Notice: To view this week’s big picture outlook, click here.

What Happened: Alongside news of a Democrat sweep in the Georgia runoffs and Congressional certification of Joe Biden’s election victory, U.S. index futures balanced overnight.

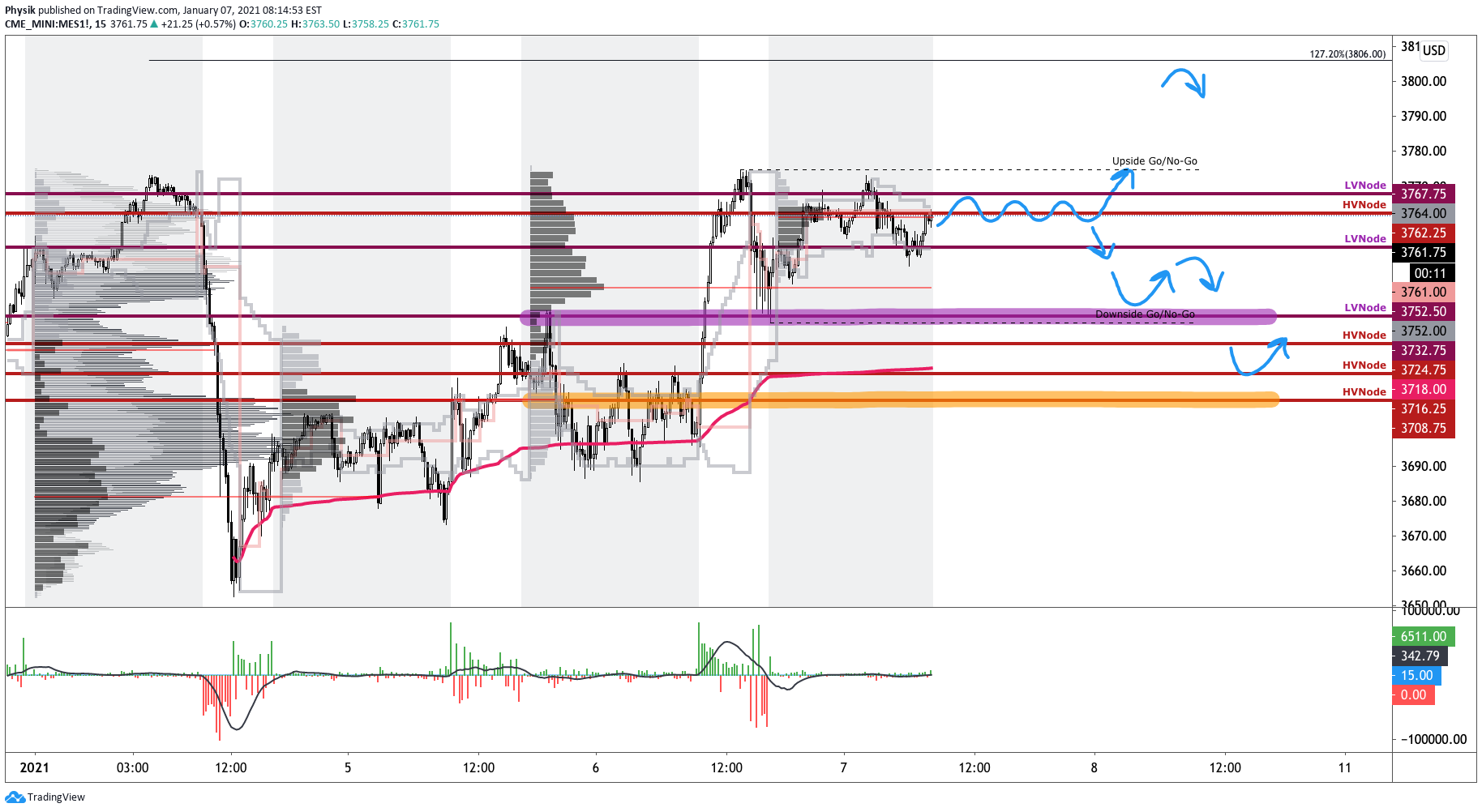

What Does It Mean: After a divergence between price and value resolved itself in Monday’s regular trade, the S&P 500 broke the $3,734.50 recovery high, above the $3,727.25 high-volume node, prior to taking out the overnight all-time high, a level that seldom ends the upside discovery process.

What To Expect: Thursday’s regular session (9:30 AM – 4:00 PM ET) will open inside of prior-balance and -range, providing little context as to what will transpire.

Participants can expect higher volatility at the open. The go/no-go level for upside is the $3,774.75 regular trade high. The go/no-go level for downside is the low-volume node at $3,731.00, an area that denotes upside conviction. On any virgin test, the S&P 500 ought to find support at this LVNode. However, should the index break below that level, then conviction has changed.

In a failure to break either go/no-go level, the normal course of action would be responsive trade.

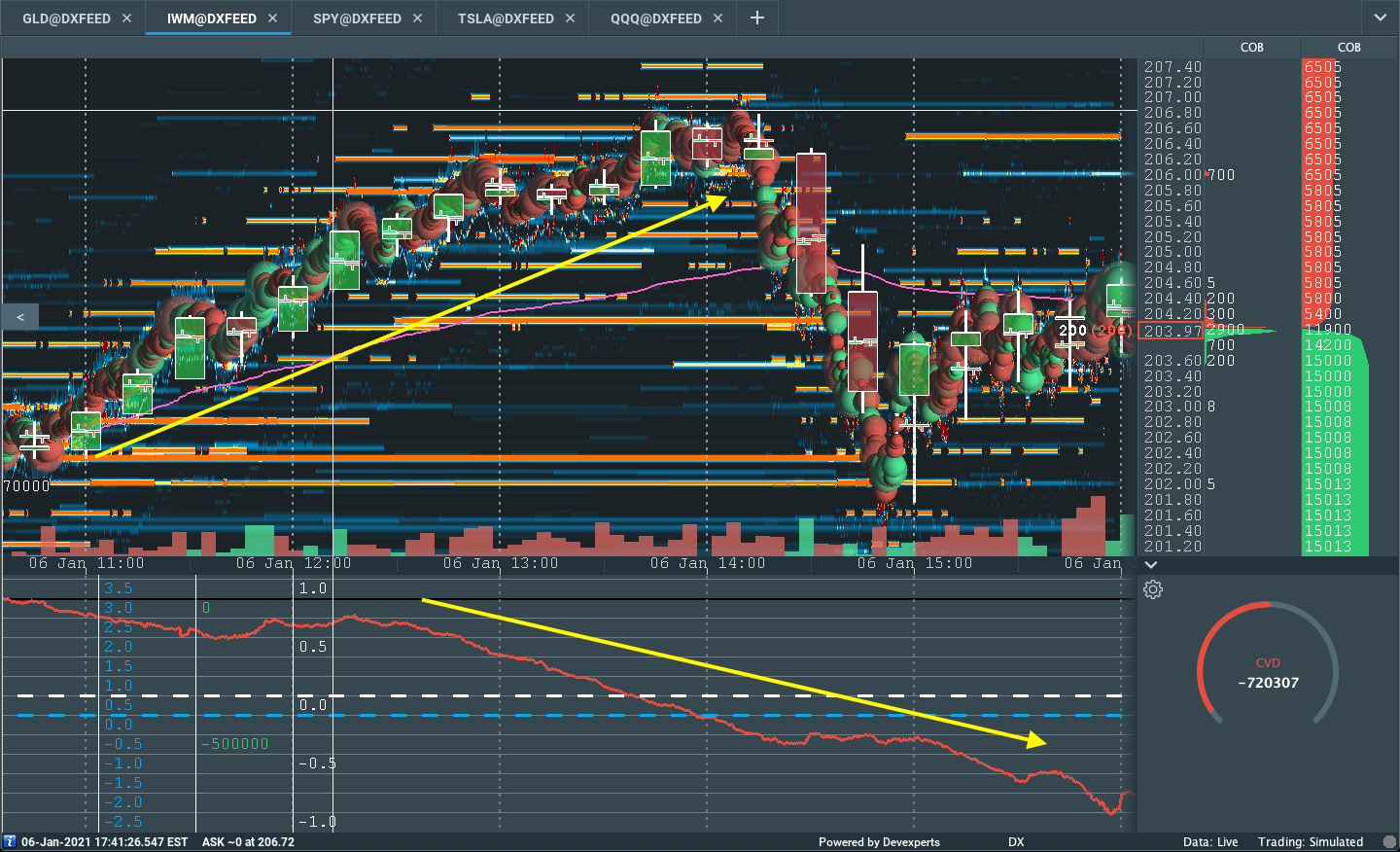

Adding, below are orderflow snapshots for the SPDR S&P 500 ETF Trust (NYSE: SPY) and iShares Russell 2000 ETF (NYSE: IWM). Note the divergence between price and volume delta in the Russell 2000 ETF; in the simplest of terms, participants were not committed at the highs.

Levels Of Interest: $3,774.75 regular trade high and $3,731.00 LVNode.

2 replies on “Market Commentary For 1/7/2021”

[…] Few dynamics to note: (1) poor structure in prior sessions, as evidenced by the low-volume areas (LVNodes) in the graphic above, (2) divergence from developing value, (3) a new overnight all-time high (i.e., historically, there is a low probability that overnight all-time highs end the upside discovery process), as well as (4) unsupportive speculative flows and delta in some instances. […]

[…] speculative flows and delta (e.g., commitment of buying or selling) in some instances, as can be viewed by order flow graphics 2 and 3 […]