What Happened: Alongside concerns over another round of shutdowns due to rising COVID-19 coronavirus infection numbers, U.S. index futures maintained lower prices overnight, suggesting acceptance of Wednesday’s spike liquidation.

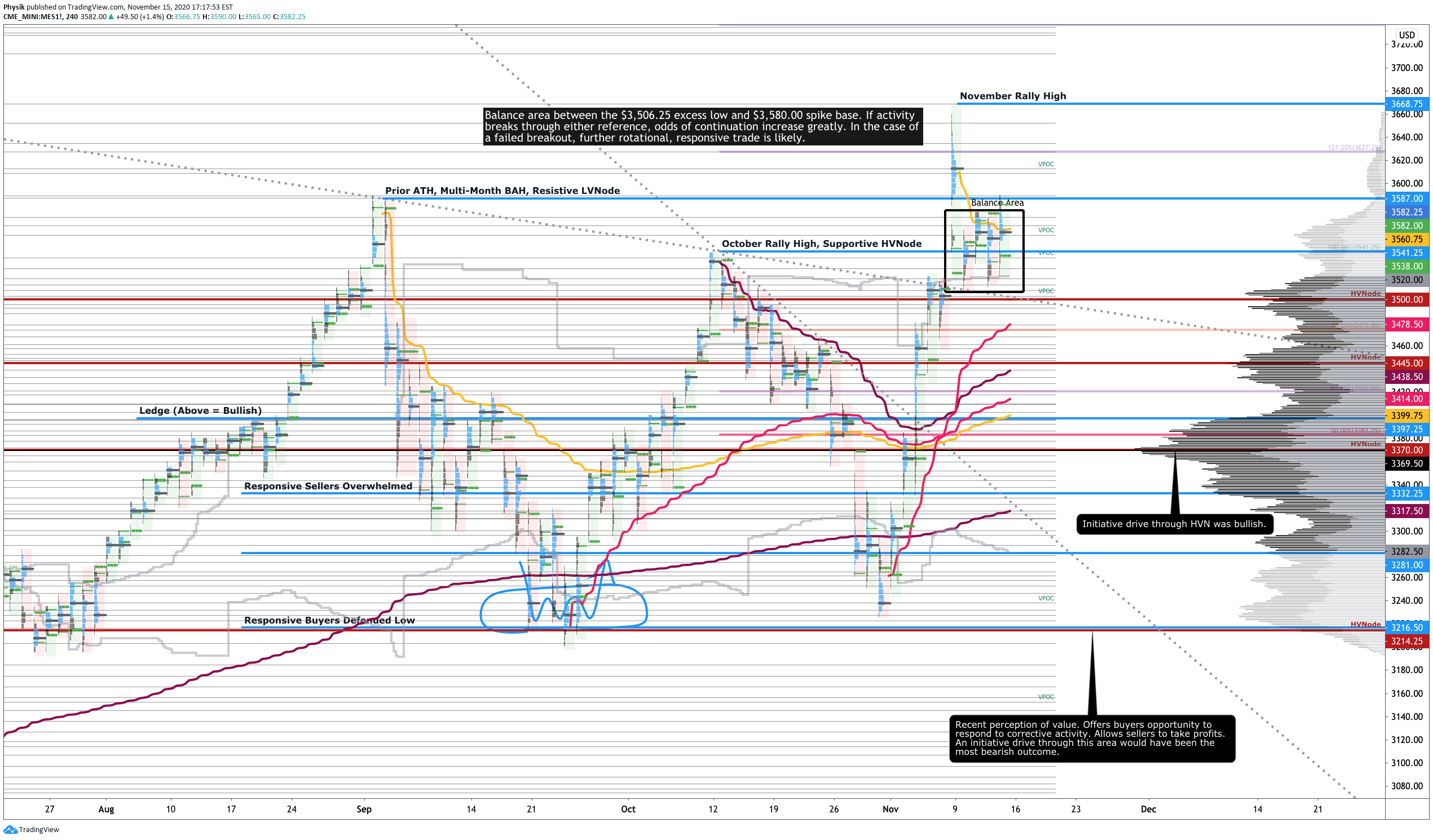

What Does It Mean: As of now, after an earlier test, the S&P 500 index future is trading above a micro-composite high-volume node at $3,557, the fairest price to do business during last week’s trade. This comes after participants struggled to maintain higher prices for the three sessions prior, evidenced by the divergent delta (i.e., non-presence of committed buying) and low-excess at the edges of balance.

This week’s mechanical trade and minimal-excess extremes, therefore, suggests Wednesday’s end-of-day spike was the result of weak-handed, short-term buyers liquidating in panic. This statement is supported by the fact that the selling did not attract increased participation (i.e., price diverged from value).

Further, participants come into Thursday’s session knowing two key points: (1) higher prices were dominated by short-term, weak-handed participants and (2) Wednesday’s end-of-day spike liquidation did not attract increased participation, suggesting much of the selling was done in panic.

As a result, after breaking balance and testing the high-volume area at $3,557 overnight, the S&P 500 offers participants a clear framework for approaching today’s trade. Therefore, if participants manage to spend time and build value in or below the prior day’s selling activity, then initiative sellers remain in control and the liquidation could be the beginning of a new trend to the downside. Otherwise, odds favor a response as the market has now advertised prices below balance, at last-week’s fairest price, offering buyers favorable entry.

The latter scenario would result in a failed break and rotation back into the upper-balance area. The former would suggest range expansion to the lower end of last week’s balance, $3,506.25.

Levels Of Interest: Micro-composite HVN at $3,557, the $3,506.25 excess low, as well as the $3,585 balance-area low.