The daily brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 750+ that read this report daily, below!

Fundamental

Wednesday’s inflation figures – the CPI (Consumer Price Index) – will help drive perceptions regarding future Fed activity.

Expected is an 8.7% rise year-over-year (YoY) and 0.2% month-over-month (MoM). In June, these numbers were 9.1% and 1.3%, respectively.

Core CPI (which excludes food and energy) is expected to rise by a rate higher than in June, 6.1% YoY and 0.5% MoM, respectively.

Mattering most is core inflation, which the Fed has more control over. If lower than expected, that may warrant some appetite for risk.

Over the last 6 months, immediately after the release of CPI data, the average movement in the S&P 500 was -1.27%.

Moreover, businesses with promising futures often command a price high above their level of earnings (P/E). However, with inflation, prices in the economy rise, resulting in investors requiring better rates of return to maintain their purchasing power, per Investopedia.

Accordingly, if investors demand a higher rate of return, the P/E has to fall. That’s because you are “paying less for more earnings and, as earnings grow, the return you achieve is higher.”

In response to much hotter inflation participants may make significant changes in their forecasts for action by the Federal Reserve (Fed).

To explain, to stem inflation, the Fed reversed its easy monetary policies and is both raising rates and engaging in quantitative tightening (QT), which amplifies the effects of the former and is the opposite of quantitative easing (QE), “widely seen as the preeminent driver of markets during the post-crisis decade.”

Those stocks commanding some of the highest prices in anticipation of future growth are (and will) be impacted the most as their discounted cash flows and ability to finance growth reduce.

Though “rates take up most attention,” what’s more important are “the decisions the Fed — and other central banks — have to make about bringing their balance sheets down,” per Bloomberg.

Positioning

As of 7:15 AM ET, Wednesday’s expected volatility, via the Cboe Volatility Index (INDEX: VIX), sits at ~1.17%. Net gamma exposures decreasing may promote larger trading ranges.

Adding, volatility is at a low point and the “flattening in the downside fixed strike skew” seems to have played its course.

As SpotGamma explains, “given that implied volatility is at a low point, if participants’ fears with respect to [CPI] are assuaged, volatility compression would likely do less to bolster equity market upside than when the VIX was at a higher starting point (e.g., 30).”

On the other hand, “the marginal impact of increased demand for options strikes down below, further out in time, is likely to do a lot to add to underlying market pressures.”

So, per Kai Volatility’s Cem Karsan, though the first market moves after CPI may be a “function of inevitable rebalancing of dealer inventory post-event,” if the “final resolution is lower,” per “the incremental effects” of liquidity (i.e., QE and QT), then options could outperform their delta (i.e., exposure to direction), not like what happened over the past half-year, as said August 5.

Sample structures to consider include low- or zero-cost bullish call ratio spreads to the upside, against the trend resistances in products like the S&P 500 (INDEX: SPX).

Technical

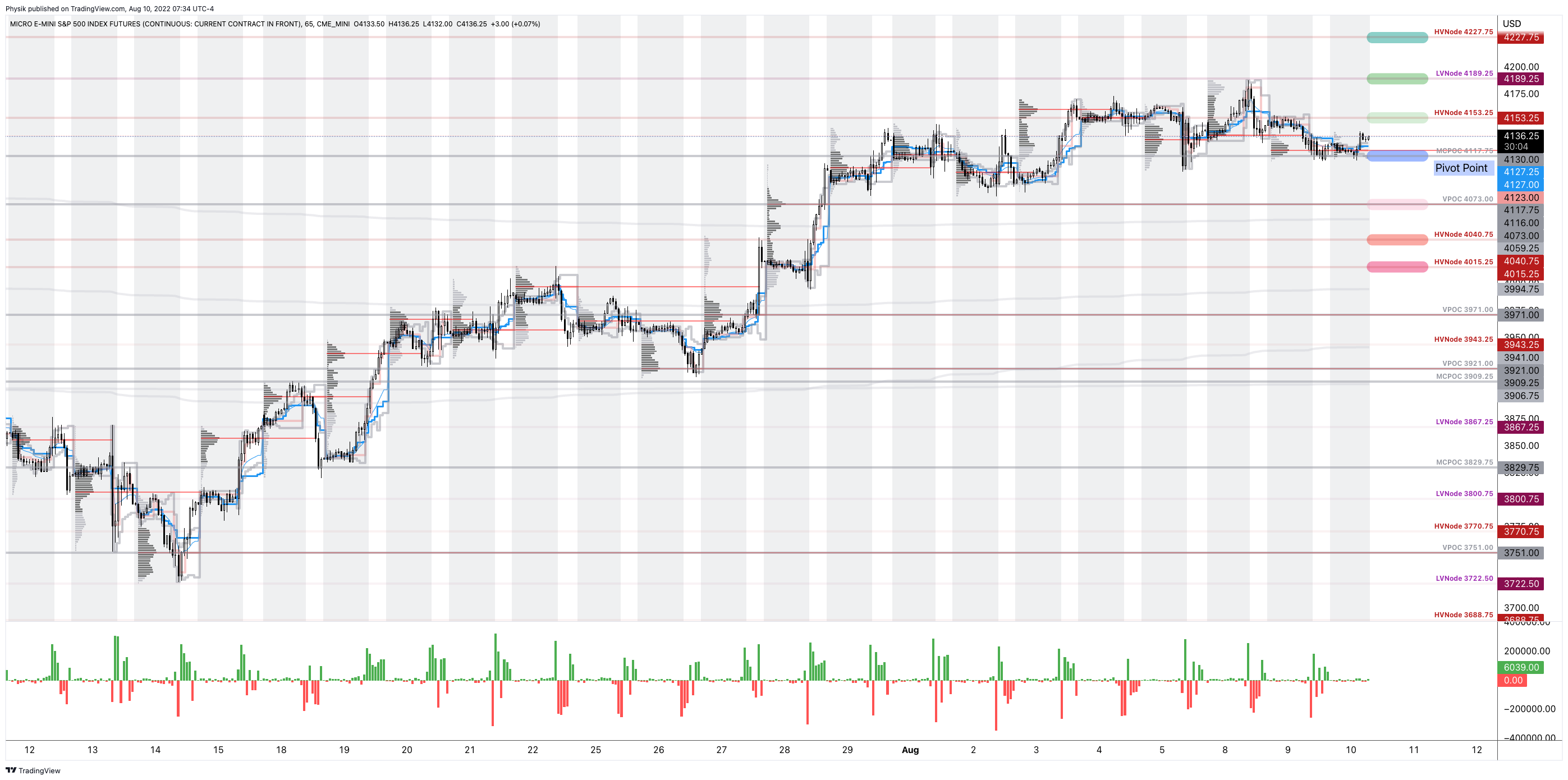

As of 7:30 AM ET, Wednesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the upper part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity, all else equal.

In the best case, the S&P 500 trades higher.

Any activity above the $4,117.75 MCPOC puts into play the $4,153.25 HVNode. Initiative trade beyond the HVNode could reach as high as the $4,189.25 LVNode and $4,227.75 HVNode, or higher.

In the worst case, the S&P 500 trades lower.

Any activity below the $4,117.75 MCPOC puts into play the $4,073.00 VPOC. Initiative trade beyond the VPOC could reach as low as the $4,040.75 and $4,015.25 HVNodes, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, ex-Bridgewater Associate Andy Constan, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.

One reply on “Daily Brief For August 10, 2022”

[…] here’s our updated liquidity tracker that is monitoring the “preeminent driver of markets during the post-crisis […]