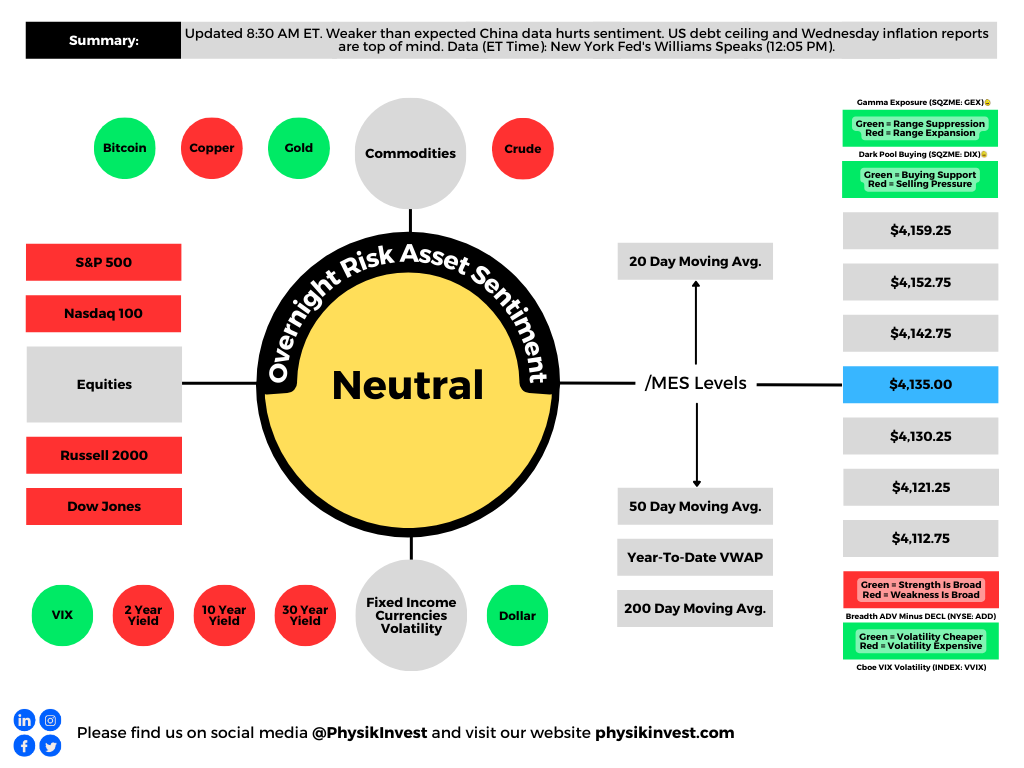

Sentiment calmer on the heels of some weaker-than-expected data from China. Generally speaking, markets are holding well, led by technology and innovation.

Price doesn’t tell the whole story, however. Breadth is softening while market boosters are slowly being picked off. Tier1Alpha says that “1-month realized volatility rose nearly 13%, [and] … if volatility continues to rise, it will have an outsized effect on the 1-month vol, as the sample is now largely filled by the smaller returns we experienced in April.” Altogether, this “could result in larger [selling] flows being triggered from systematic strategies that use volatility scaling as a means for risk control.”

“With that vol premium getting squeezed out, there is little room for error,” SpotGamma adds; uncertainties that may manifest pressure and compound weaknesses under the hood include inflation reports and the debt ceiling issue.

“The next big moment comes Tuesday, when President Joe Biden is scheduled to meet House Speaker Kevin McCarthy and other congressional leaders,” Bloomberg explains. “The meeting is high stakes. Republican leaders want promises of future spending cuts before they approve a higher ceiling, while Biden is insisting on a ‘clean’ increase.”

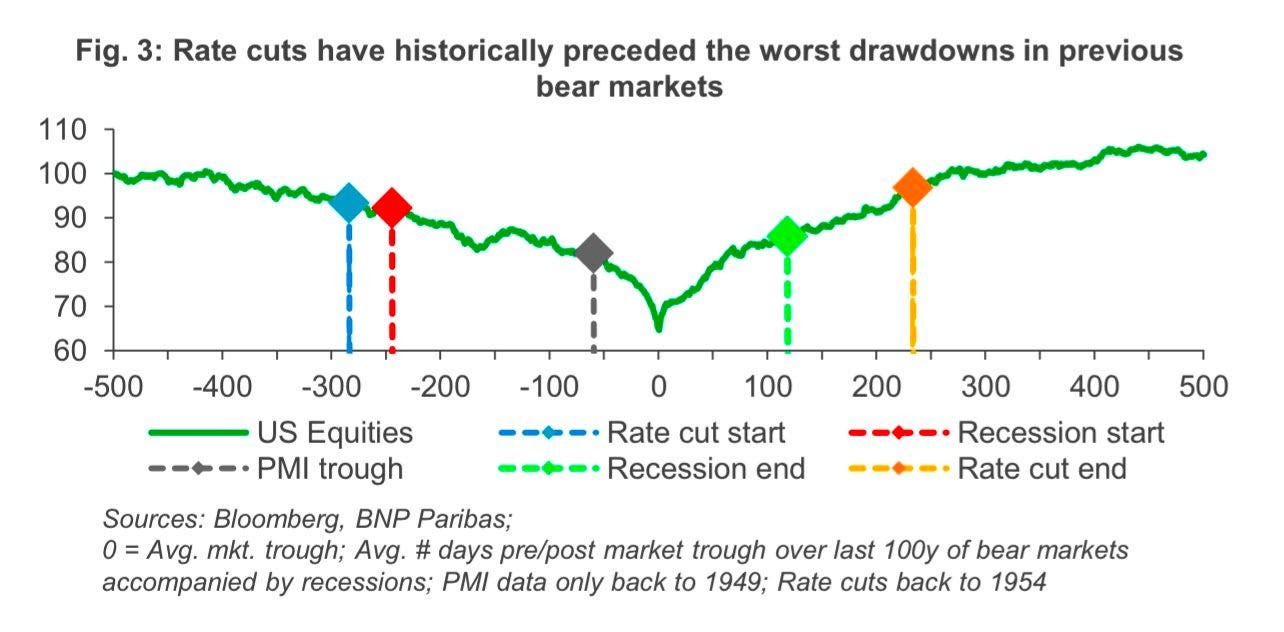

Further, traders expect increased chances of rate cuts. This may not be outlandish; “Looking at the past 17 hiking episodes, the two-year, 10-year Treasury yield curve bottoms out 108 trading days before the first rate cut.”

“Using that guide, the 2s10s curve reached negative 111 basis points on March 8 and has since steepened to about negative 41 basis points. Assuming that marked the trough, 108 trading days lands in mid-August — sandwiched between the Fed’s July 26 and September 20 rate decisions.”

For better hedging participation in market upside, check out Physik Invest’s recently published trade structuring report.

About

Welcome to the Daily Brief by Physik Invest, a soon-to-launch research, consulting, trading, and asset management solutions provider. Learn about our origin story here, and consider subscribing for daily updates on the critical contexts that could lend to future market movement.

Separately, please don’t use this free letter as advice; all content is for informational purposes, and derivatives carry a substantial risk of loss. At this time, Capelj and Physik Invest, non-professional advisors, will never solicit others for capital or collect fees and disbursements. Separately, you may view this letter’s content calendar at this link.