What Happened

Equity index futures sideways, overnight, on powerful derivative market forces, alongside participants’ aims to base ahead of added clarity on the economic outlook.

Ahead is data on inflation and jobless claims (8:30 AM ET), wholesale inventories (10:00 AM ET), and the monthly budget statement (2:00 PM ET).

What To Expect

As evidenced by a b-shaped liquidation break profile distribution (i.e., morning drop on fast tempo, followed by sideways trade) there was likely selling by short-term momentum-driven participants who had poor location.

We are confident this may be the case given where the price is, relative to the volume-weighted average price (VWAP) anchored from the Federal Open Market Committee (FOMC) announcement, last week; the average buyer, since then, is losing.

To note, given the context – lackluster breadth and market liquidity metrics – the failure to expand the range, markedly, suggests there was no new money selling.

This activity, which marks a potential willingness to clear stubborn inventory and break balance, is occurring in the face of poor structure down below, a dynamic that adds to technical instability.

Context: Yesterday, I made an emphasis on some of the “high leverage and risk” short-term speculators’ record call buying and put selling posed on the equity market, at large.

That’s odd. Why?

Well, into the near-vertical price rise of highly volatile stocks like Tesla Inc (NASDAQ: TSLA), customers (you and I) signed up, through the agency of counterparties, to add liquidity to the market, via options activity.

So long as implied volatility remained bid (and stock prices go to the moon) – the effect of inadequate liquidity – counterparties were to exacerbate upside volatility in hedging their exposure to customer positioning. In other words, dealer short-gamma.

Note those participants that take the other side of options trades will hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma (e.g., Tesla), they buy into strength and sell into weakness, exacerbating volatility. When dealers are long-gamma (e.g., S&P 500), counterparties buy into weakness and sell into strength, calming volatility.

Enter shock – Elon Musk selling Tesla stock – alongside a decline in implied volatility, amidst a build of gamma at higher stock prices (which has the effect of dampening realized volatility), we saw the unthinkable happen; high-flying stocks (more so Tesla, which is a large S&P 500 index constituent) turned away from the moon and headed back to earth.

The implications of this were staggering; the bulk of customers’ short puts (long calls) quickly rose (declined) in value and traded in-the-money (out-of-the-money).

As SpotGamma noted, yesterday, “[t]here was a serious dearth of liquidity to start today’s session,” and volatility rose, as a result, in compensating for that fact.

Now, if customer short put, counterparty long put.

To hedge, counterparty ought to buy, right? Nope.

As SqueezeMetrics explains, “Sold puts are, quite literally, a bunch of huge buy limit orders below the market, and then a bunch of liquidity-taking stop-losses further down.”

This is, to put it simply, due in part to short-term speculators lacking the wherewithal to stay in these margin-intensive positions; as price falls, put buying (covering of shorts, too) takes liquidity and destabilizes the market.

We’re starting to see this activity, in individual stocks, affect the S&P 500 complex, too.

The CBOE Volatility Index (INDEX: VIX) was higher, with demand coming in across the front area of the VIX futures term structure, mostly; both suggest a demand for hedges and a reduction in the flows (e.g., vanna) that support sideways to higher trade.

That has already been reflected by the trend of outperformance in the extended day.

In other words, the front-running of increasingly impactful (and supportive) vanna and charm flows (both of which are tied to the hedging of options exposure), as a result of increased options activity (which, at least at this juncture, exposes customers to high leverage and risk), seems to be changing, slowly.

We’re (likely) opening sideways to lower today. That’s a change, for once!

With expectations that there may be a front-running of the monthly (OPEX) options expiration (into which the forces that promote pining usually turn stronger with counterparties supplying more liquidity as their long gamma rises), a time when dealer gamma exposure is to decline, allowing for increased realized volatility (as a result of less liquidity), the added demand for hedges (as evidenced by the bid in volatility and VIX term structure shift), is of concern.

Participants have been uber bullish, up until early this week. Should sentiment turn, and (1) those participants cover their levered, long delta exposure alongside (2) new money hedging, tempo ought to quicken; an abrupt liquidation could be in the cards.

In light of seasonality, buybacks, and earnings surprises, the potential for a rally into the end of the year remains strong. As a result, we start to look for big picture references where we may see responsive buying. See the graphic below!

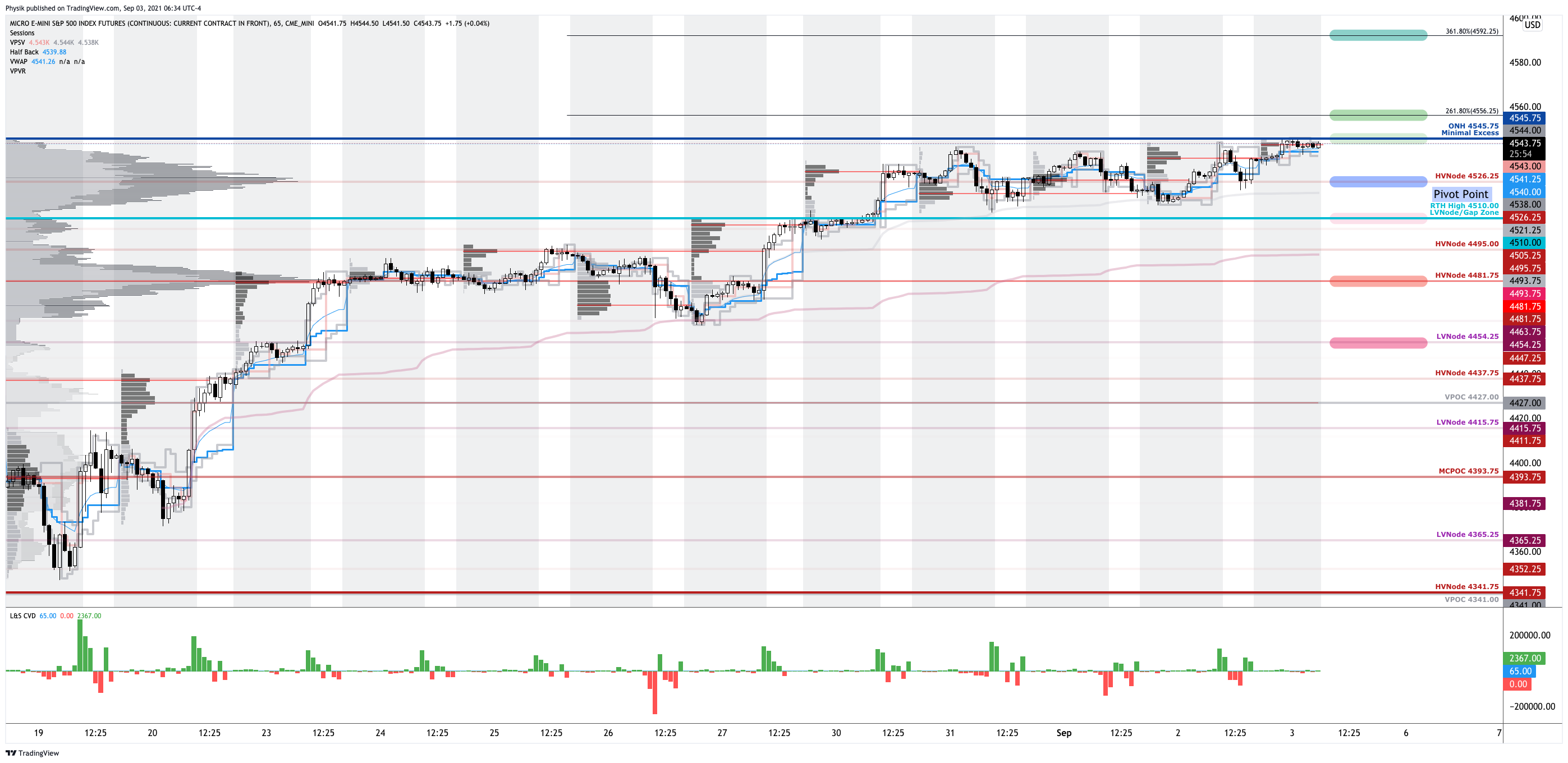

Expectations: As of 5:30 AM ET, Wednesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Balance Scenarios: Modus operandi is responsive trade (i.e., fade the edges), rather than initiative trade (i.e., play the break).

In the best case, the S&P 500 trades sideways or higher; activity above the $4,680.25 overnight high (ONH) puts in play the $4,695.25 micro composite point of control (MCPOC). Initiative trade beyond the MCPOC could reach as high as the $4,711.75 regular trade high and $4,722.00 Fibonacci, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,680.25 ONH puts in play the $4,658.75 overnight low (ONL). Initiative trade beyond the ONL could reach as low as the $4,619.00 untested point of control (VPOC) and $4,590.00 balance area boundary, or lower.

Click here to load today’s updated key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Vanna: The rate at which the delta of an option changes with respect to volatility.

Charm: The rate at which the delta of an option changes with respect to time.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor, developing insights around impactful options market dynamics.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.