The daily brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 300+ that read this report daily, below!

What Happened

Overnight, equity index futures were sideways to lower. Commodities and bonds were mixed. Implied volatility measures fell. The dollar rose.

A volatile quarter-end ahead of a long weekend. Noteworthy is the market’s responsiveness to visual levels. For instance, the S&P 500’s (FUTURE: /ES) high of the day printed at $3,821.50 or so, a key level in yesterday’s morning letter.

This points to heightened activity by technically-driven traders with short time horizons. Such traders often lack the wherewithal to defend retests and, additionally, the type of trade may be indicative of the other time frame participants waiting for more information to initiate trades.

Moreover, on an annual basis, core inflation was the lowest since November while consumers’ spending cooled suggesting the economy is on a weaker footing. In Europe, inflation hit a record, boosting calls for more aggressive monetary policy action.

Adding, Goldman Sachs Group Inc (NYSE: GS) strategists see equity valuations falling further “[u]nless bond yields start to decline and buffer rising equity risk premiums.” Michael Burry, the Founder of Scion Asset Management, too, sees declines lasting on “earnings compression.”

Ahead is data on S&P Global Inc’s (NYSE: SPGI) manufacturing PMI (9:45 AM ET), as well as the ISM manufacturing index and construction spending (10:00 AM ET).

What To Expect

Fundamental: A bit philosophical here, today, as a difficult half-year has passed and I’m low on the time I have to commit to analysis this morning.

Markets are substantially lower from the end of 2021, all the while there are now, in greater quantity and frequency, calls being made that equities have more room to the downside.

That very well may be the case, and the upcoming earnings season is likely to provide investors clarity with respect to corporates’ ability to weather or pass on higher costs, among other things.

Read: Former Bridgewater Associate Talks Recession Odds, Capturing A Macro Edge.

Regardless, everything we discuss on a daily basis – fundamental and technical market drivers – will do little for us if we do not have a framework for assessing risk and opportunity.

Before ever taking a position, I ask myself the following: What is it that I have to lose? For me, the answer depends.

At times, it is dependent on a position’s payoff profile. At others, it’s the max pain I’m willing to subject myself to during adverse market conditions or when I have limited mental capital.

As Dennis Gartman of the Gartman Letter said:

“Capital comes in two varieties: Mental and that which is in your pocket or account.”

“[T]he mental is the more important and expensive of the two. Holding to losing position costs measurable sums of actual capital, but costs immeasurable sums of mental capital.”

And, with that, the other key is that the money is made in not losing it. Fortunately, this law was impressed on me, early. Returning 100%, only to suffer a 50% loss, sets you back to where you were, initially.

These comments are pursuant to traders I’ve had the honor of connecting with over the past year or so. Many made a killing to only have given most, if not all of it, back.

This has an immeasurable effect on one’s mental capital.

Though I’ve not participated in the most recent weaknesses, my mental capital has suffered. I’ve, subsequently, reduced the size of my positions and opted to define my losses, buying into volatility while it is cheap, as I view it, and waiting for the relationship to flip to sell in size.

Returning to the comment on whether the market’s de-rate has played out. I do not know. Can it go further? Probably. There are a host of references converging below current market prices, as pointed to in the Technicals section, below, that probably are taken at some point in the year.

That said, whether long or short, ask what it is that you have to lose?

If it’s a number, define your loss and take the trade. Take (or provide) liquidity when others don’t want to. Buy (or sell) volatility when it is cheap (or expensive). Let the trade work.

It’s a coinflip, probably, at the end of the day. If we know what we have to gain and lose, we’ve moved the expected outcome that much further our way. Have a good long weekend, team.

Read: A guide to making money for individual traders retrieved from SqueezeMetrics.

Technical: As of 6:30 AM ET, Friday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

In the best case, the S&P 500 trades higher; activity above the $3,770.25 HVNode puts in play the $3,793.75 HVNode. Initiative trade beyond the latter HVNode could reach as high as the $3,821.50 LVNode and $3,840.75 ONH, or higher.

In the worst case, the S&P 500 trades lower; activity below the $3,770.25 HVNode puts in play the $3,727.75 HVNode. Initiative trade beyond the latter HVNode could reach as low as the $3,688.75 HVNode and $3,639.00 RTH Low, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

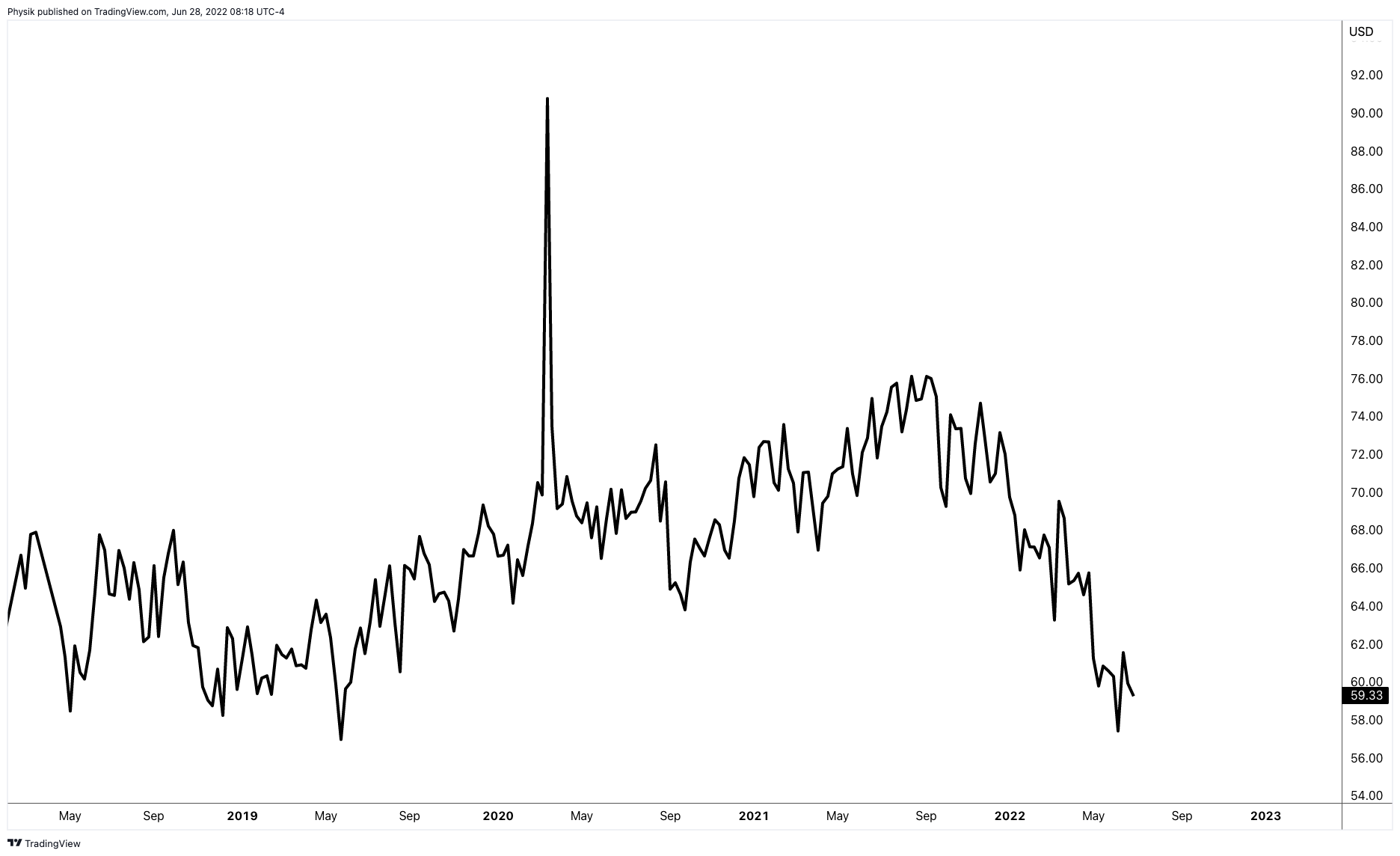

Considerations: At $3,500.00 in the S&P 500 (INDEX: SPX), or $350.00 in the SPDR S&P 500 ETF Trust (NYSE: SPY) is the convergence of multiple visual references.

The 50.00% retracement (COVID-19 low through to 2021 peak), the 200-week moving average, and the volume-weighted average price anchored from the 2018 market bottom all converge at this $3,500.00 ($350.00) high open interest strike.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.