Physik Invest’s Daily Brief is read by thousands of subscribers. You, too, can join this community to learn about the fundamental and technical drivers of markets.

Positioning

A brief letter, today. Have a good weekend!

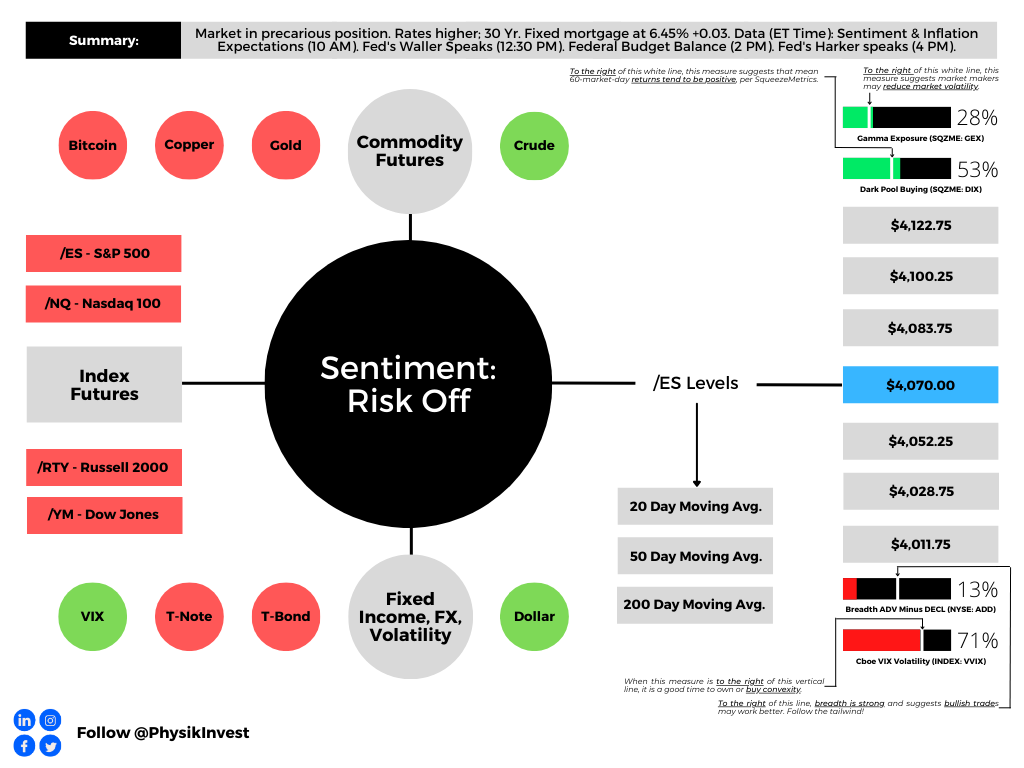

Last week, this letter discussed the precariousness of the market’s position. The data suggested pressure was to surface. This pressure surfaced and was exacerbated by traders’ new demands to hedge their downside, hence higher implied volatility (IVOL), among other things like poor Treasury auctions and higher yields pulling investors out of equities.

Furthermore, pressures from demands to protect against the downside are mounting. To explain, think about what’s happening to the other side of those positions traders demanded. As markets trade lower, those positions work against the counterparty. To hedge, the counterparty likely sells underlying. This adds to pressure and instability.

When does it stop?

Well, all else equal, the Damped Spring’s Andy Constan thinks the instability sticks around at least until the S&P 500 (INDEX: SPX) reaches the $4,050.00 strike area, which we discussed the importance of in yesterday’s letter, and profits are taken, or the middle of next week after an update of the Consumer Price Index (CPI). Any short-term relief having to do with the decay of those options would be exacerbated next week by volatility compression if traders’ inflation fears are assuaged.

After next week, the market may be more at the mercy of macro-type repositioning, but we will discuss next week in detail. Also, note that previously attractive trades included selling rich call verticals to finance put verticals. These are no longer the most attractive trades.

Technical

As of 6:50 AM ET, Friday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the lower part of a negatively skewed overnight inventory, outside of the prior day’s range, suggesting a potential for immediate directional opportunity.

The S&P 500 pivot for today is $4,070.00.

Key levels to the upside include $4,083.75, $4,100.25, and $4,122.75.

Key levels to the downside include $4,052.25, $4,028.75, and $4,011.75.

Disclaimer: Click here to load the updated key levels via the web-based TradingView platform. New links are produced daily. Quoted levels likely hold barring an exogenous development.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for a period of time, this will be identified by a low-volume area (LVNodes). The LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to the nearest HVNodes for more favorable entry or exit.

About

The author, Renato Leonard Capelj, works in finance and journalism.

Capelj spends the bulk of his time at Physik Invest, an entity through which he invests and publishes free daily analyses to thousands of subscribers. The analyses offer him and his subscribers a way to stay on the right side of the market. Separately, Capelj is an options analyst at SpotGamma and an accredited journalist.

Capelj’s past works include conversations with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, Lithuania’s Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Connect

Direct queries to renato@physikinvest.com or find Physik Invest on Twitter, LinkedIn, Facebook, and Instagram.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes.