Key Takeaways:

- A resurgence in cases of the COVID-19 coronavirus portends restrictions on mobility which could have material consequences on the economic recovery.

- Sentiment appears stretched ahead of data on retail sales, housing, trade, manufacturing, services, as well as resolve of election-related uncertainty and fiscal stimulus.

- Despite a positive response to upside earning surprises, divided government, and vaccine results, the potential exists for a failed higher time frame breakout.

What Happened: Following the post-election rally, U.S. index futures extended their gains on news that a vaccine developed by Pfizer Inc (NYSE: PFE) and BioNTech SE (NASDAQ: BNTX) was more than 90% effective in preventing cases of the COVID-19 coronavirus.

Though the response resulted in the upside break of a multi-month balance area, in subsequent days, index futures pared gains, weighed down by the innovation-driven technology sector.

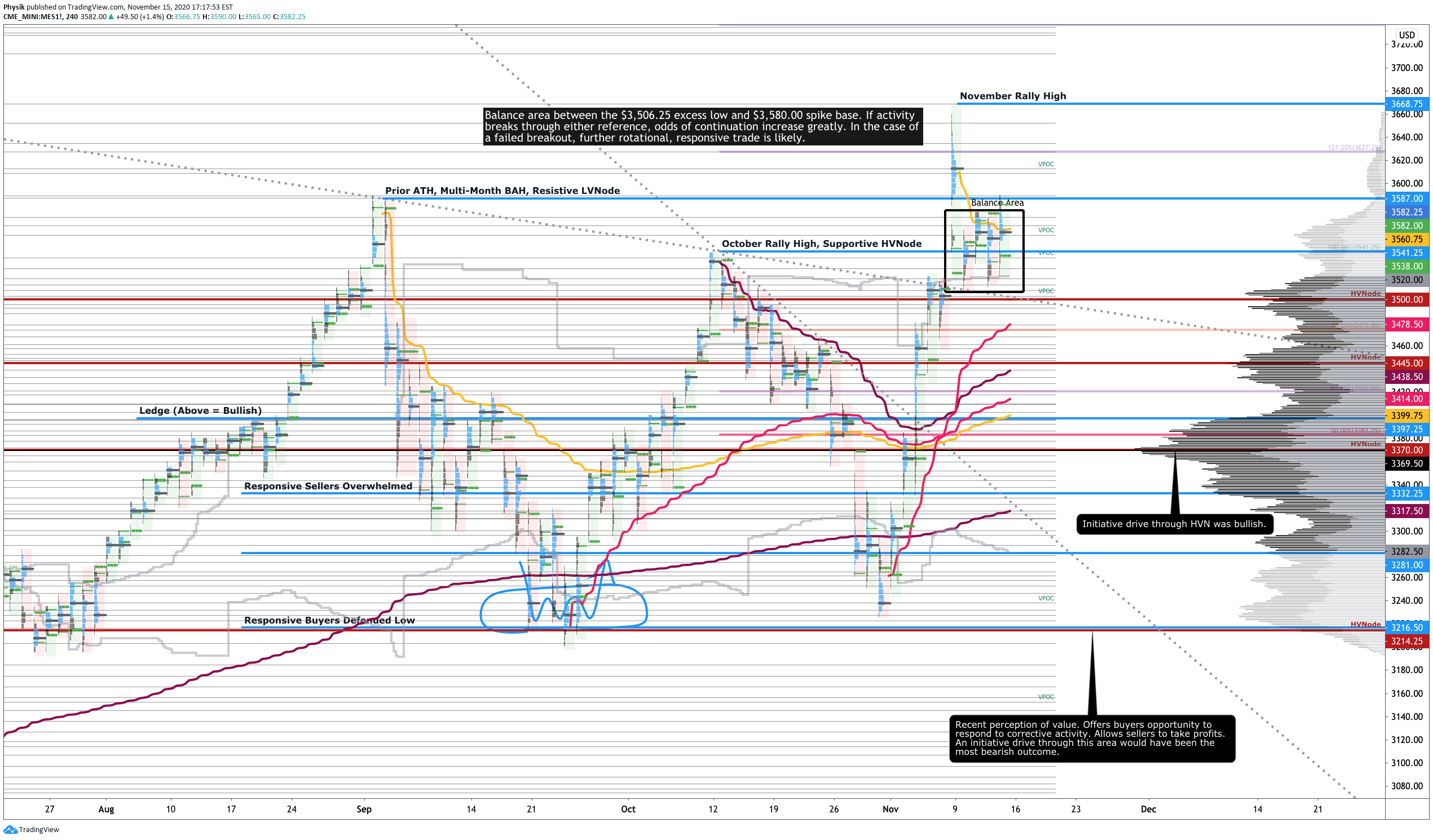

What Does It Mean: After Monday’s initiative upside drive on coronavirus vaccine optimism, an end-of-day spike liquidation preceded a week-long, range-bound rotation, and suggested the possibility of a failed higher time frame breakout.

What To Expect: On Friday’s end-of-day rally away from value, the S&P 500 closed at a new all-time high, just above the balance area marked by the $3,580 spike base and $3,506.25 excess low.

If participants manage to spend time and build value outside of the balance area, then the odds favor continued upside. Otherwise, the market will return to balance, favoring short-term, responsive trade as low as the aforementioned excess low.

Levels of Interest: Four-day balance-area between the $3,580 spike base and $3,506.25 excess low.