The daily brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 300+ that read this report daily, below!

What Happened

Overnight, equity index futures continued lower as weakness spread overseas. Commodities were mixed and yields were lower. At a high-level, measures of implied volatility held their bid.

Apart from the removal of structural forces underpinning a rally into mid-week, earnings reports played into “fears of the consequences of if inflation is brought under control,” per Bloomberg.

Ahead is data on jobless claims and manufacturing (8:30 AM ET). Later, existing home sales and leading economic indicators (10:00 AM ET). No events are scheduled for tomorrow.

What To Expect

Fundamental: On the heels of Target reporting lower profits on costs and tighter margins, the beloved Cathie Wood of Ark Invest chimed in with a note on an explosion in inventories. Late last year, we quoted Wood suggesting businesses were scrambling to increase inventories.

Though early, she said inflation would eventually be on its way out and inventory build-ups were one of the indicators to watch.

“Walmart Inc’s (NYSE: WMT) inventories increased 33% in nominal terms on a year over year basis, translating into 20-25% in real or unit terms, as Target Corporation’s (NYSE: TGT) inventories increased by 42% and 30-35%, respectively,” Wood said.

At the same time, sentiment has plunged to Great Recession levels, all the while consumers are “rebelling against their loss of purchasing power,” and China is in turmoil (talked about May 16).

These comments play into the recession narratives we unpacked earlier this week (May 17 and May 18). Monetary policies sent money to capital and that bolstered deflationary trends.

Then came the pandemic and the increasing effects of inequality; money was sent to labor, and that bolstered inflationary trends.

As we quoted Kai Volatility’s Cem Karsan explaining, today’s contractionary monetary policy is a blunt tool and is not equipped to “address the main problem which is a lack of supply to absorb the demand.”

Likewise, Credit Suisse Group AG’s (NYSE: CS) Zoltan Pozsar explained what he felt was “the Fed is pursuing demand destruction through negative wealth effects,” as the “central banks can only deal with nominal” chokepoints.

By that token, we must “[c]onsider at least the possibility that the extreme volatility and lack of liquidity [we] see in markets is by design, and the Fed will not be deterred by it, but rather that it will be emboldened by it in its singular pursuit of price stability.”

Why does any of this matter?

As quoted, yesterday, “[w]ith supply-side economics, the only way that they can control [price stability] is to pull back. And slow capital markets decrease via the wealth effect. Ultimately, there’s a significant lag, so [the Fed is] not in a position to ultimately control inflation without bringing down markets.”

By that token, a stock market drop is both a recession and a direct reflection of the unwind of global carry. It is the manifestation of a deflationary shock, and today’s sentiment, the gradual build-up of inventories, tightening of financial conditions, and the like, are a reflection of this.

Perspectives: Recall that the indexes are trading relatively strong, in comparison to constituents, especially those that are smaller technology and growth companies.

Essentially, “we’re two-thirds of the way through a dot-com type collapse,” we quoted Simplify Asset Management’s Mike Green explaining.

“It’s just happened underneath the surface of the indices which is [that] … dynamic of passive flows supporting the largest stocks within the index, whereas the smaller stocks can be influenced to a greater extent by the behavior of discretionary managers.”

Pursuant to those remarks, JPMorgan Chase & Co’s Marko Kolanovic says there are significant opportunities in the beaten areas of the market.

“I almost refuse to talk about ‘where should I buy S&P?’” he said adding that “[m]ost of the bad things have happened already this year.”

“There will be no recession this year, some summer increase in consumer activity on the back of reopening, China increasing monetary and fiscal measures.”

Per the earlier quoted Pozsar, Kolanovic, like Wood, maybe too early in his calls.

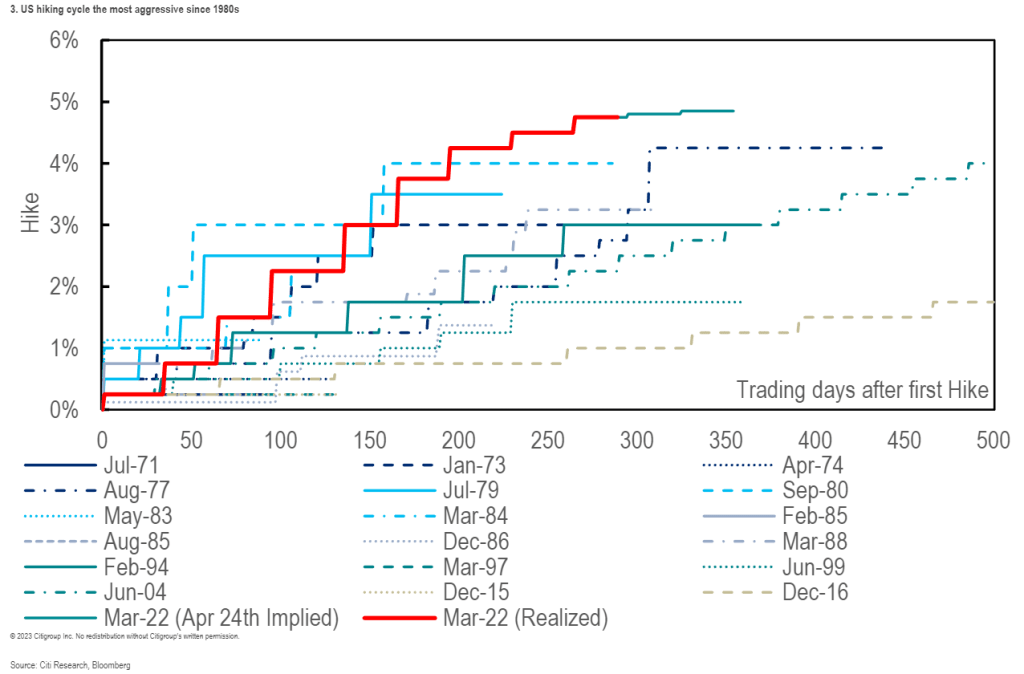

“Banks’ stock buybacks are lowering SLRs [], and the Fed is about to embark on QT,” Pozsar says. For context, QT (Quantitative Tightening) is the central banking authorities’ removal of balance sheet assets via sales or the non-reinvestment of the principal sum of maturing securities.

The dynamic is as follows: if bonds are sold, their values fall and yields rise, thus pushing yield-hungry investors into less risky asset categories.

“These nominal balance sheet and liquidity trends, will at some point clash with the realities of a garden variety of supply chain issues,” as a result of geopolitical chokepoints.

Given Pozsar’s findings, the Fed is likely to do QE again in the summer of 2023.

Checking Eurodollar (FUTURE: /GE), a reflection of participants’ outlook for U.S. interest rates, shows the peak of the Fed-rate-hike cycle – terminal rate – at around June 2023.

Positioning: This week’s expiration of options on the Cboe Volatility Index (INDEX: VIX), per SpotGamma, pulled forward the positive effects of volatility compression heading into the large May monthly equity and index options expiration (OPEX).

“Barring a forced re-pricing, we saw what was already little fuel to the upside drained into the weighty VIX options expiration (as bets on the VIX decay, this leads to hedging that bolsters S&P 500 upside),” SpotGamma said.

“Following this event (and the coming monthly May OPEX), we see the door open to lower prices amid the removal of “max put” positioning which “clears the way for lower-lows.”

Heading into the monthly OPEX, if the S&P 500 Index (INDEX: SPX) is well below $4,000.00, “the buyback of short futures to short put exposures that no longer require liquidity providers to hedge,” may bolster a sharp reversal.

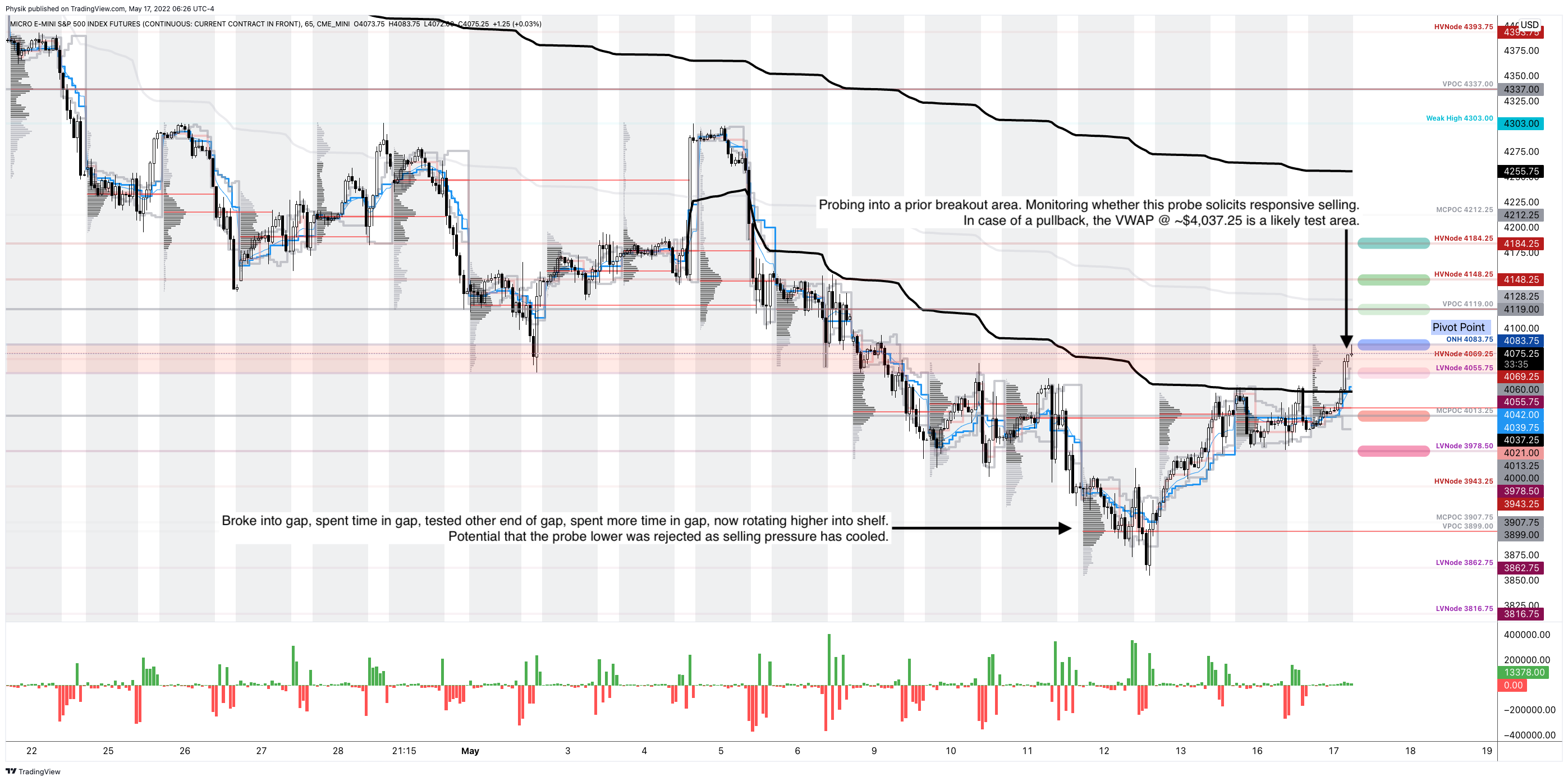

Technical: As of 8:30 AM ET, Thursday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, will likely open in the lower part of a negatively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

In the best case, the S&P 500 trades higher; activity above the $3,862.75 low volume area (LVNode) puts in play the $3,908.75 micro composite point of control (MCPOC). Initiative trade beyond the MCPOC could reach as high as the $3,943.25 high volume area (HVNode) and $4,061.00 virgin point of control (VPOC), or higher.

In the worst case, the S&P 500 trades lower; activity below the $3,862.75 LVNode puts in play the $3,836.25 LVNode. Initiative trade beyond the LVNodes could reach as low as the $3,795.75 and $3,727.25 HVNodes, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.