerting downward pressure on demand.

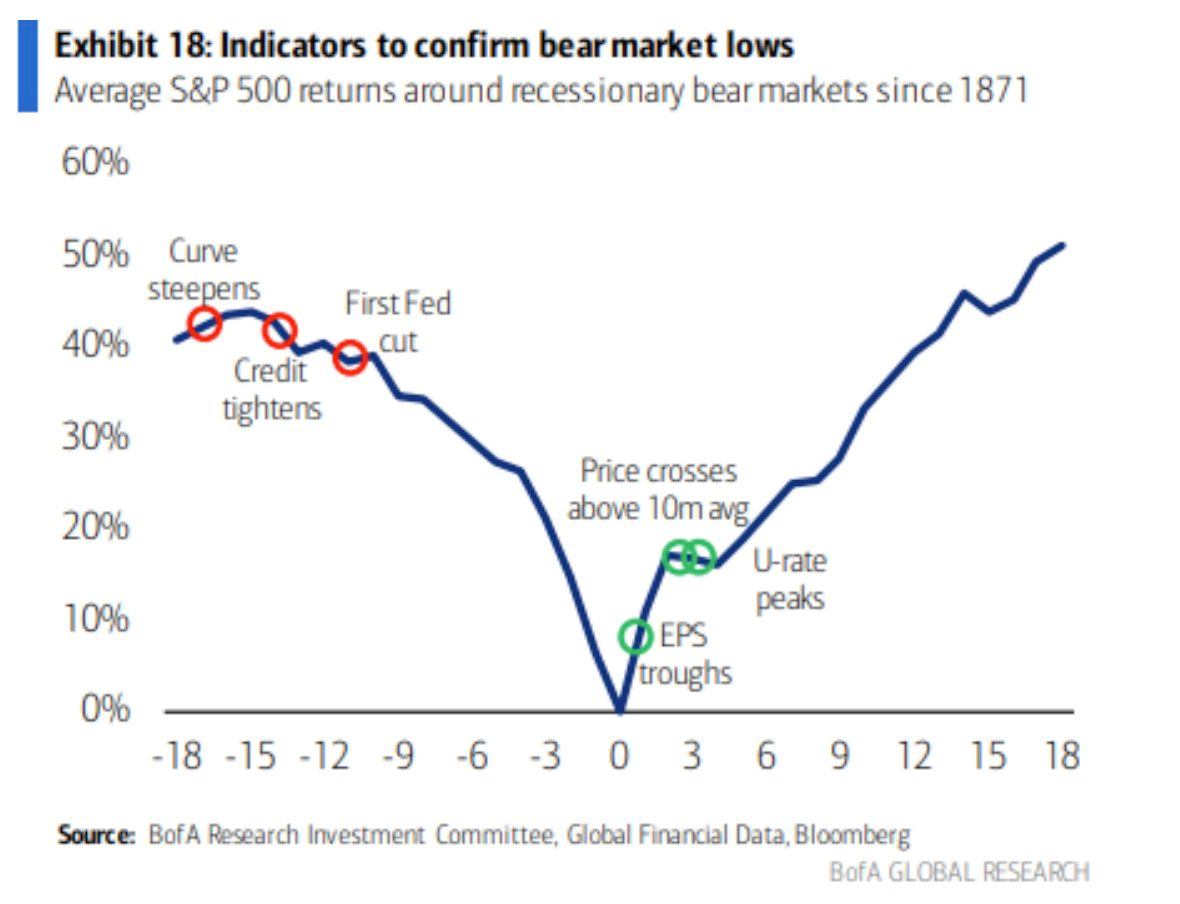

In a different scenario, where higher real interest rates persist, it would negatively affect the economy. A hard landing would be risked, Fabian Wintersberger believes, leading to a fall in GDP and escalating debt ratios. Regardless of the path, the private sector will likely reduce investment and continue deleveraging for as long as feasible.

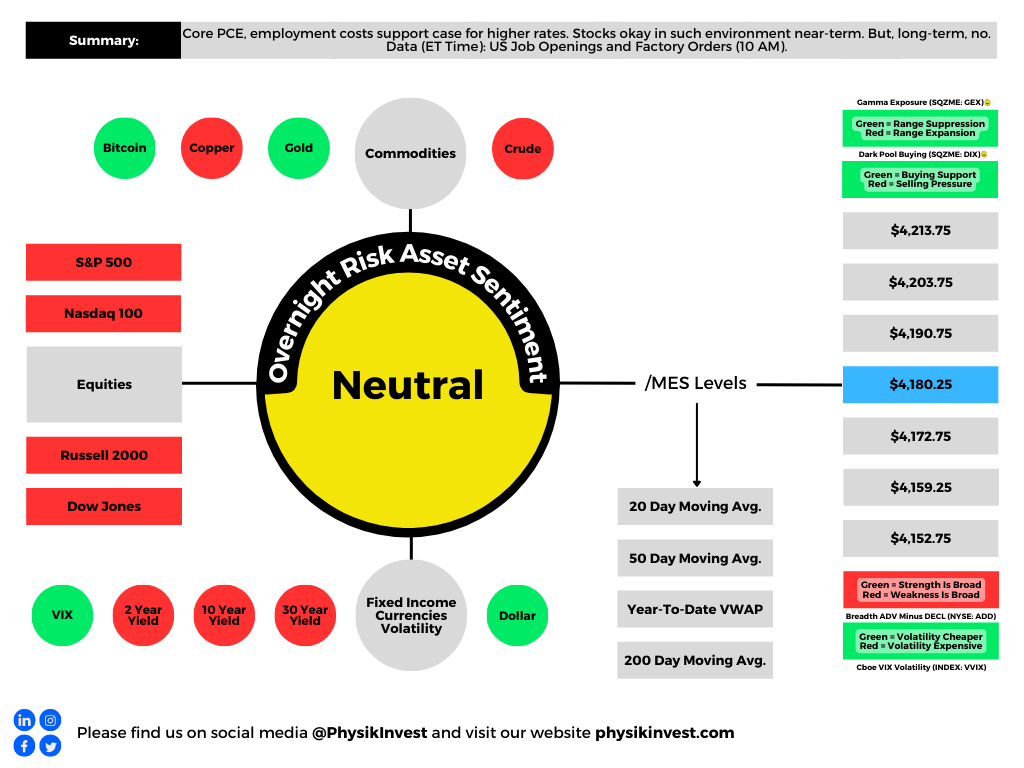

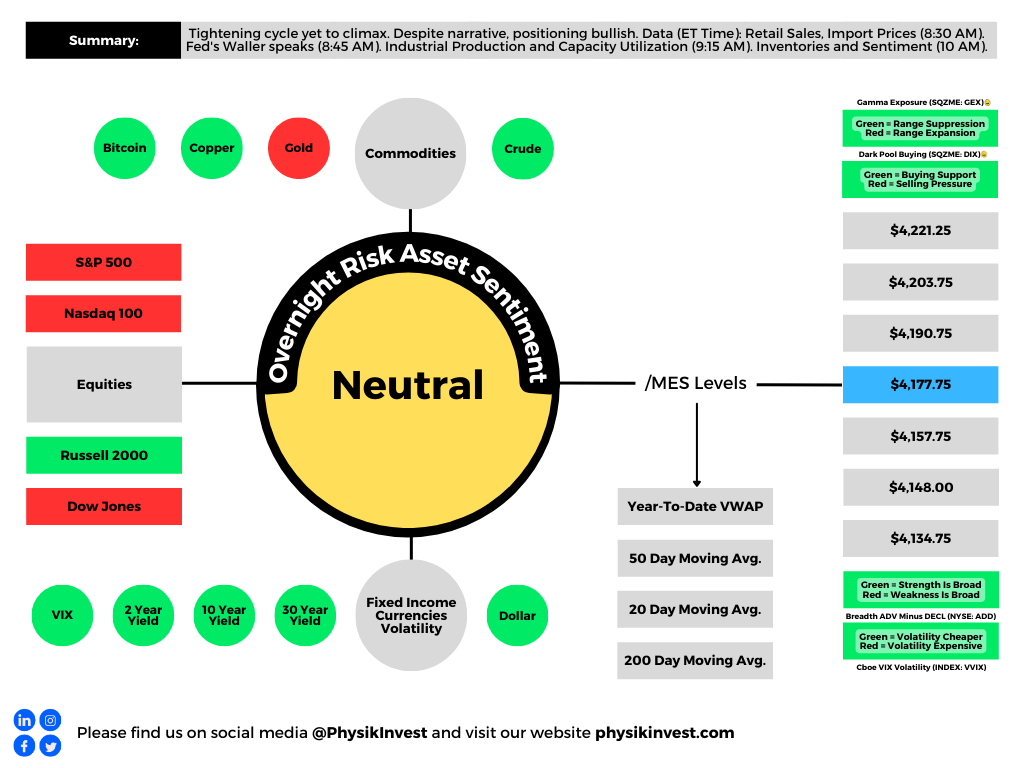

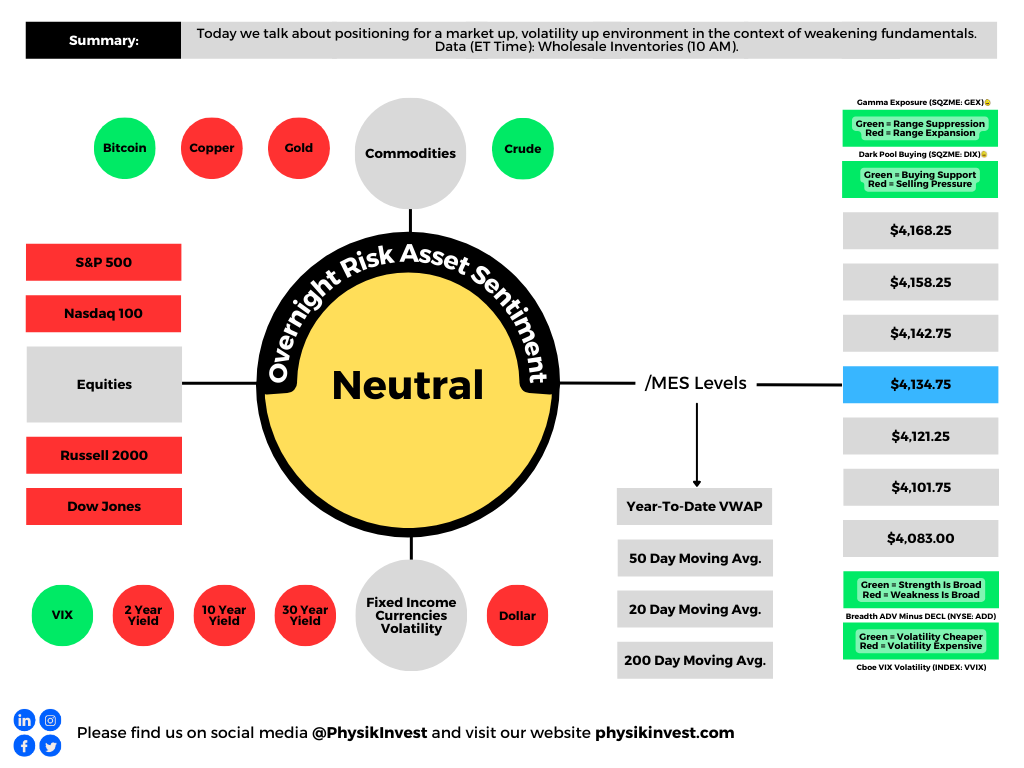

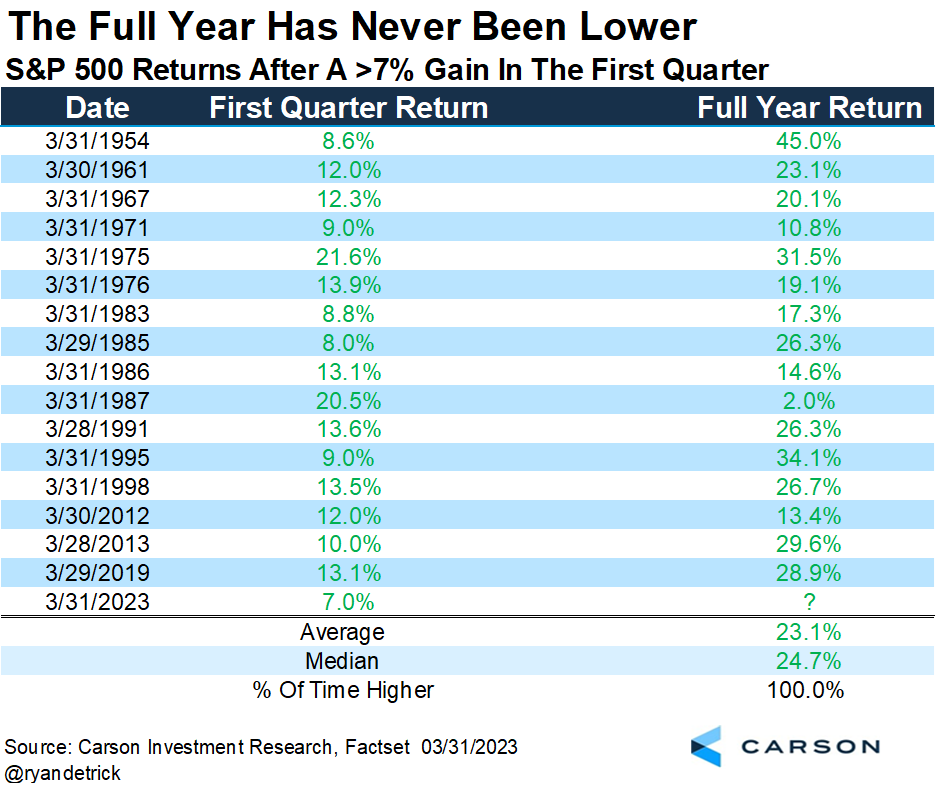

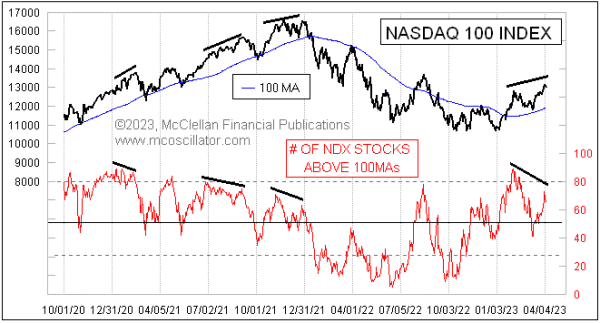

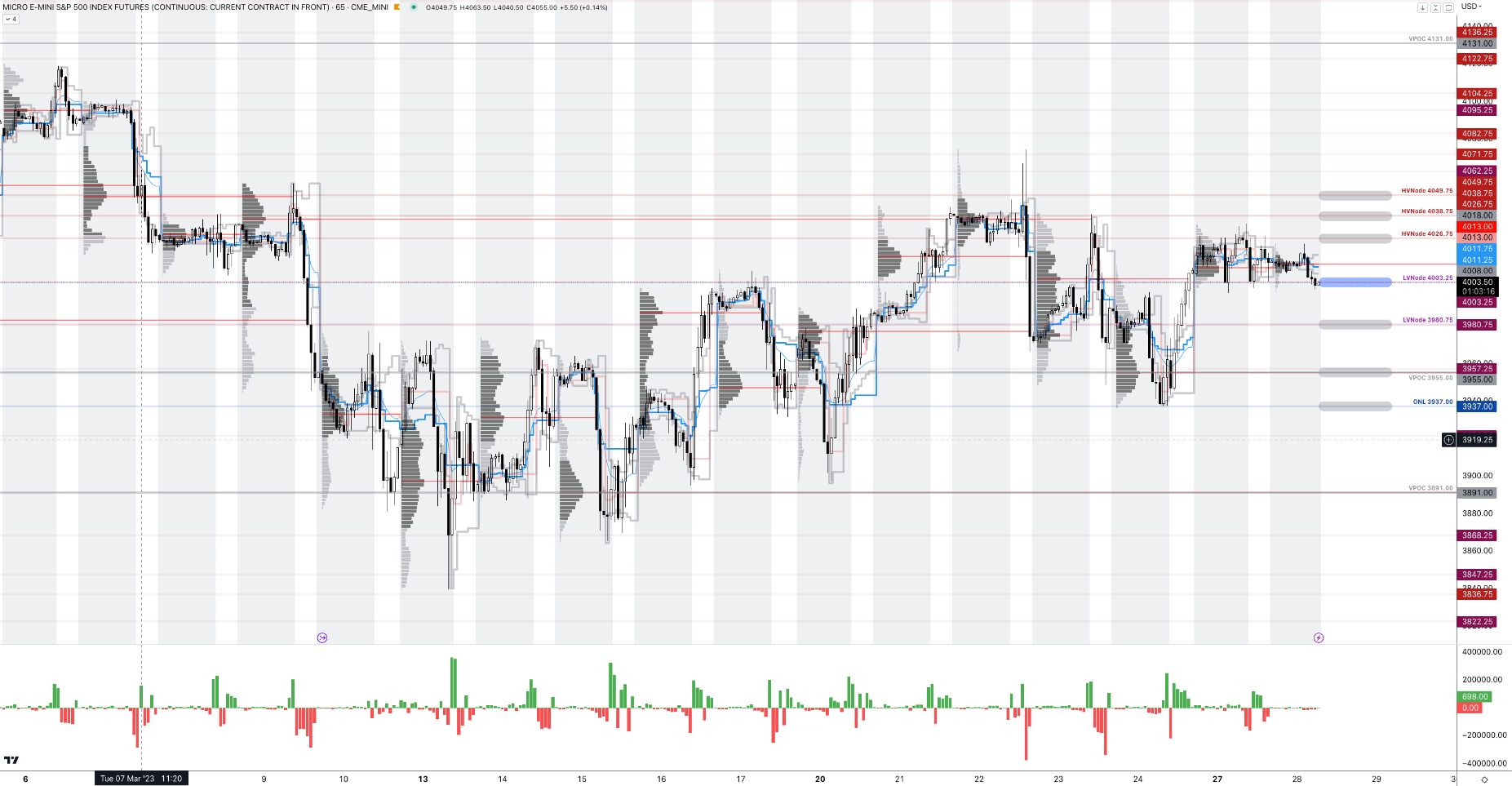

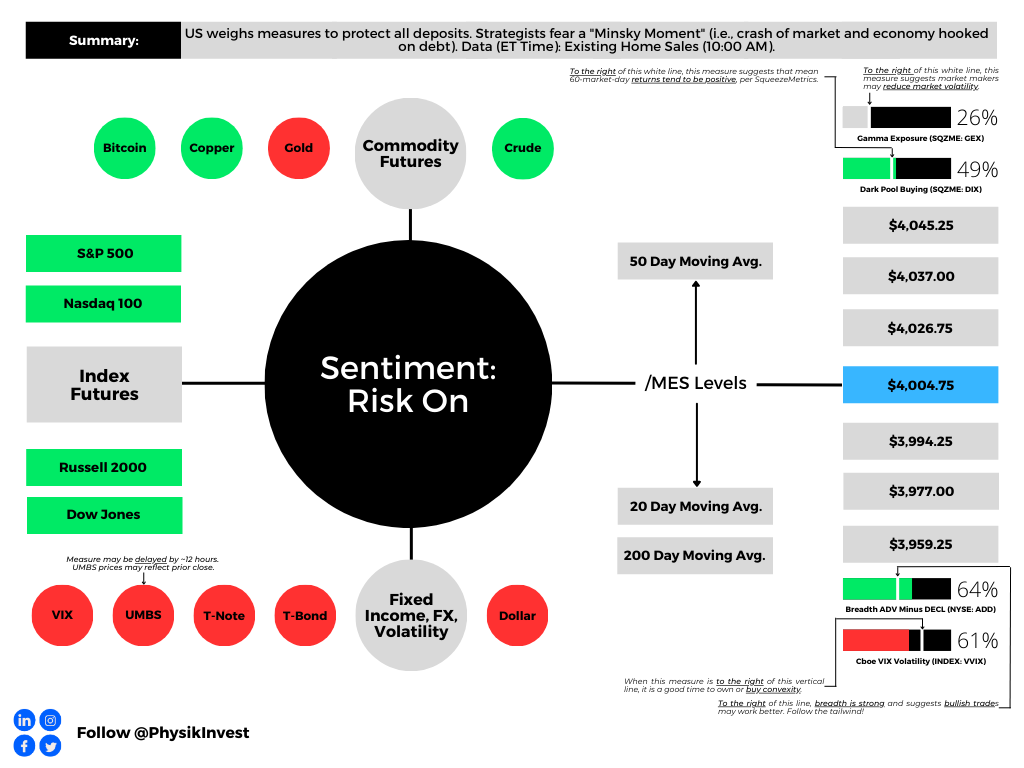

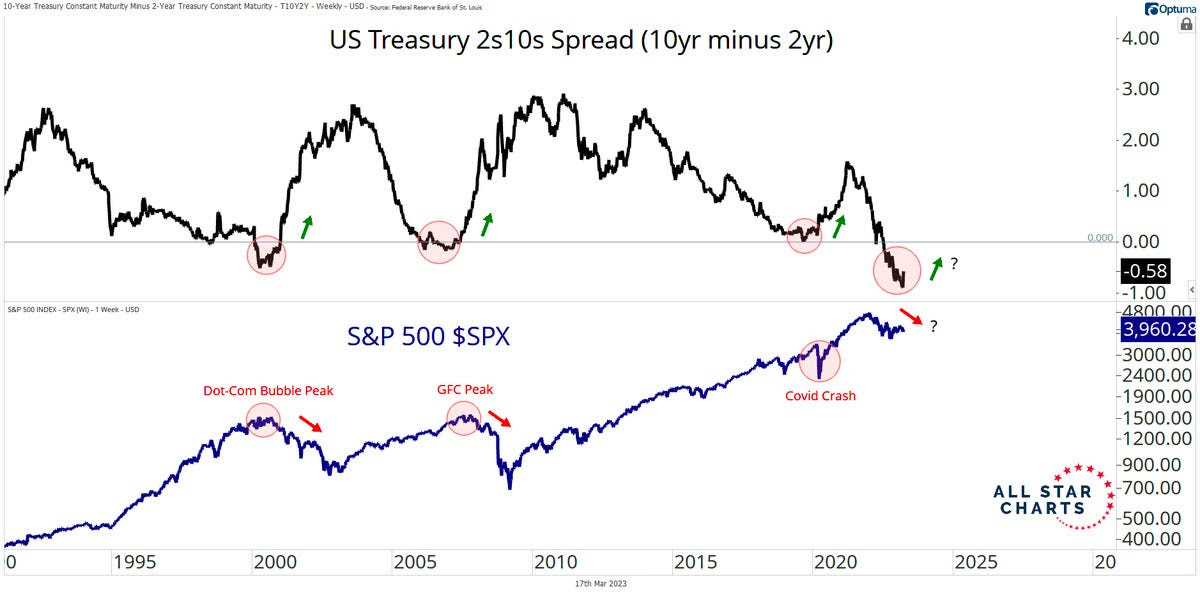

What does all this mean for the stock market? Investors across all time frames are ultra-enthusiastic, bidding products like the S&P 500 to new highs. However, breadth could be more exciting, judging by the Russell 2000 and equal-weighted indexes.

Such is the takeaway when looking at market internals also.

So, what’s the story? Bloomberg says, “This isn’t your father’s S&P 500. Don’t worry about valuations.”

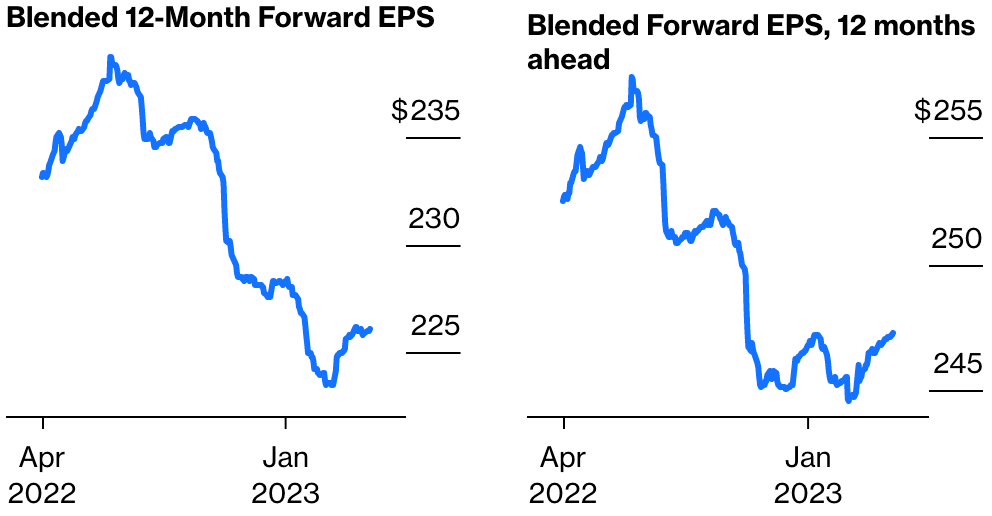

Typically, these statements raise promote caution. However, investors seem to see no alternative at the moment. The market is fueled by enthusiastic buying of a handful of stocks “accumulating greater and greater weighting.” While the forward P/E of the equal-weight S&P 500 aligns with pre-pandemic averages, the so-called Magnificent 7, steering the well-known S&P 500 (i.e., the SPX), boasts a higher value at 28.

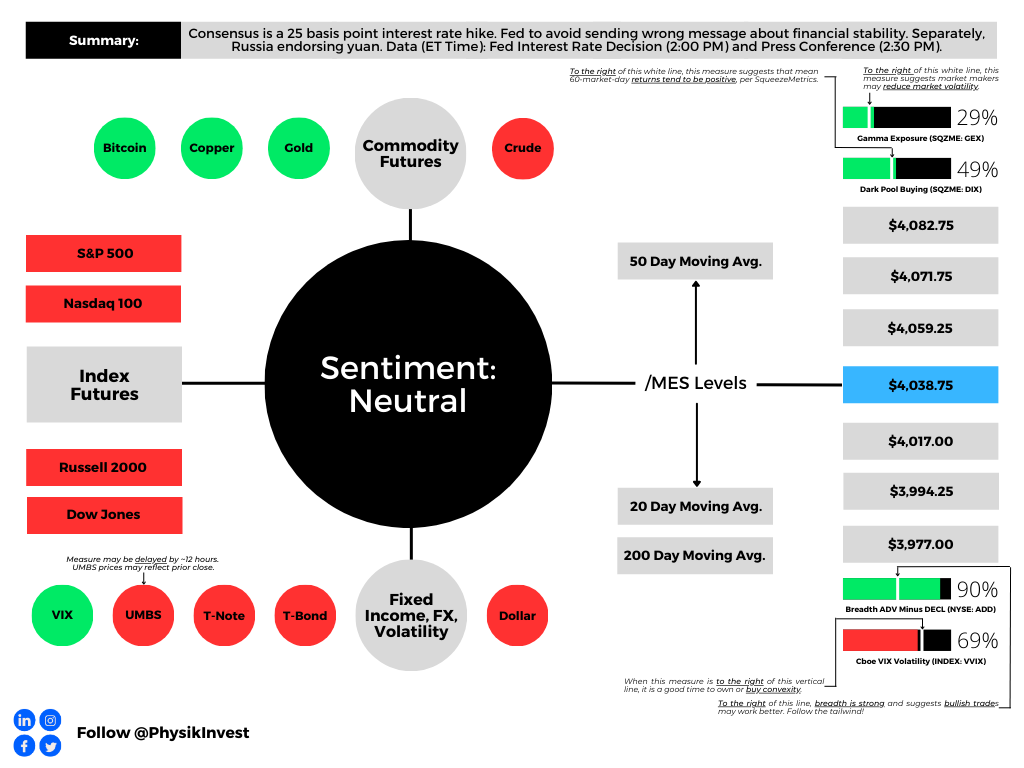

Accordingly, over the shorter term, there are risks, including the market pausing here to “demand some deliverables” and the passage of options expiries last week.

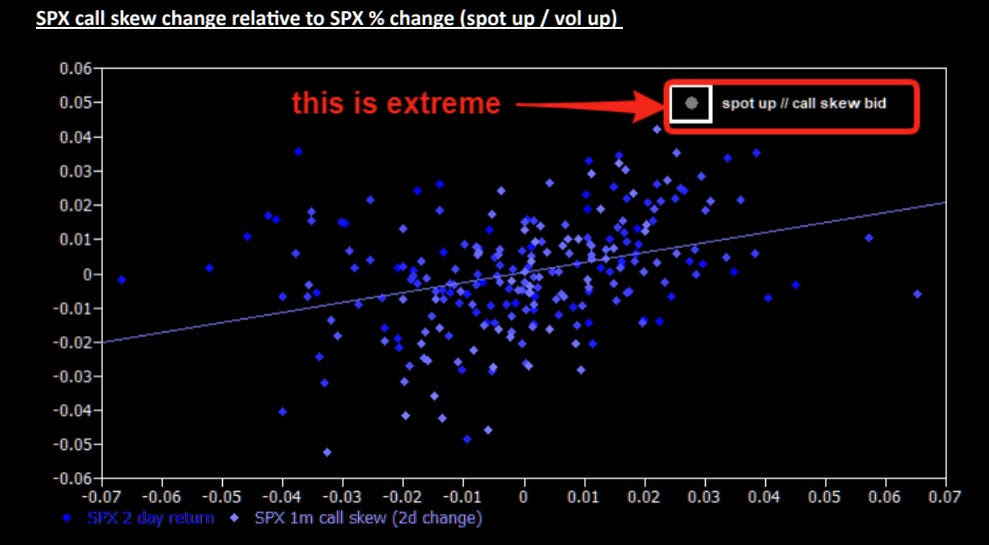

“The reflexive nature of the market tells us that what we are witnessing here is much more mechanical than anything and probably has nothing to do with what is happening in the real world,” Mott Capital Management’s Michael Kramer discusses.

SpotGamma explains there was “rhythmic buying” of options “related to the QYLD Nasdaq BuyWrite ETF, which rolls the Thursday before monthly OPEX.”

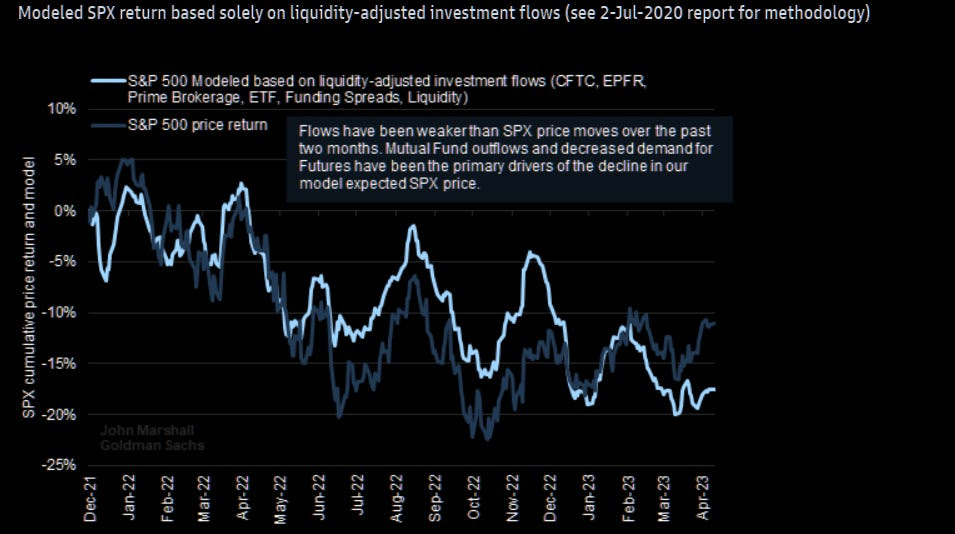

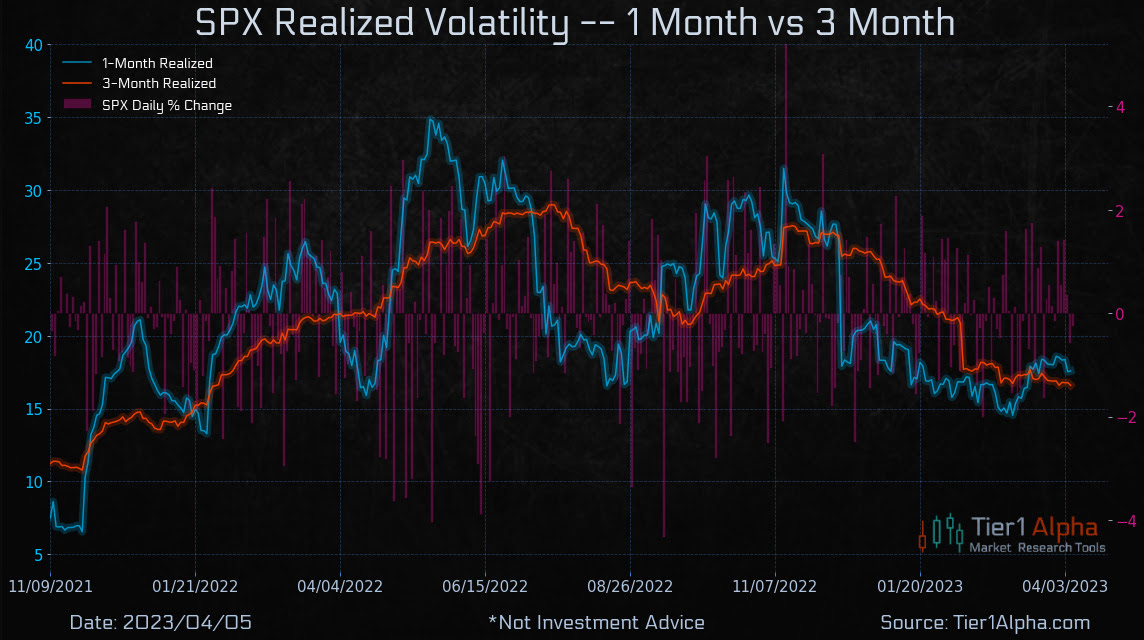

Kramer, aligning with views expressed by individuals such as Cem Karsan from Kai Volatility, anticipates a potential reversal. The premise is based on the assumption that investors owned a substantial share of call options. With a reduction in their quantity and a decrease in the risk they pose to counterparts engaged in hedging through long stocks and futures, there is expected to be diminished “mechanical” support in the subsequent weeks. SpotGamma emphasizes that Monday is the final day for any options expiration effect.

“The structural supply and demand imbalance should end on Friday,” Karsan states. “I would be careful chasing this tech up here, in particular, if we see some weakness going forward like we’ve been talking about.”

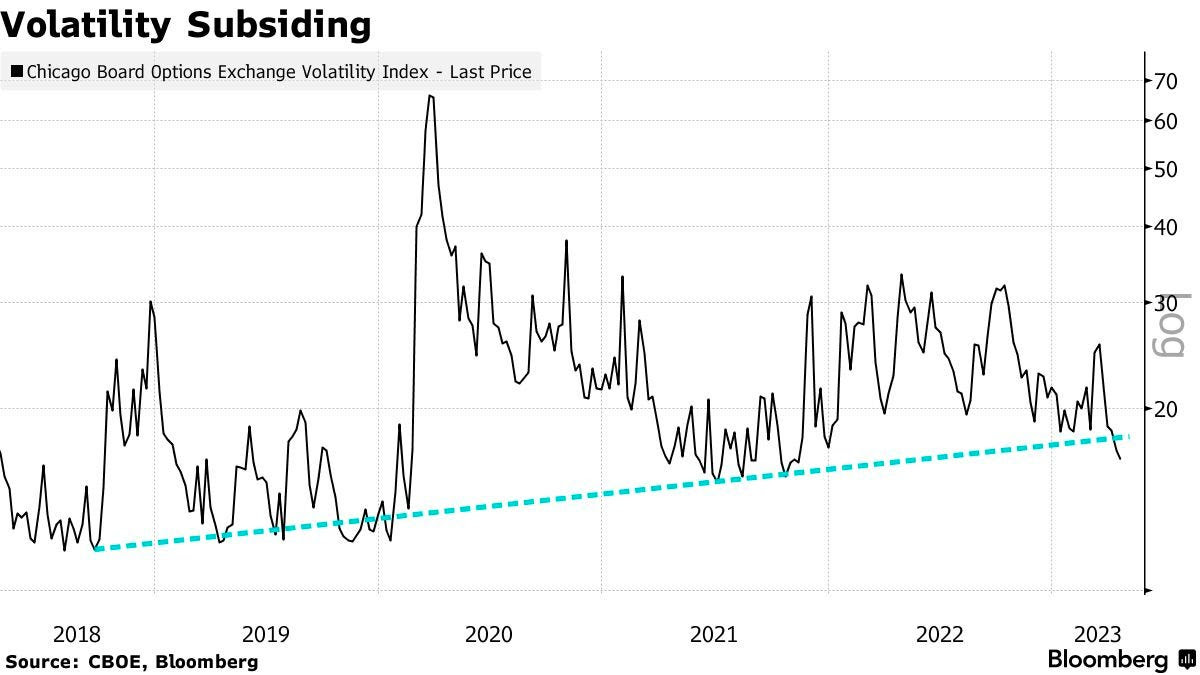

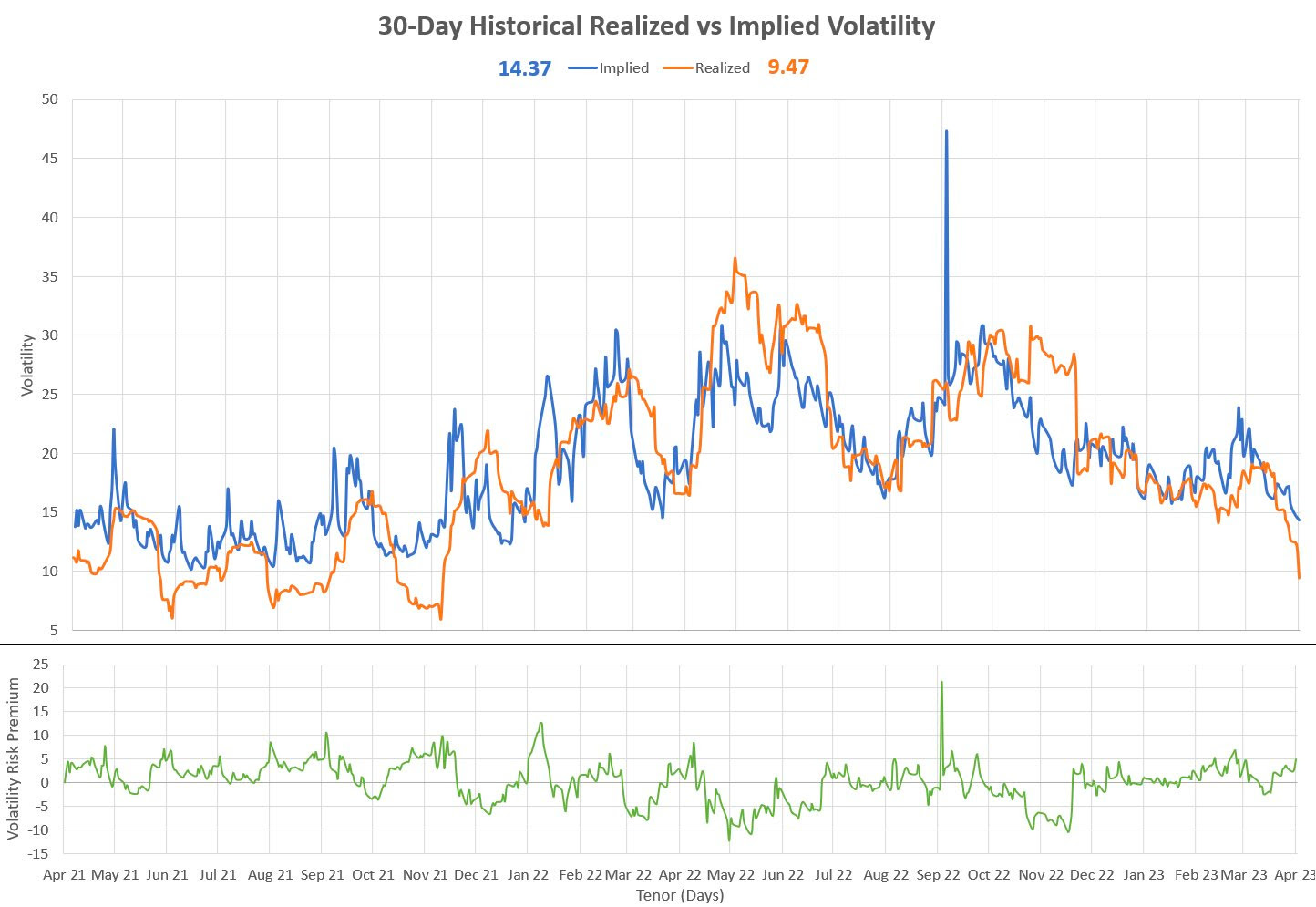

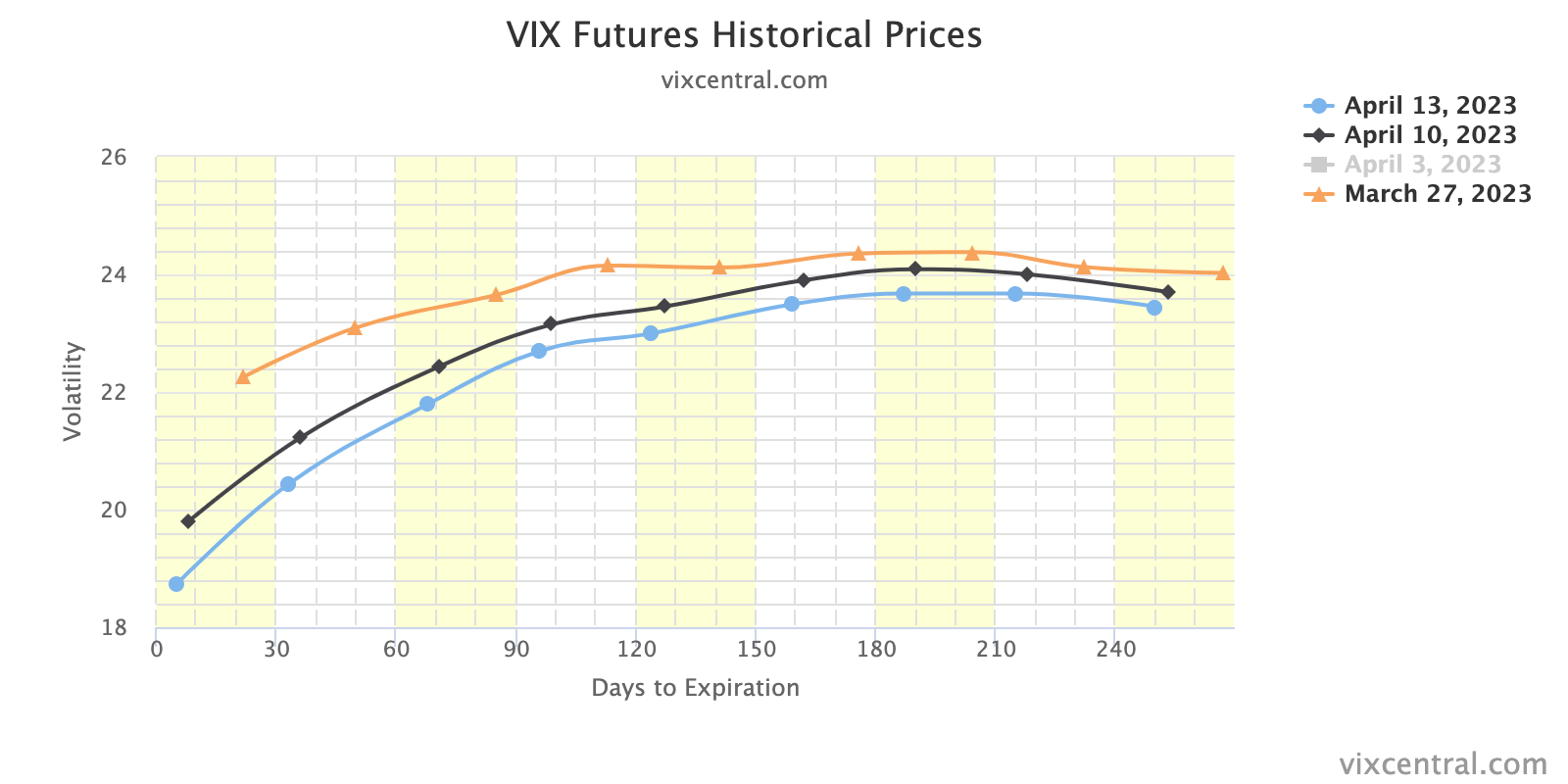

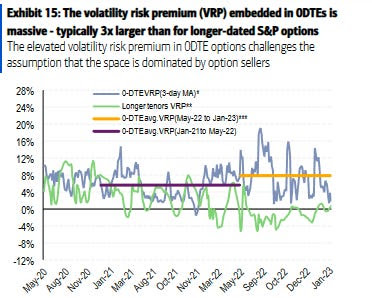

The crucial factor is the amount of “vol supply” emerging from this event, which could counteract “vol demand” (recall that investors often seek protection through options or volatility, the all-encompassing term). This counteraction may postpone weakness, setting the stage for a more significant decline later in Q1, as highlighted by Karsan.

It’s important to note that a substantial market position involves hedging equity with short-call options and long-put options. Options prices may decrease with increased volatility supply, leading to the counterpart’s re-hedging of this position by buying back underlying stock and futures hedges (i.e., if a counterpart is short futures against an SPX long-call and short-put position, they will buy futures to rebalance their delta as implied volatility falls).

“Can that counter the lack of positive flows, the vol buying, and some of the macro liquidity issues,” Karsan asks, acknowledging the pressures linked to asset runoff, Treasury issuances, the diminishing reverse repo, and external events such as the Red Sea attacks, which are perceived as potentially more impactful on supply chains than the global pandemic. In any case, there are increasing prospects of a “February 14 Valentine’s Day Massacre.”

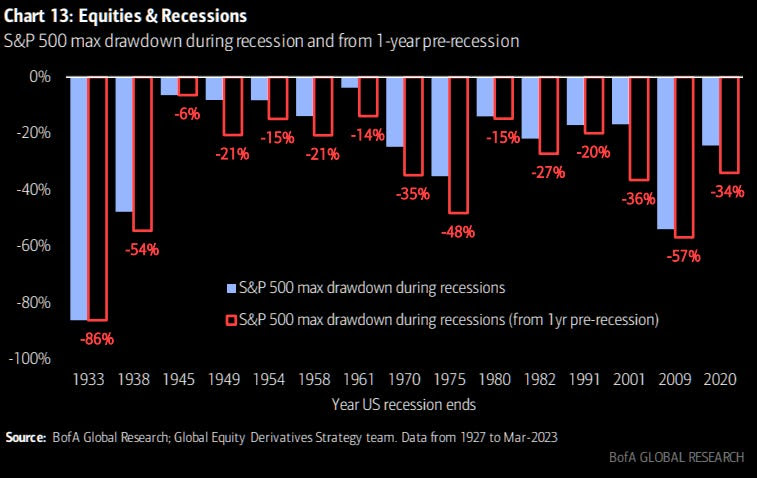

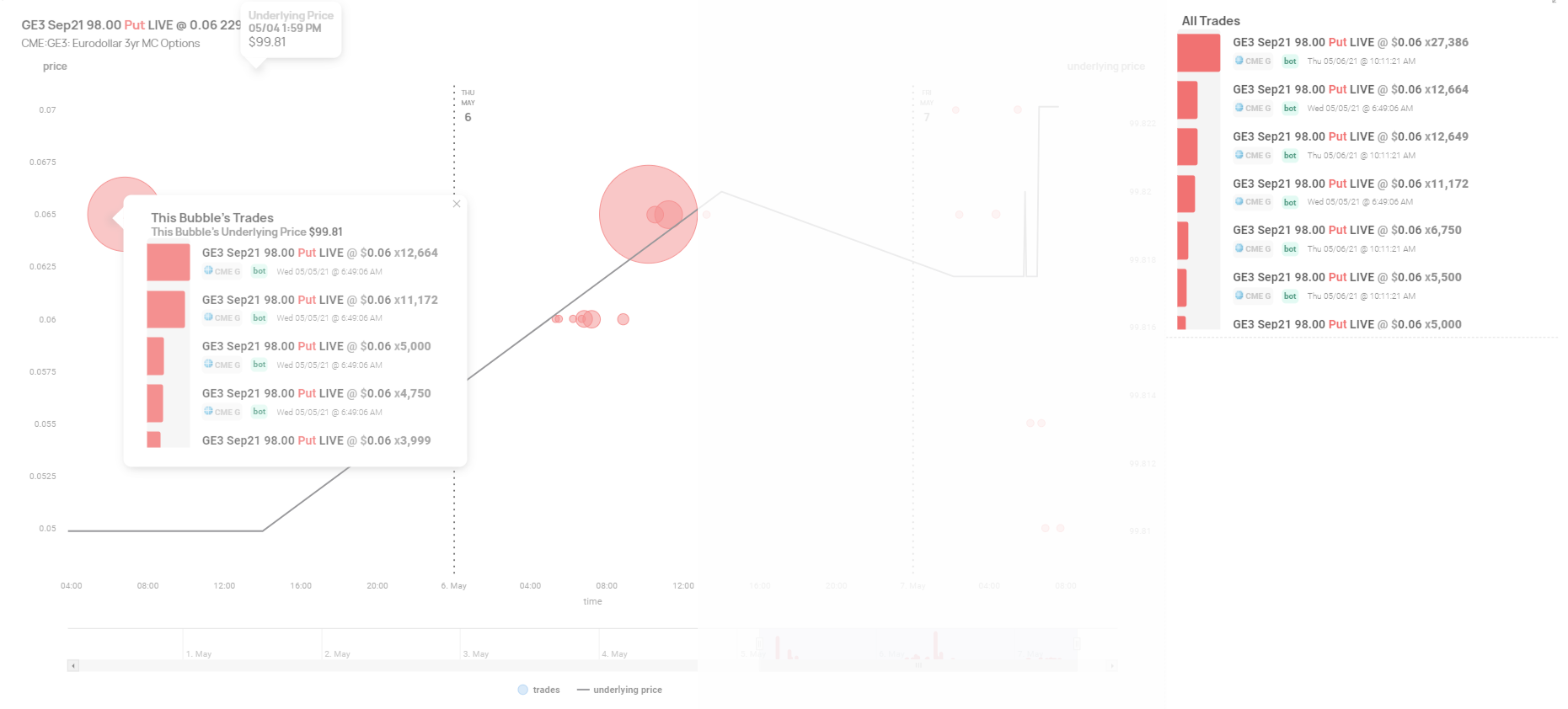

What’s the course of action? According to Simplify Asset Management, considering that far out-of-the-money puts are now priced at half of what they were at the onset of the global pandemic four years ago, hedging at this point is a prudent move.

Butterflies in the Nasdaq 100 and S&P 500 present an appealing opportunity. Take, for instance, the 15000/13500/12000 NDX butterfly expiring in the next month or two. It costs between $500 and $1,500 to open. If it’s the shorter-dated one that is in the money today, closing it could yield about a $90,000 credit, excluding changes in implied volatility and the passage of time. The maximum value is $150,000, and the risk is confined to the amount paid at open. Talk about the convexity!

We’ve analyzed this specific trade for you, although in the S&P 500 and without the distant protective put. Given the distinct environment, there is an elevated risk of a volatility increase warranting the acquisition of far-away protection, represented in this instance by the 12000 put.

Though owning volatility safeguards against a substantial decline, consider the expenses of maintaining that position and the inevitable decline in its value during calm or rising periods. It is “the investment equivalent of death by a thousand cuts.”

“Vol is cheap enough when you go out two or three months, particularly on the call side,” Karsan ends. “Into a rally particularly that should continue to be relatively bid. That doesn’t mean go own one-month vol because that is more uncertain here, right? You will experience a lot of decay if the decline doesn’t happen till February. Right? There is still theta to be had.”