Market Commentary

Index futures are attempting to balance and validate higher prices.

- Pay attention to economic reports.

- Earnings season officially starting.

- Balance-to-higher into April OPEX.

What Happened: U.S. stock index futures balanced overnight ahead of first-quarter earnings reports by large financial firms.

What To Expect: Monday’s regular session in the S&P 500 (9:30 AM – 4:00 PM EST) will likely open inside of prior-range and -value, suggesting a limited potential for directional opportunity.

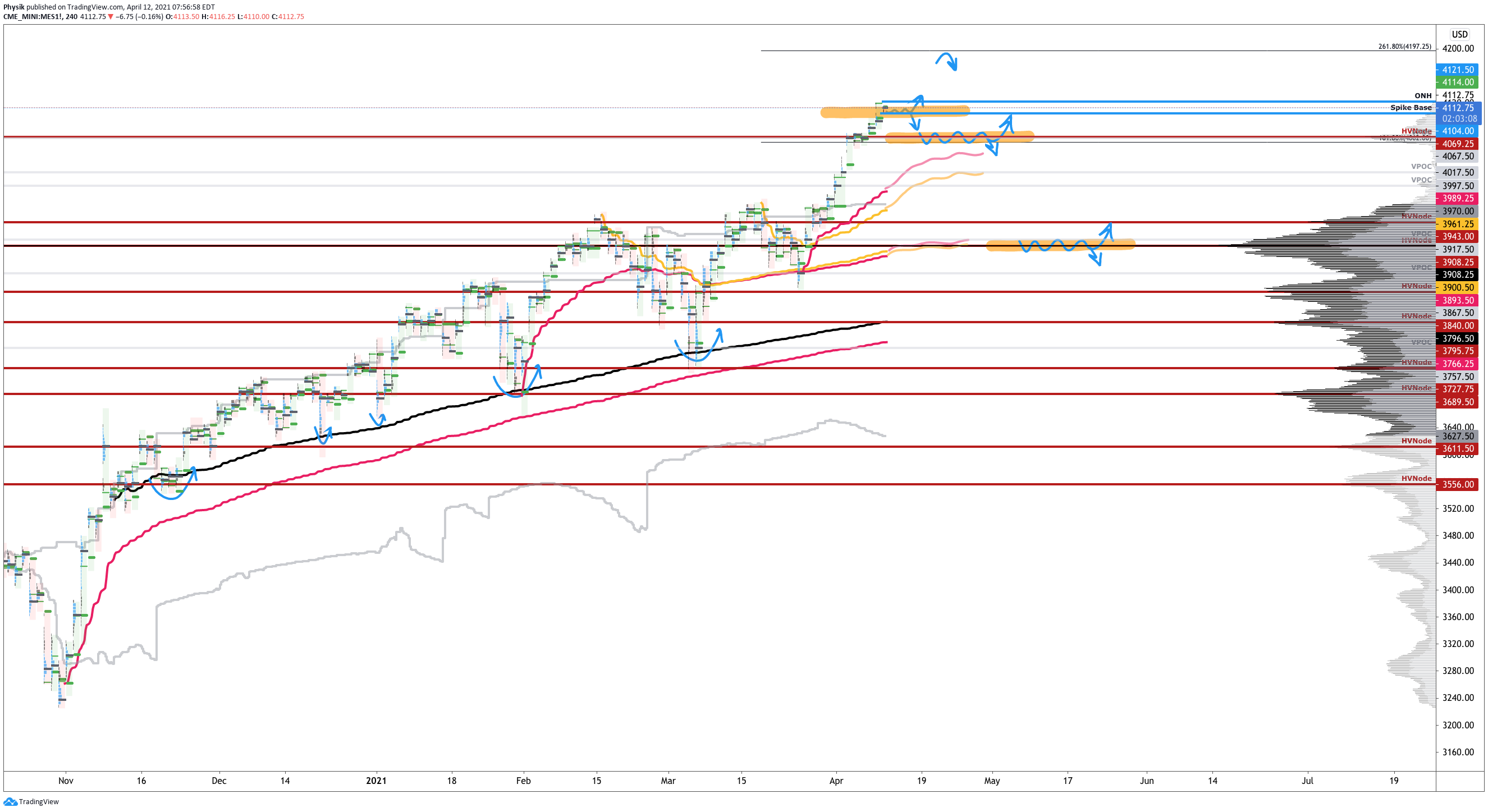

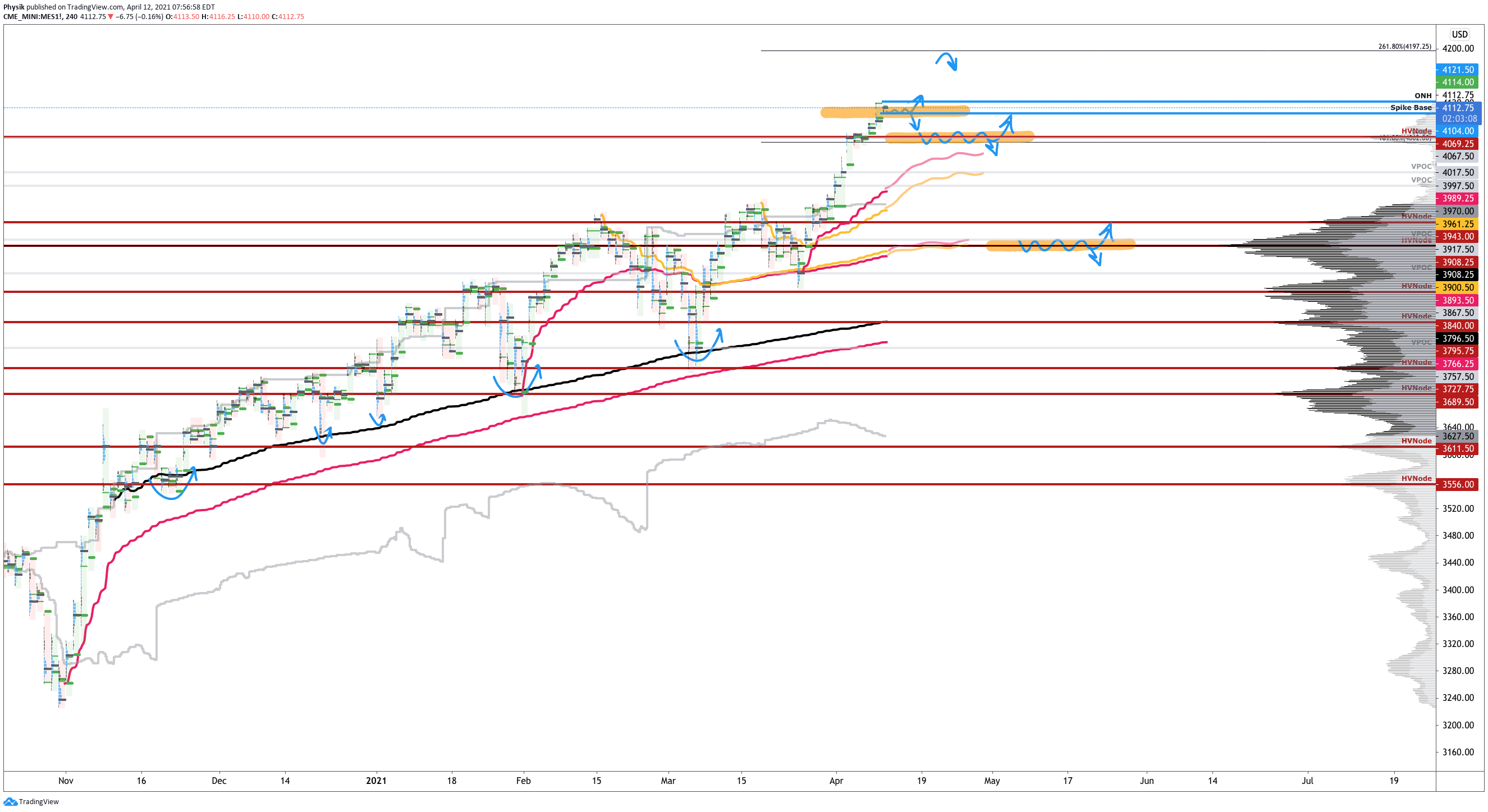

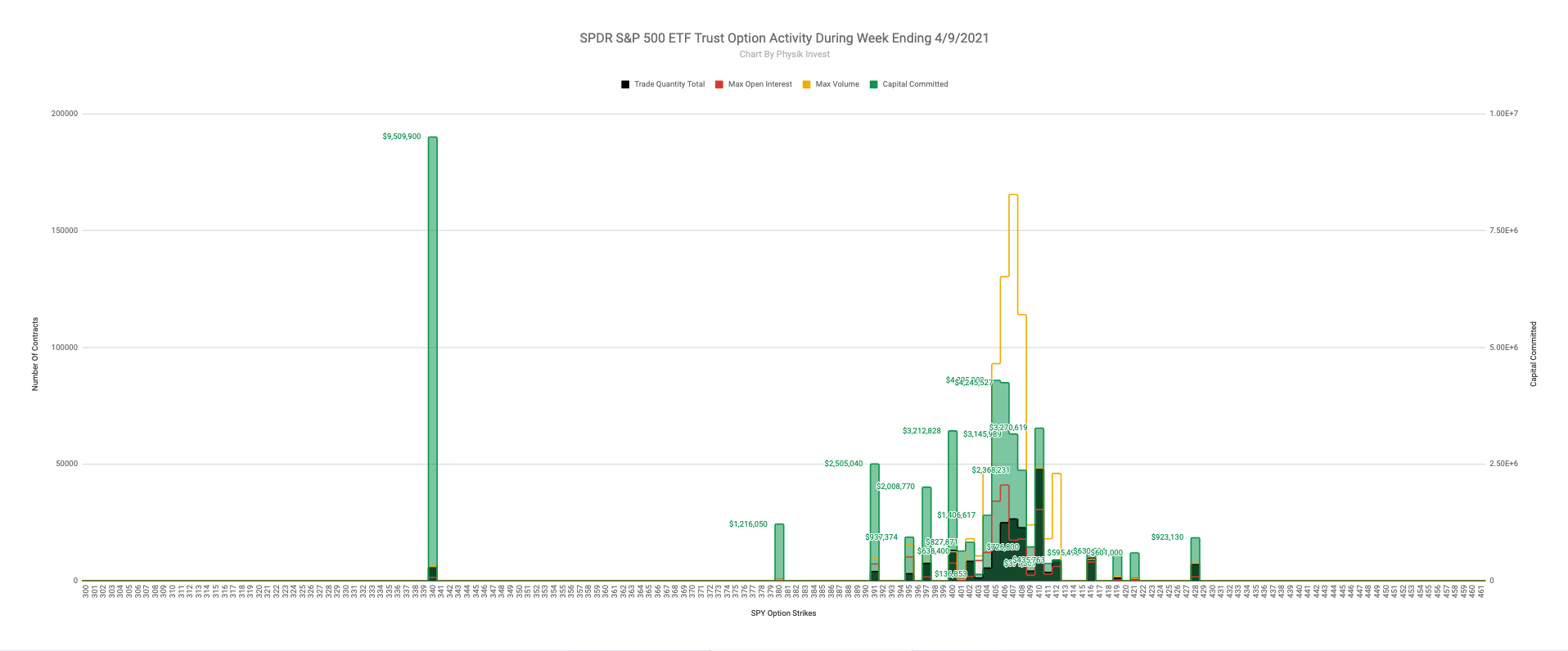

Adding, during prior regular trade, the best case outcome occurred, evidenced by initiative trade above the S&P 500’s $4,100.00 high-interest strike, which will act as a magnet into Friday’s monthly options expiration (OPEX).

Option Expiration (OPEX) Significance: Option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire worthless) and the reduction dealer gamma exposure.

As a result, given low trading volumes, and because of how impactful activity in the derivatives market is, traders should consider the potential for further balance or digestion of higher prices.

Further, for today, participants can trade from the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,104.00 spike base targets the $4,121.50 overnight-high (ONH). Initiative trade beyond the ONH could reach as high as the $4,197.25 price extension. In the worst case, the S&P 500 trades lower; activity below the $4,104.00 spike base targets the $4,069.00 and $3,943.00 high-volume areas (HVNode).

More On Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process. More On Volume Areas: A structurally sound market will build on past areas of high-volume (HVNode). Should the market trend for long periods of time, it will lack sound structure (identified as a low-volume area (LVNode) which denotes directional conviction and ought to offer support on any test). If participants were to auction and find acceptance into areas of prior low-volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

News And Analysis

Markets | U.S. economic recovery underpins dollar strength. (Moody’s)

FinTech | Jack Ma’s Ant Group bows to Beijing with an overhaul. (WSJ)

Trade | U.S. freight traffic posted its biggest annual gain ever. (Axios)

Housing | U.S. housing frenzy driven by an inventory shortage. (Axios)

FinTech | Biden team eyes potential threat from Digital Yuan plans. (BBG)

Economy | Survey suggests 53% of Canadians near insolvency. (BNN)

Hedge Funds | How Ken Griffin rebuilt Citadel’s ramparts post-2008. (FT)

Markets | Bloomberg analysts arguing over $400K bitcoin target. (CD)

FinTech | Coinbase experiences brisk user growth ahead of IPO. (VC)

Economy | Five reasons why COVID herd immunity is impossible. (Nature)

Politics | U.S., China deploy carriers in South China amid tension. (CNN)

Economy | Goldman Sachs warns Biden Tax Plan will cut earnings. (BBG)

Banking | Credit Suisse faces tough choices on investment bank. (WSJ)

Economy | In unprecedented times, don’t rely on precedent. (BR)

What People Are Saying

Innovation And Emerging Trends

Markets | Financial industry supports cutting equities settlement. (MM)

Technology | Businesses taking a hurry-up-and-wait approach to AI. (WSJ)

FinTech | Charles Schwab is looking to shape crypto procedures. (Block)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, Canadian businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.