Physik Invest’s Daily Brief is read by thousands of subscribers. You, too, can join this community to learn about the fundamental and technical drivers of markets.

Week Recap

Monday’s newsletter was the first in-depth commentary on markets since the letter writer left on some travel. Discussed were recession expectations and traders’ bets on a policy reversal. The expectations of policy pivots and liquidity additions “due to the debt ceiling”, as well as the big monthly options expiration (OpEx) this January, manifested green shoots that likely do not last.

To be able to participate in the market’s upside (and take advantage of the S&P 500 and Cboe Volatility Index up environment) with limited downside, this letter offered some example trades that looked attractive.

Call structures with long options closer to the money and short options farther from the money (to lower the cost of the spread) have worked well, this letter explained.

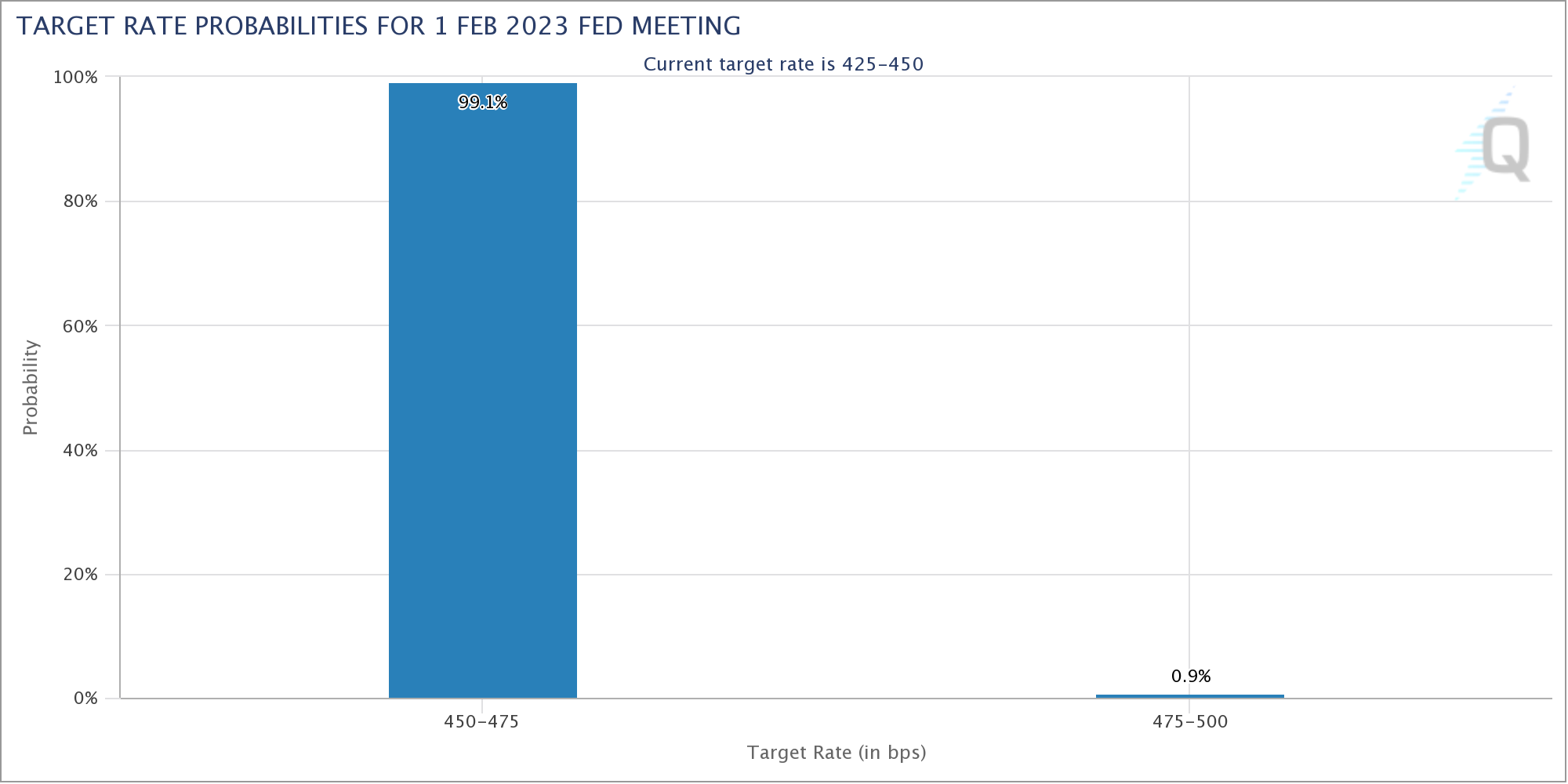

February is likely to kick off with an interest rate hike. Traders are pricing the pace of rate hikes to slow, however. We’ll unpack this and more next week. Take care!

Technical

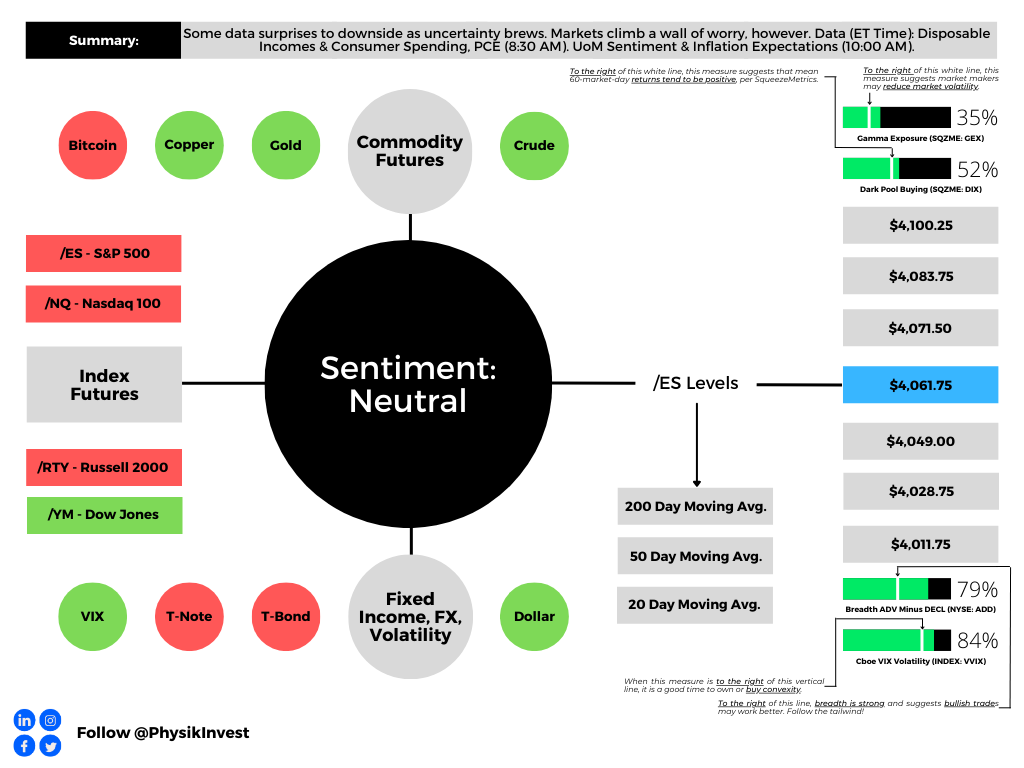

As of 7:00 AM ET, Friday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the upper part of a balanced overnight inventory, inside of the prior range, suggesting a limited potential for immediate directional opportunity.

The S&P 500 pivot for today is $4,061.75.

Key levels to the upside include $4,100.25, $4,083.75, and $4,071.50.

Key levels to the downside include $4,049.00, $4,028.75, and $4,011.75.

Disclaimer: Click here to load the updated key levels via the web-based TradingView platform. New links are produced daily. Quoted levels hold weight barring an exogenous development.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for a period of time, this will be identified by a low-volume area (LVNodes). The LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to the nearest HVNodes for more favorable entry or exit.

POCs: Areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

In short, Renato Leonard Capelj is an economics graduate working in finance and journalism.

Capelj spends most of his time as the founder of Physik Invest through which he invests and publishes daily analyses to subscribers, some of whom represent well-known institutions.

Separately, Capelj is an equity options analyst at SpotGamma and an accredited journalist interviewing global leaders in business, government, and finance.

Past works include conversations with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, Lithuania’s Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Contact

Direct queries to renato@physikinvest.com or Renato Capelj#8625 on Discord.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes.