We’re excited to announce that we will be publishing ultra-detailed notes with context on fundamentals, positioning, and specific trades. Notes will be nearly 3,000 words or more, and will not be in the traditional newsletter format. Though this newsletter will continue to be published, it will not maintain previously long lengths because of time constraints. Notwithstanding, there will be occasional longer issues, we promise! We aim for quality rather than quantity. Stay tuned for future money-making updates.

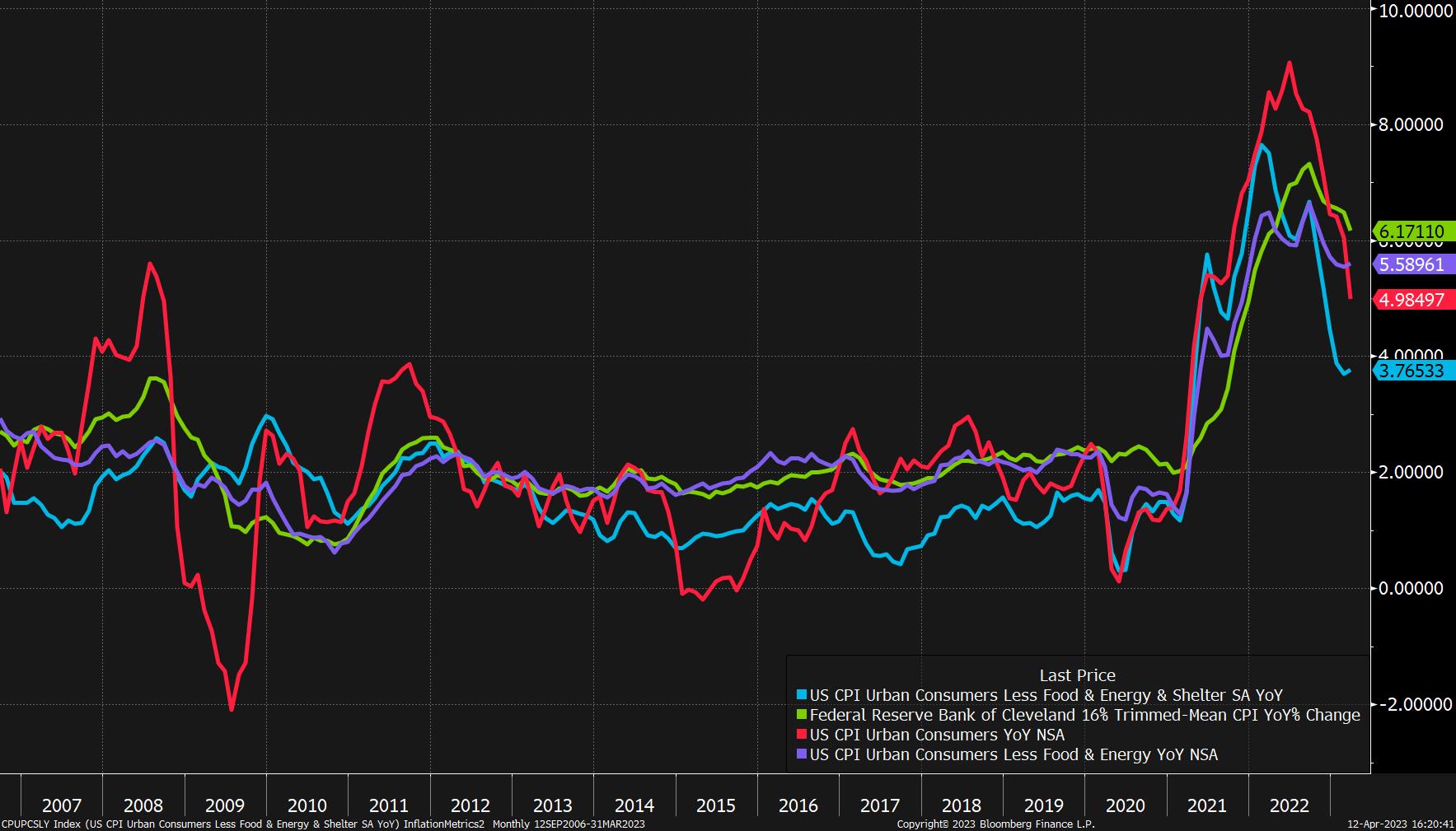

Market indicators suggest an interest rate hike in May is more likely. This is backed by inflation data and Federal Reserve meeting minutes.

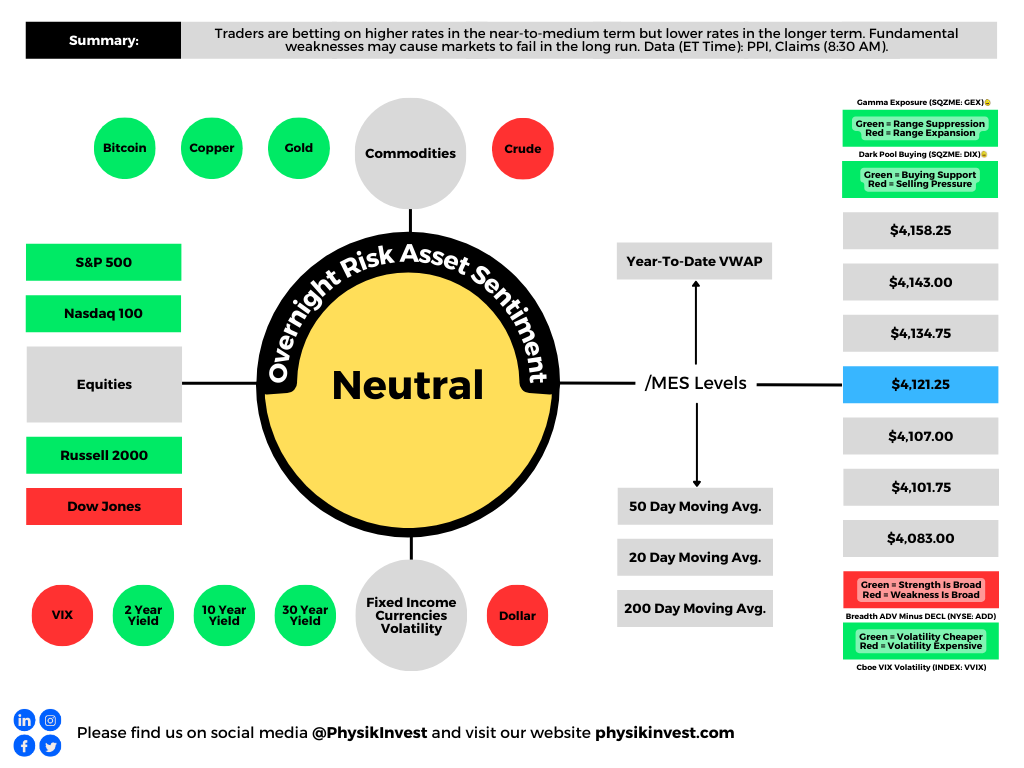

To be more specific, the indicators show traders are betting on higher rates in the near-to-medium term, and lower rates in the longer term. Adding, while inflation has moderated and there have been recent turbulences in the banking sector, monetary policymakers think higher rates for just a bit more are valid. However, they are also aware that a reduction in lending could potentially lead to defaults, recession, and a credit crunch in the worst-case scenario.

Fed President John Williams agreed that bringing down inflation requires more work. Williams suggested that the Fed should consider one more interest-rate hike before pausing, but the actual trajectory of rates will be based on analysis of newer data.

Per Cem Karsan from Kai Volatility, the negative effects of policy decisions will take time to reflect in the market.

He said investors are mostly bullish with a +1 Put, +100 Stock, -1 Call position, while dealers hold the opposite with a -1 Put, -100 Stock, +1 Call position. As the volatility trends lower (e.g., S&P 500 realized volatility or RVOL is ~10), options lose value, and dealers must buy back their short stock to re-hedge. This supports the market.

Thus, Karsan said the markets will be contained in the short to medium term, but fundamental weaknesses, such as the Fed hiking long-end yields, may cause them to fail in the long run. We maintain medium-term strength is monetizable via call spread structures discussed in prior newsletters. Rotating profits into longer-dated bets on markets or rates falling is attractive as well.

About

Welcome to the Daily Brief by Physik Invest, a soon-to-launch research, consulting, trading, and asset management solutions provider. Learn about our origin story here, and consider subscribing for daily updates on the critical contexts that could lend to future market movement.

Separately, please don’t use this free letter as advice; all content is for informational purposes, and derivatives carry a substantial risk of loss. At this time, Capelj and Physik Invest, non-professional advisors, will never solicit others for capital or collect fees and disbursements. Separately, you may view this letter’s content calendar at this link.