Market Commentary

Index futures diverge as the bracketing process continues.

- OPEC to decide on production today.

- Ahead: Claims, PMI, ISM, Fed speak.

- SPX and NDX explored higher prices.

What Happened: U.S. stock index futures auctioned sideways to higher overnight.

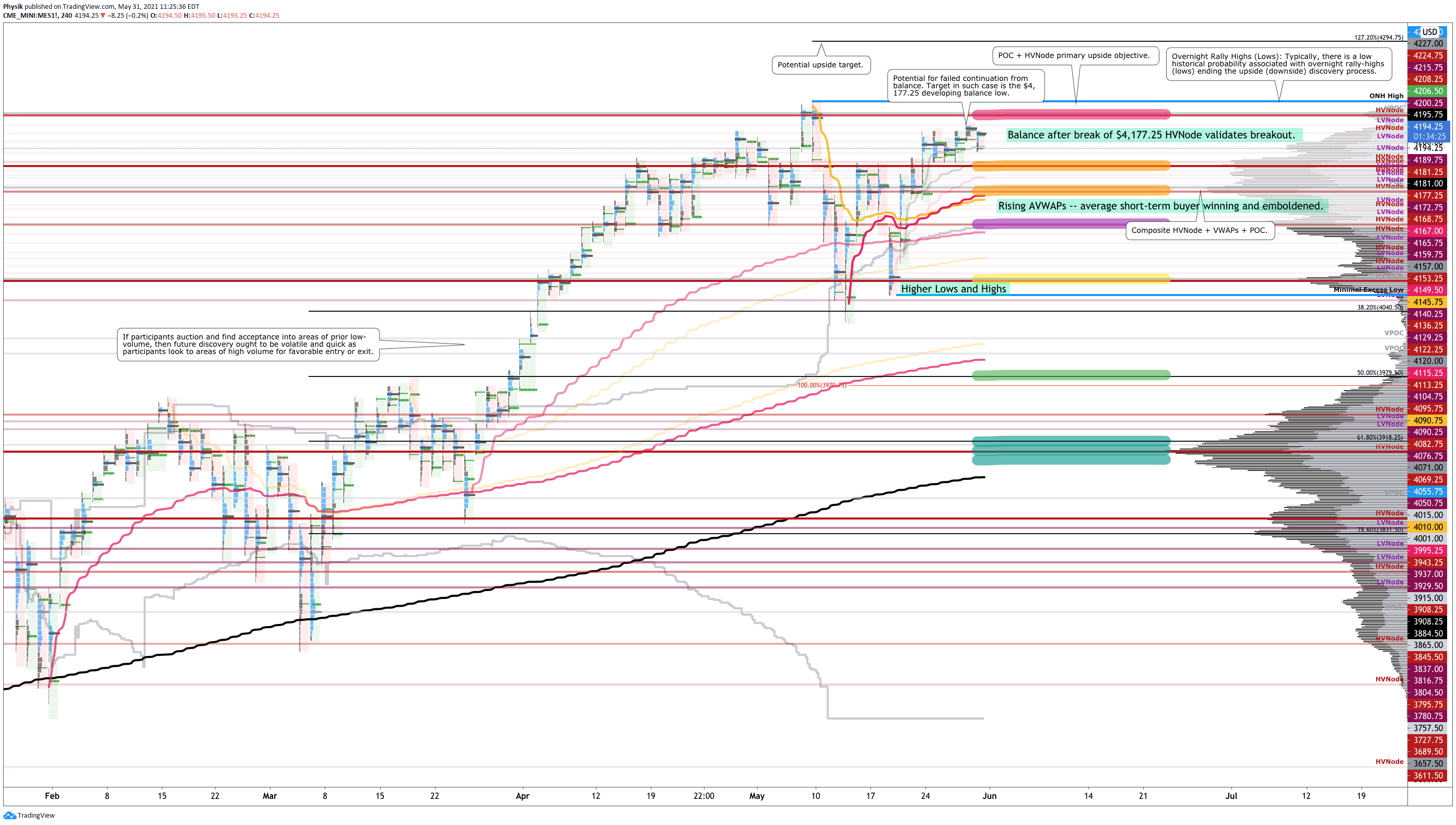

The S&P 500 and Nasdaq 100 discovered higher prices before coming back into the prior range. The Russell 2000 and Dow Jones Industrial Average hugged channel resistances suggesting a break may be imminent.

Fundamentally speaking, the U.S. added more jobs than expected last month. That’s good news ahead of Thursday releases on unemployment claims, June manufacturing PMI, ISM manufacturing, Fed speak, used car sales numbers, OECD corporate tax talk, and some miscellaneous earnings.

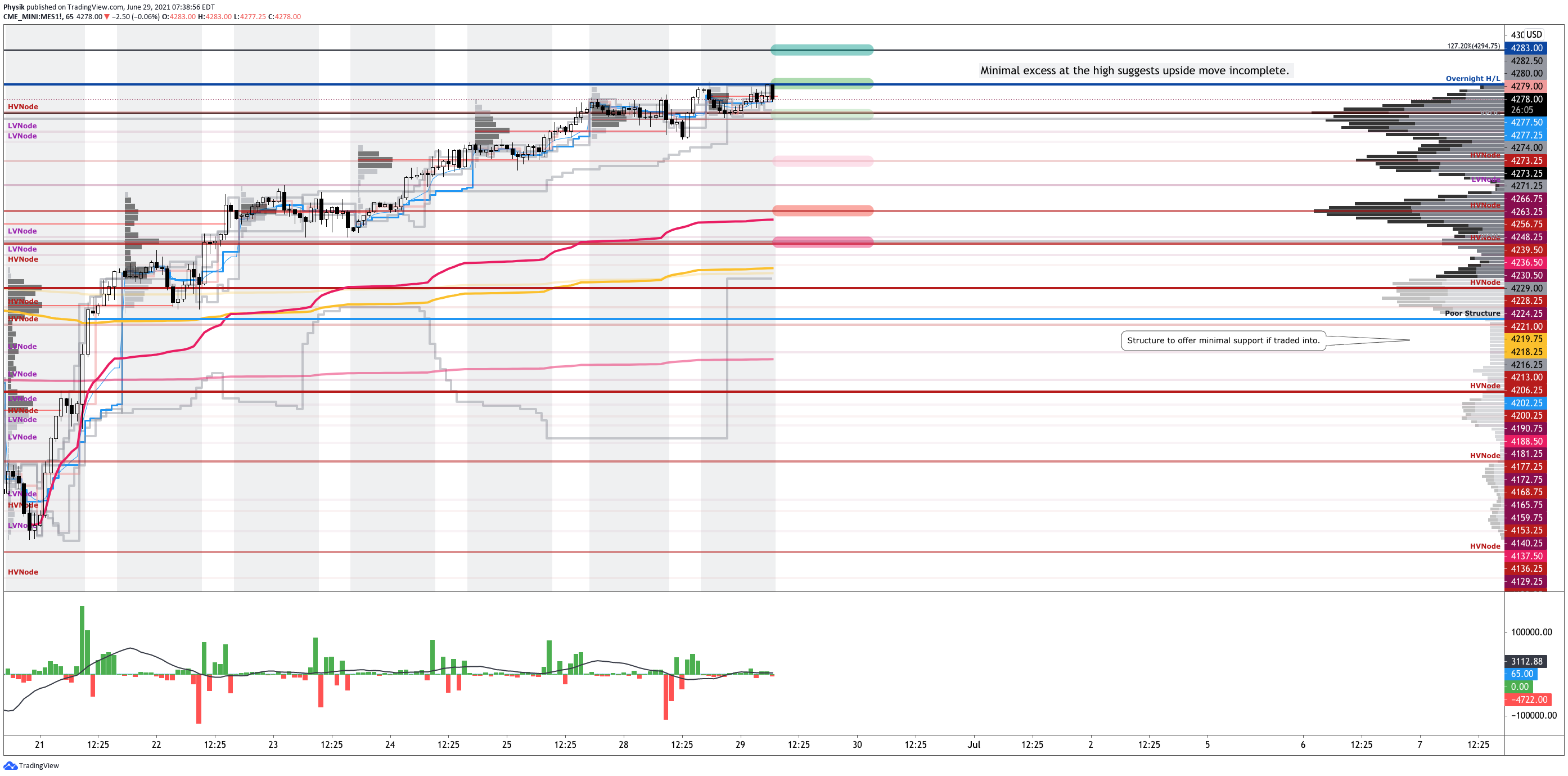

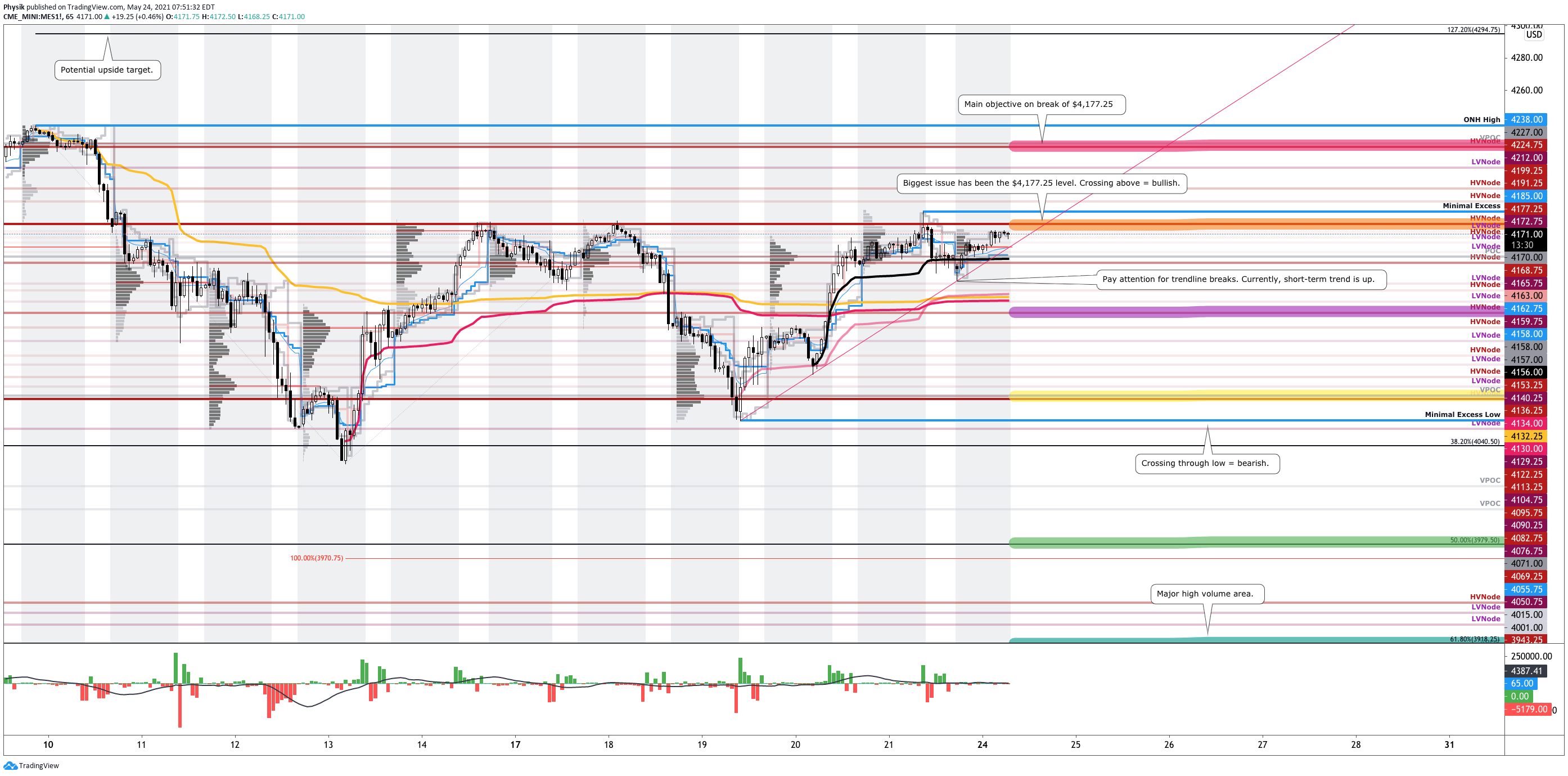

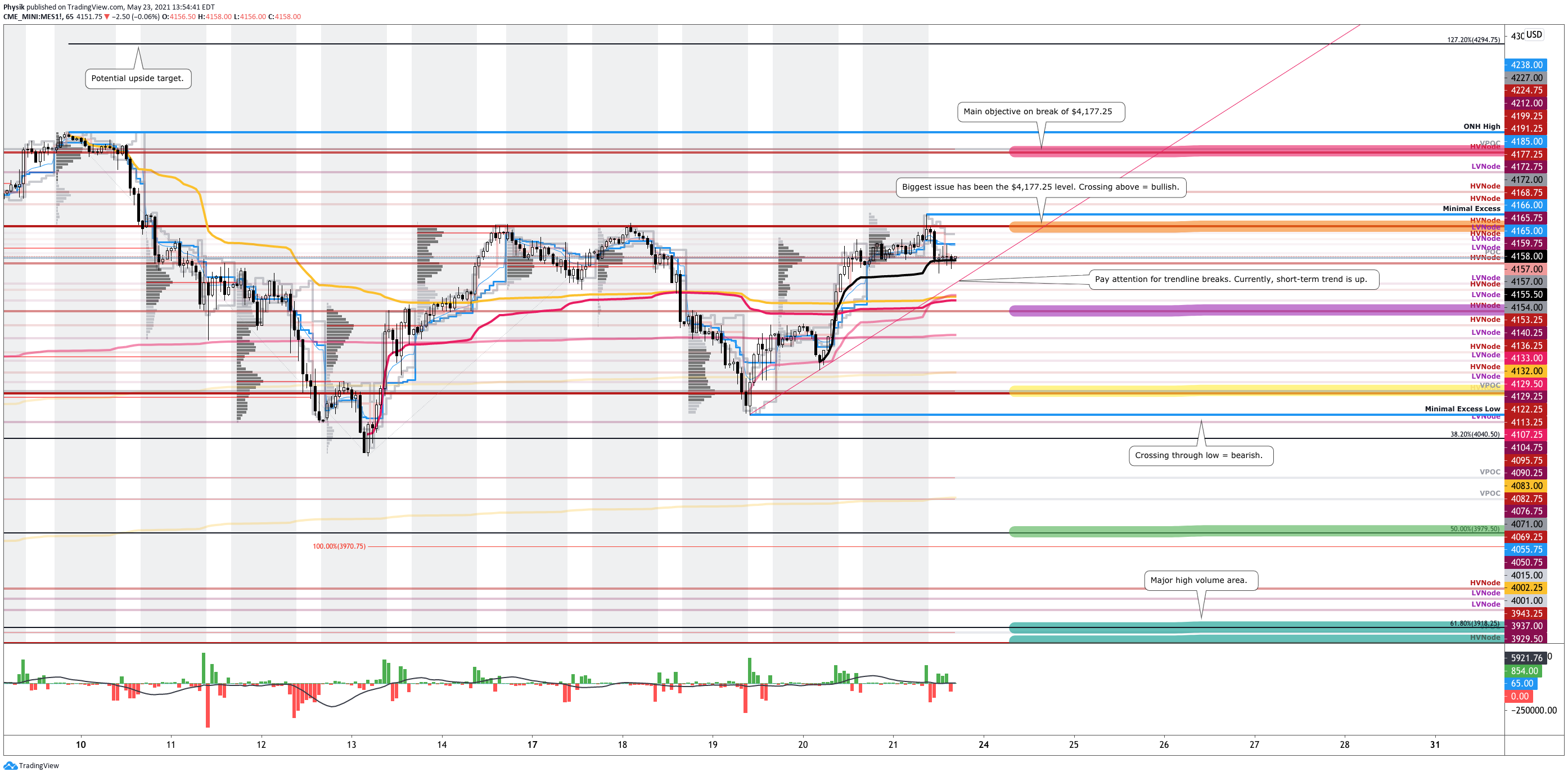

What To Expect: Thursday’s regular session (9:30 AM – 4:00 PM EST) in the S&P 500 will likely open inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, the best case outcome occurred, evidenced by sideways to higher trade, above the micro-composite Point of Control (POC) at $4,273.25.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

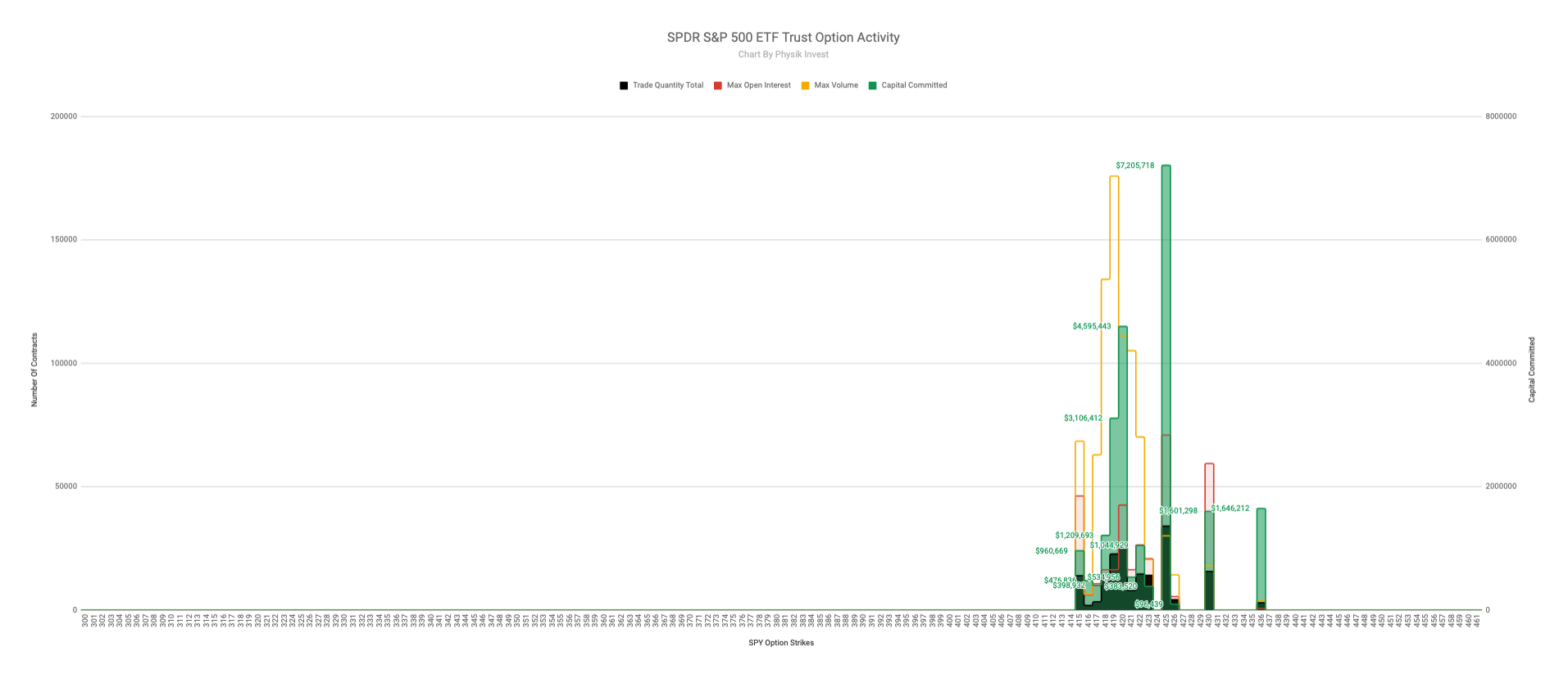

Further, after strong buying by longer time frame participants, short-term traders took over; moves became mechanical, halting at key, visual references. This comes alongside narrowing breadth, tapering volumes ahead of a holiday weekend, as well as fundamental concerns such as the resurgence of COVID-19.

Still, according to some, there is no cause for concern; “The delta variant should not have significant repercussions for the pandemic situation in developed markets (e.g. Europe and North America, which have [made] strong progress in vaccinations) due to the level of population immunity,” said strategists led by chief global markets JPMorgan Chase strategist Marko Kolanovic.

Given that broad outlook, for today, participants can trade from the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,285.00 POC puts in play the $4,294.75 level. Initiative trade beyond $4,294.75 could reach as high as the minimal excess $4,305.75 overnight high (ONH).

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices. Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

In the worst case, the S&P 500 trades lower; activity below the $4,285.00 POC puts in play the HVNodes at $4,273.25, $4,256.75, and $4,239.75.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test). If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

News And Analysis

Markets | Tesla Q2 deliveries could clear 200K, set record. (BBG)

Markets | Congress has voted to overturn True Lender rule. (Moody’s)

Markets | Credit conditions ahead – things are looking good. (S&P)

Economy | Pandemic exacerbates affordable housing stress. (Fitch)

Markets | Ford will curb output at more plants on chip issue. (WSJ)

Markets | EV car sales up as Europe’s climate targets bite. (REU)

Markets | What could higher taxes mean for U.S. equities? (BLK)

Economy | Jobs gain is higher after disappointing months. (BBG)

Markets | Robinhood wants you to buy into its IPO in-app. (WSJ)

Markets | The delta variant poses no risk to stock markets. (MW)

Energy | Saudis, Russia have deal for OPEC+ output hikes. (BBG)

Markets | The spotlight is turning to M&A for fintech SPACs. (S&P)

What People Are Saying

Innovation And Emerging Trends

FinTech | Robinhood to pay $70M in large FINRA penalty. (CNBC)

Energy | Hydropower market report – analysis and forecast. (IEA)

FinTech | Senators mull Fed crypto as China races ahead. (S&P)

FinTech | A vision for decentralized finance built on bitcoin. (BBG)

FinTech | SoftBank gave $200M to Latam crypto exchange. (REU)

Travel | Air taxis coming but not in the way you are thinking. (WSJ)

FinTech | Bank users cement relations with digital channels. (S&P)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.