Physik Invest’s Daily Brief is read free by thousands of subscribers. Join this community to learn about the fundamental and technical drivers of markets.

Administrative

A light letter, today.

Check out the Daily Brief for February 27, 2023, for how to take advantage of higher interest rates and define the outcome of your trading.

As an aside, the second to last positioning section paragraph in that letter talks about using short-dated bets like “butterflies, broken-wing butterflies, ratio spreads, back spreads, and beyond.” In the initial version of the letter, your letter writer accidentally wrote box spreads instead of back spreads. Apologies.

Positioning

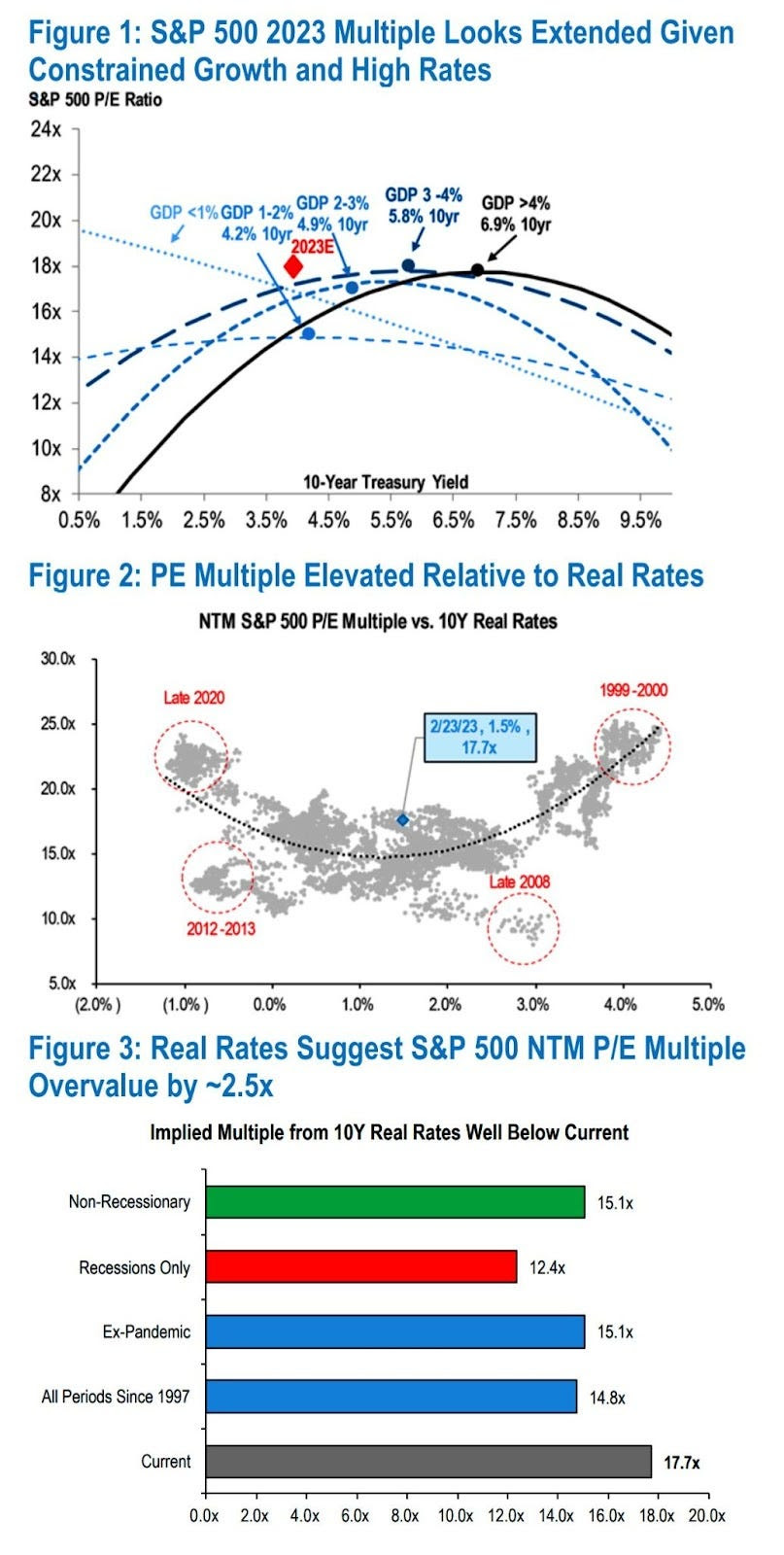

Yields are ~5.00%, and this is around the S&P 500’s (INDEX: SPX) earnings yield (i.e., the 6-month Treasury yield is about equal to the SPX’s earnings yield of 5.2%).

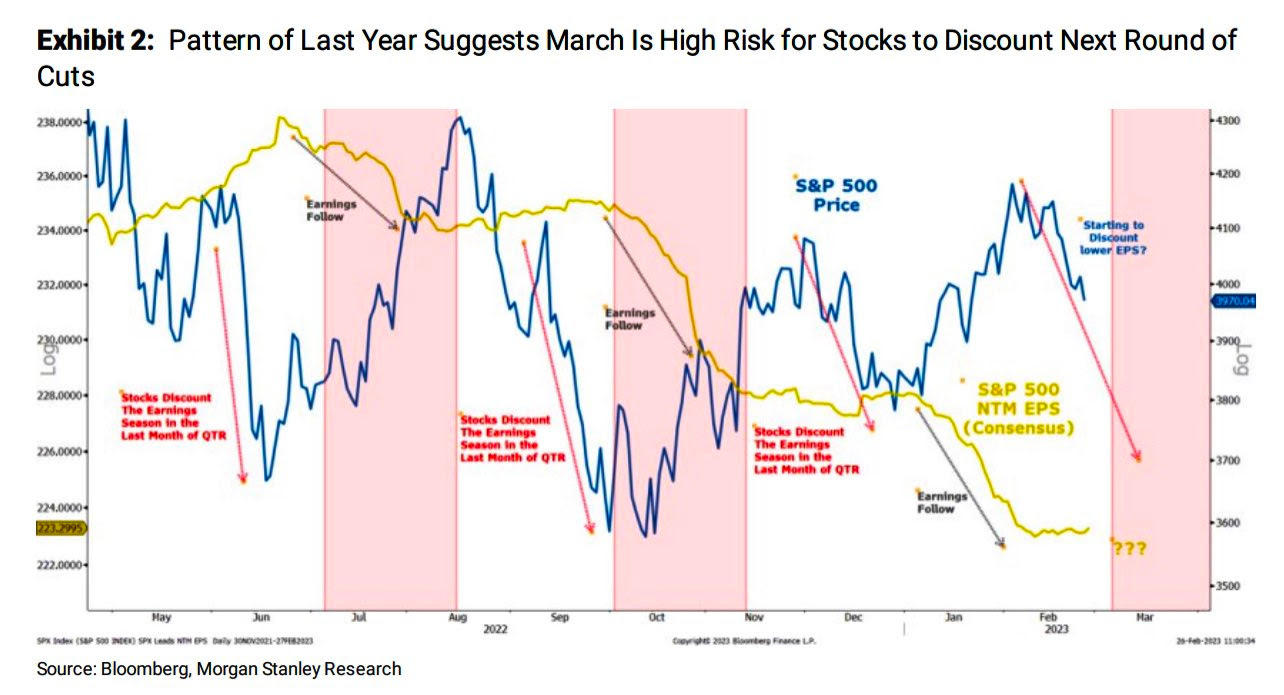

A nod to rising rates and risk premiums, the likes of Morgan Stanley suggest the S&P 500 (INDEX: SPX) will come under further pressure.

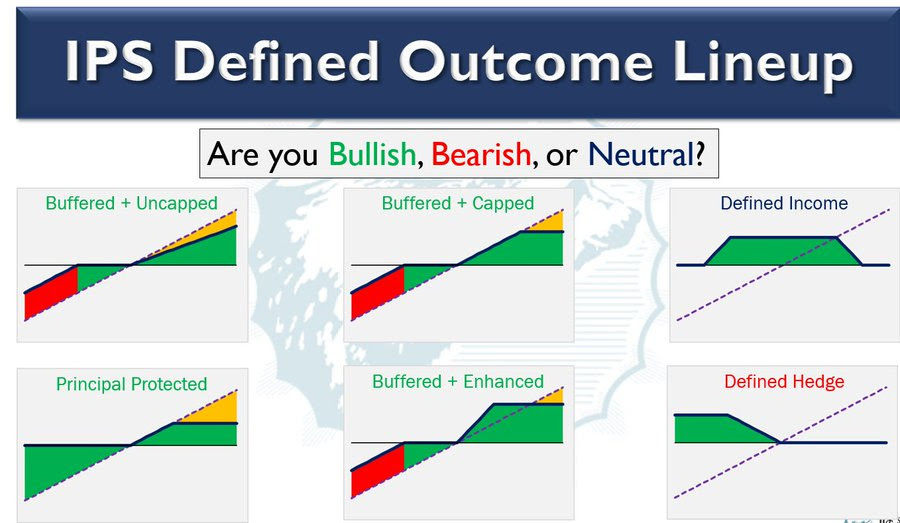

Since not all who read the letter are active in the same timeframe, in the interest of expanding the opportunity set if we will, your letter writer detailed ways to express one’s longer-term opinion on the upside or downside in a capital-protected way.

Essentially, traders can create their own structured notes, investing in a manner that returns principal only. The difference between the bond/box spread outlay and cash remaining is invested in leverage potential. At maturity, the worst-case is a return of principal.

Further, through such structures, traders can participate in the upside by about the same amount they would with a traditional construction (e.g., 60/40). However, you cut the downside.

Alternatively, traders can bias themselves short or non-directionally. In a short-bias situation, one can buy a put spread (and/or sell a call spread) with an outlay (or max loss) not exceeding the cash remaining after the purchase of a bond or box spread.

Through a short-biased setup, traders may participate in potential downside on the pricing of equity market headwinds.

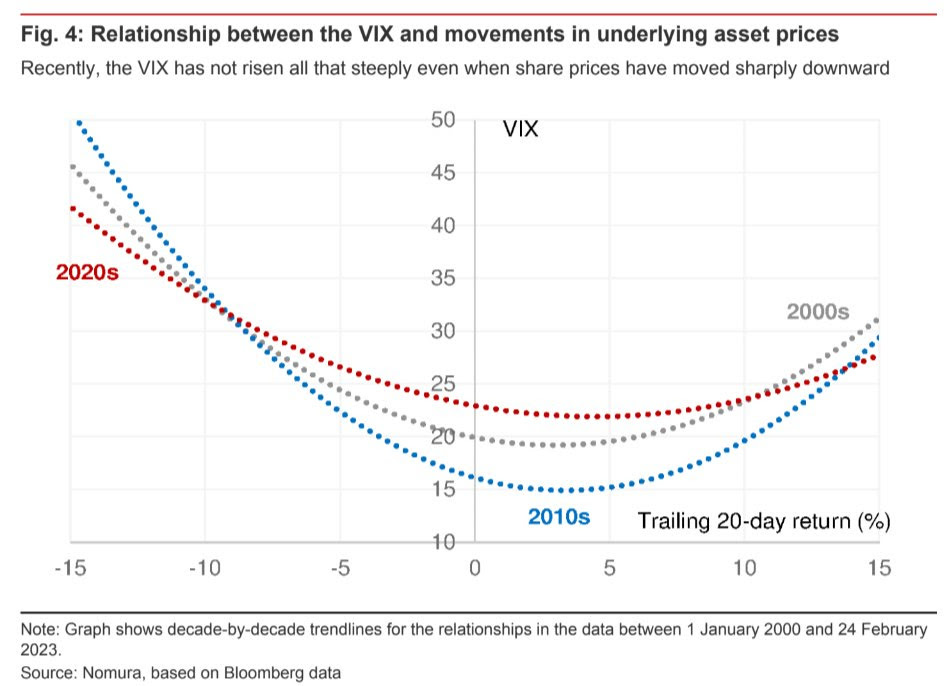

The suggested downside trades are rather attractive now in the absence of hedging demands in longer-dated protection convex in price and volatility. Naive measures like the Cboe VIX Volatility (INDEX: VVIX), as well as the graphic below, allude to the little demands for convexity and a declining sensitivity of the VIX with respect to changes in share prices.

Technical

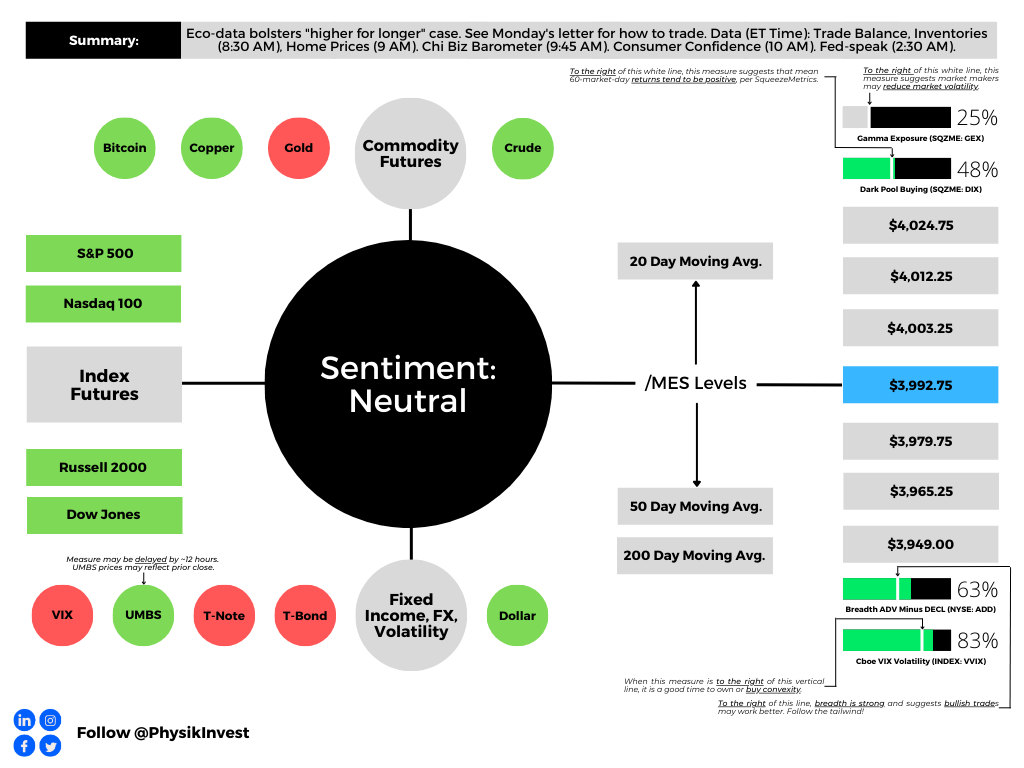

As of 6:30 AM ET, Tuesday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the upper part of a negatively skewed overnight inventory, inside of the prior day’s range, suggesting a limited potential for immediate directional opportunity.

The S&P 500 pivot for today is $3,992.75.

Key levels to the upside include $4,003.25, $4,012.25, and $4,024.75.

Key levels to the downside include $3,979.75, $3,965.25, and $3,949.00.

Disclaimer: Click here to load the updated key levels via the web-based TradingView platform. New links are produced daily. Quoted levels likely hold barring an exogenous development.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for a period of time, this will be identified by a low-volume area (LVNodes). The LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to the nearest HVNodes for more favorable entry or exit.

POCs: Areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: Denote areas where two-sided trade was most prevalent over numerous sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

About

The author, Renato Leonard Capelj, works in finance and journalism.

Capelj spends the bulk of his time at Physik Invest, an entity through which he invests and publishes free daily analyses to thousands of subscribers. The analyses offer him and his subscribers a way to stay on the right side of the market. Separately, Capelj is an options analyst at SpotGamma and an accredited journalist.

Capelj’s past works include conversations with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, North Dakota Governor Doug Burgum, Lithuania’s Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Connect

Direct queries to renato@physikinvest.com. Find Physik Invest on Twitter, LinkedIn, Facebook, and Instagram. Find Capelj on Twitter, LinkedIn, and Instagram. Only follow the verified profiles.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes. Capelj and Physik Invest manage their own capital and will not solicit others for it.

One reply on “Daily Brief For February 28, 2023”

[…] growth and inflation headwind to bonds and commodities), traders can look to Physik Invest’s Daily Brief for February 28, 2023, for ideas on how to navigate. In that letter, we talked about how traders can participate in the […]