Physik Invest’s Daily Brief is read free by thousands of subscribers. Join this community to learn about the fundamental and technical drivers of markets.

Administrative

Recall our past letters pondering the use of the yuan for settlements in the East. Well, there’s been progress on that end.

Also recall “the recycling of petrodollars by oil-rich nations” fueling “several emerging market debt crises” and prompting “the creation of a more speculative, debt-fueled economy in the US.” Is this a reversing trend? We shall unpack in a future letter, soon.

Fundamental

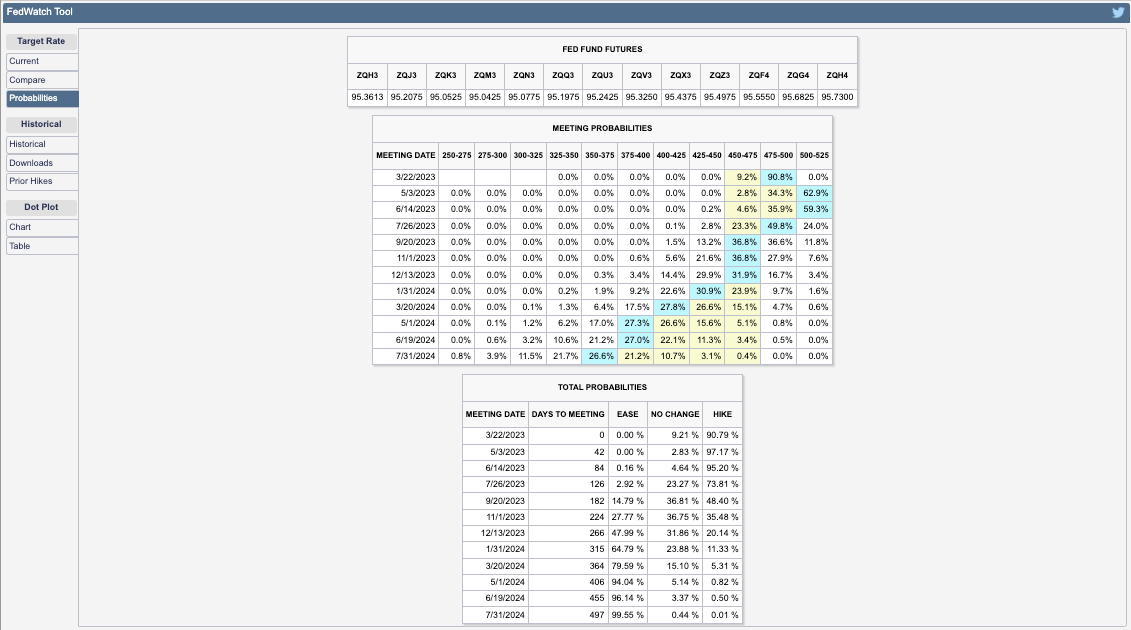

The Federal Reserve (Fed) is likely to bump its current target rate up 25 basis points to 4.75-5.00%. Failing to bump interest rates would likely send the wrong message about financial stability. To give up on the inflation fight (a pause or interest rate cut) would tell investors “look out below,” Bloomberg summarizes.

The path after is less certain, though most think there is likely to be at least one additional hike in the coming months. The catch is that if market-induced financial tightening persists through the second quarter, it would substitute for rate hikes.

Assuming the Fed publishes its summary of economic projections (SEP) or dot plot, they will likely show the governors “getting less aggressive,” adds Bloomberg’s John Authers.

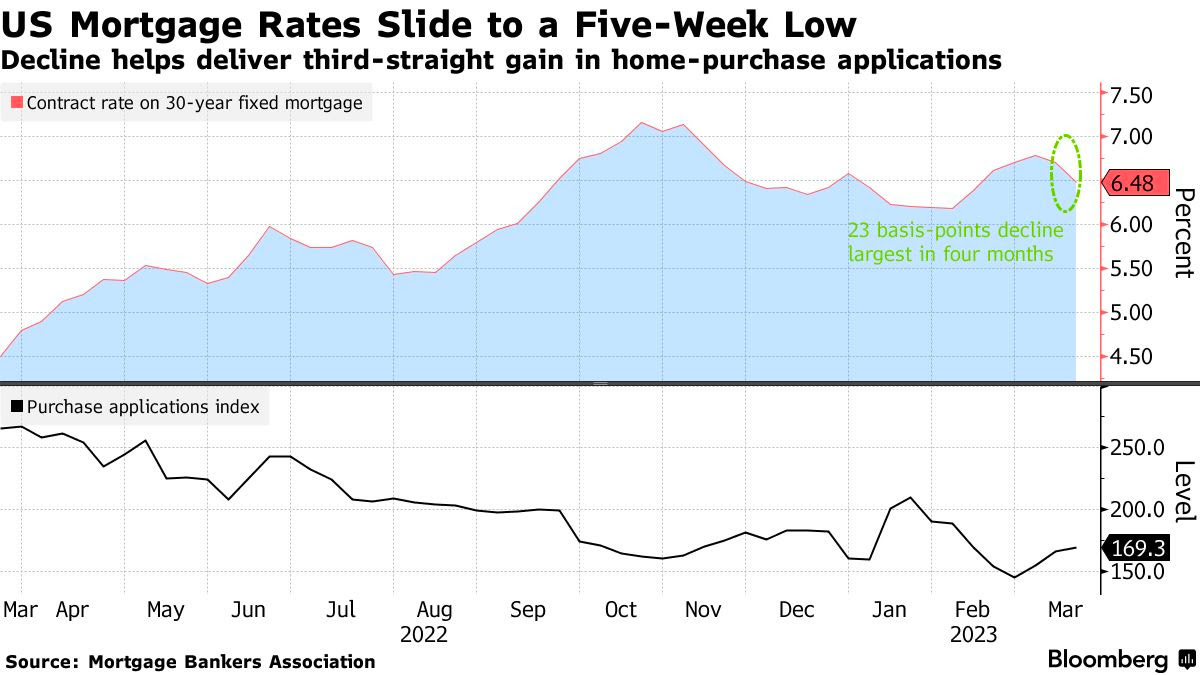

If we recall, Kai Volatility’s Cem Karsan talked about the Fed not wanting liquidations; they want a slow sale, not a fire sale. So, with there being a lag, the Fed may want to slow and assess, carefully telegraphing this being not a pivot. A pivot would probably inspire confidence among investors to own assets “mak[ing] things hotter,” Karsan explains, noting that the Fed really needs to walk up the long end of the yield curve. Recall that the long end fell considerably on the back of the turmoil and intervention, as well as recent data (e.g., housing starts showing more supply, likely a mortgage application booster that would further “make things hotter”).

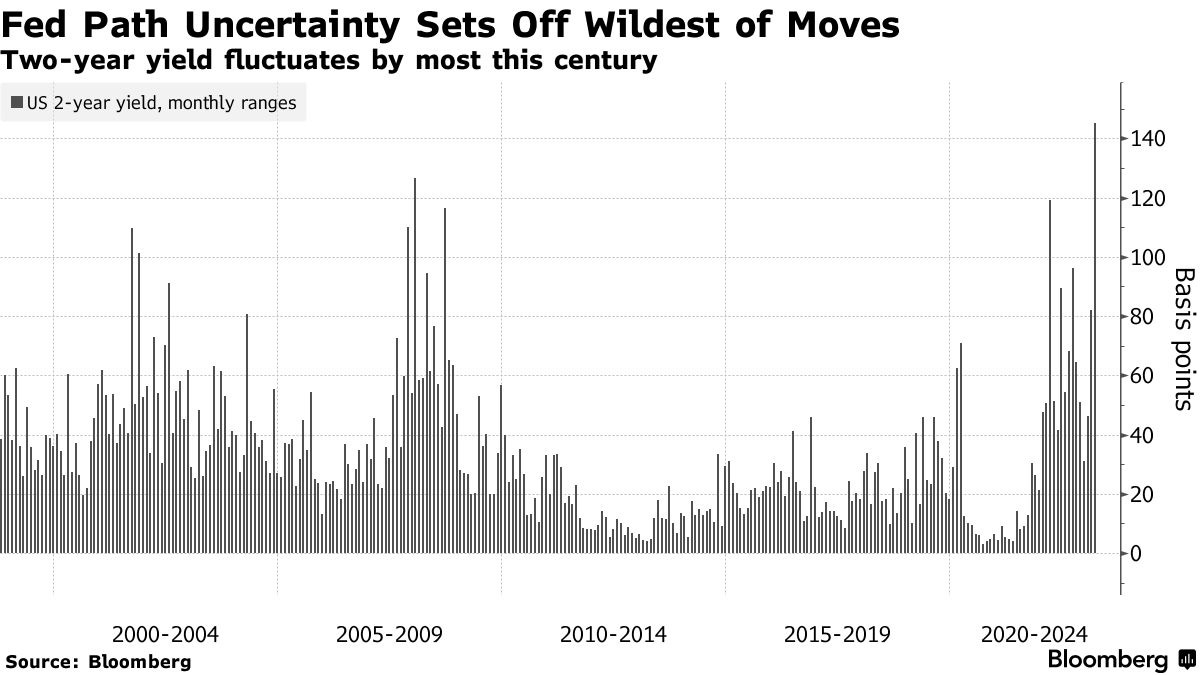

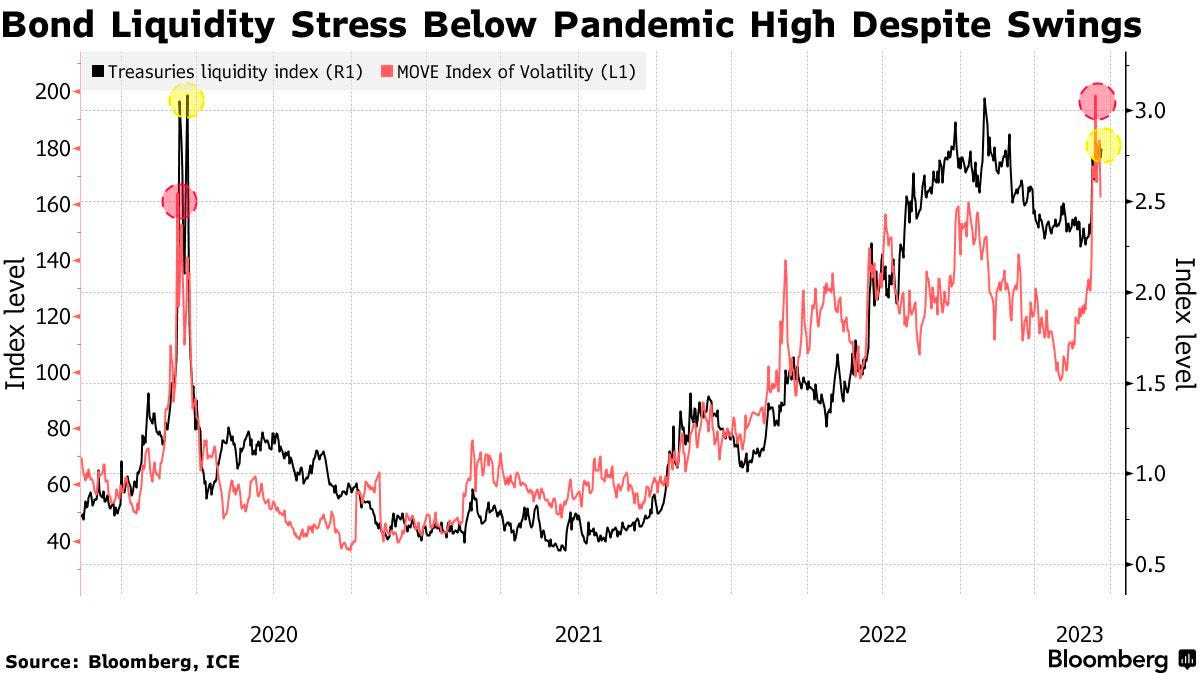

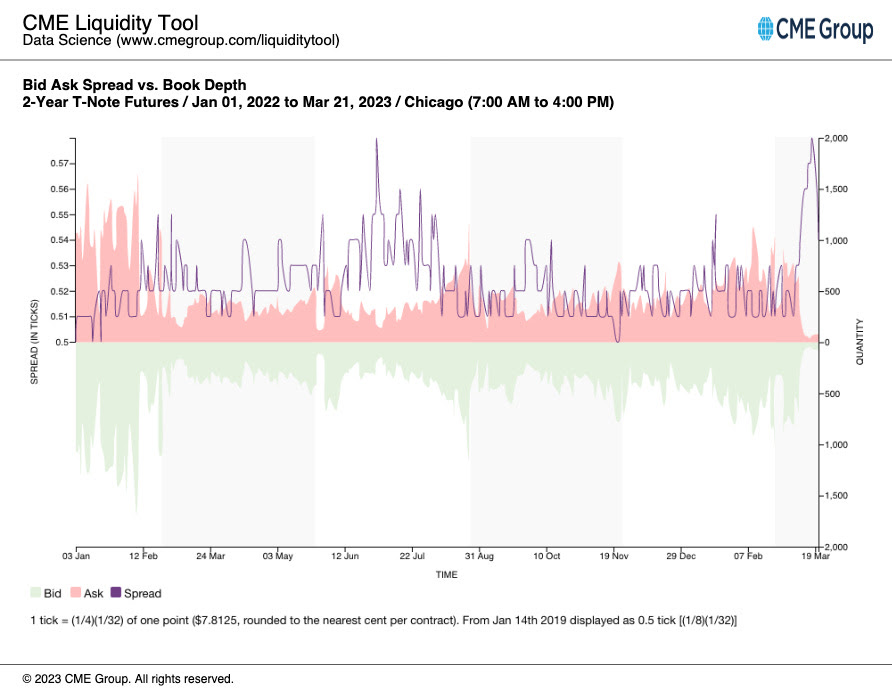

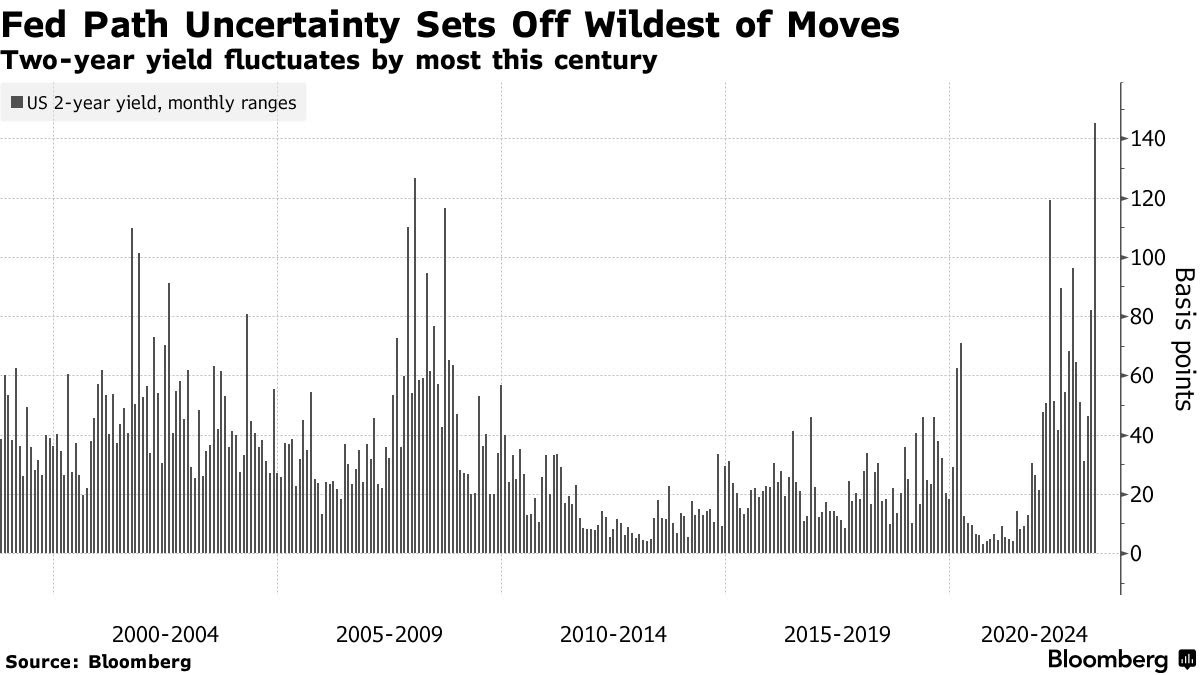

Additionally, there’s been lots of talk about volatility in bond markets.

In large part the result of low liquidity, Treasury volatility could prompt the Fed to adjust their quantitative tightening or QT (i.e., the flow of capital out of capital markets) program, instead. Just as quantitative easing or QE (i.e., the flow of capital into capital markets) did little to spark off inflation, it’s unlikely that temping QT would disrupt efforts to rein inflation.

Adjusting QT, which is contributing to the excessive volatility, “would be preferable to not raising rates … [since] an abrupt pause in rate hikes would likely resurrect the notion that there’s, indeed, a Fed ‘put’ designed to bail out Wall Street at the first sign of stress,” a potential catalyst for market upside, says Robert Burgess.

Positioning

In Tuesday’s letter, we talked about the potential for fears of downside easing and fears of missing out (i.e., FOMO) on upside rising. Specifically, the letter said the following:

“A response may be FOMO-type demand for call options exposures, coupled with CTAs further ‘raising their equity exposure’ on trend signals and lower volatility, boosting markets into a ‘more combustible’ state as explained on 2/17. This fear of missing out is visible in options volatility skew; traders are hedging those tail outcomes.”

In support of the most recent strength, per JPMorgan Chase & Co’s (NYSE: JPM) trade desk commentary, there is a buy skew. Goldman Sachs Group Inc (NYSE: GS) strategists agree, noting that flows are almost entirely “cover-driven.”

Recall that traders sought protection amidst all the calamities recently. Accordingly, measures of implied volatility or IVOL including the Cboe Volatility Index or VIX rose (e.g. traders demand exposure to downside put protection by way of S&P 500 options which bids options prices and manifests higher IVOL and counterparty pressure from their equity future/stock sales to hedge this demand). These same measures of IVOL are now falling as traders’ closure of protection results in counterparty pressures being lifted (helping explain, in part, the above “cover-driven” remark by GS).

Does this rally have breadth behind it? Look no further than market internals.

A pause before the Fed announcement, and then breadth catches up to price?

Or, has the typical post-Fed IVOL boost been spent?

Regardless, we maintain that low-cost call options structures as proposed in previous letters worked (and may continue to work). Notwithstanding, look for opportunities to play the downside should markets trade higher into a “more combustible” position.

More on trade ideas in the next letters. Take care.

Technical

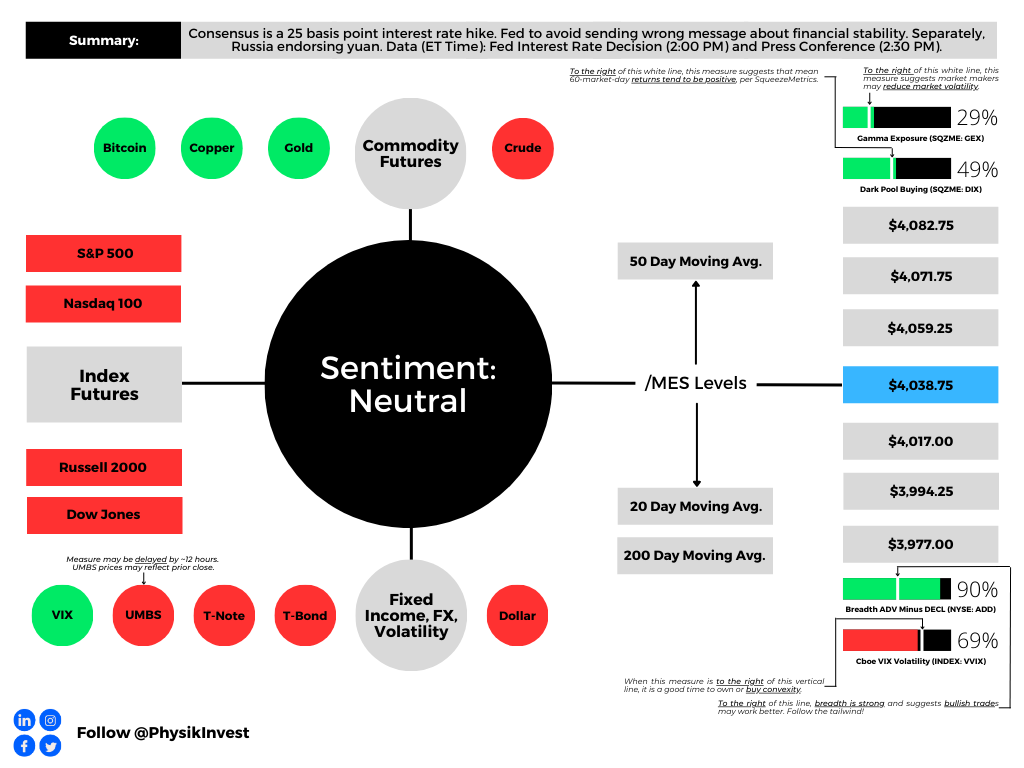

As of 8:15 AM ET, Wednesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the upper part of a negatively skewed overnight inventory, inside of the prior day’s range, suggesting a limited potential for immediate directional opportunity.

The S&P 500 pivot for today is $4,038.75.

Key levels to the upside include $4,059.25, $4,071.75, and $4,082.75.

Key levels to the downside include $4,017.00, $3,994.25, and $3,977.00.

Disclaimer: Click here to load the updated key levels via the web-based TradingView platform. New links are produced daily. Quoted levels likely hold barring an exogenous development.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for a period of time, this will be identified by a low-volume area (LVNodes). The LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to the nearest HVNodes for more favorable entry or exit.

POCs: Areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

The author, Renato Leonard Capelj, spends the bulk of his time at Physik Invest, an entity through which he invests and publishes free daily analyses to thousands of subscribers. The analyses offer him and his subscribers a way to stay on the right side of the market.

Separately, Capelj is an accredited journalist with past works including interviews with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, North Dakota Governor Doug Burgum, Lithuania’s Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Connect

Direct queries to renato@physikinvest.com. Find Physik Invest on Twitter, LinkedIn, Facebook, and Instagram. Find Capelj on Twitter, LinkedIn, and Instagram. Only follow the verified profiles.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes. Capelj and Physik Invest manage their own capital and will not solicit others for it.