Key Takeaways:

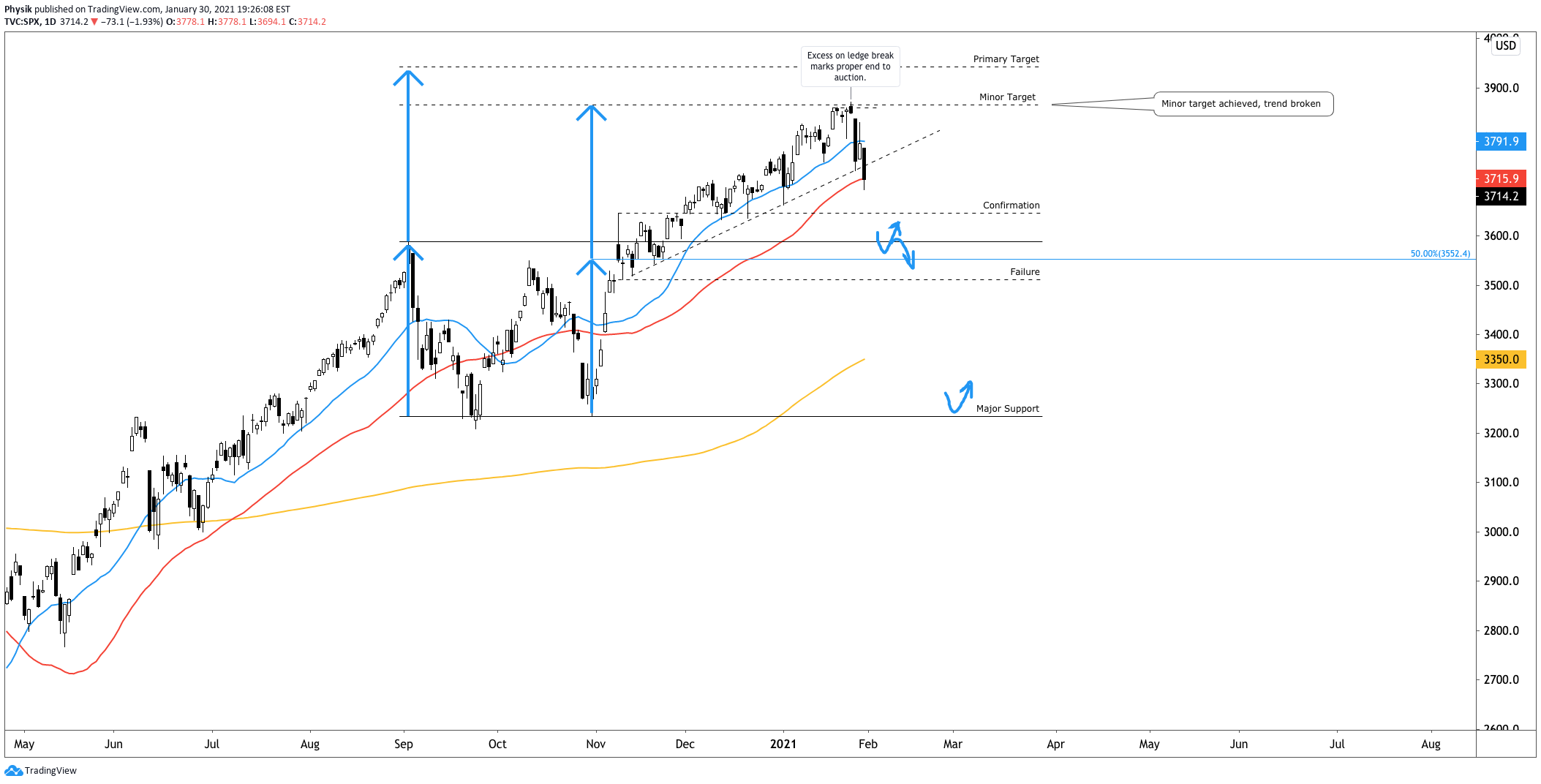

- Trend broke, growth downgraded, a top is in.

- De-leveraging amid hot sentiment, panicking.

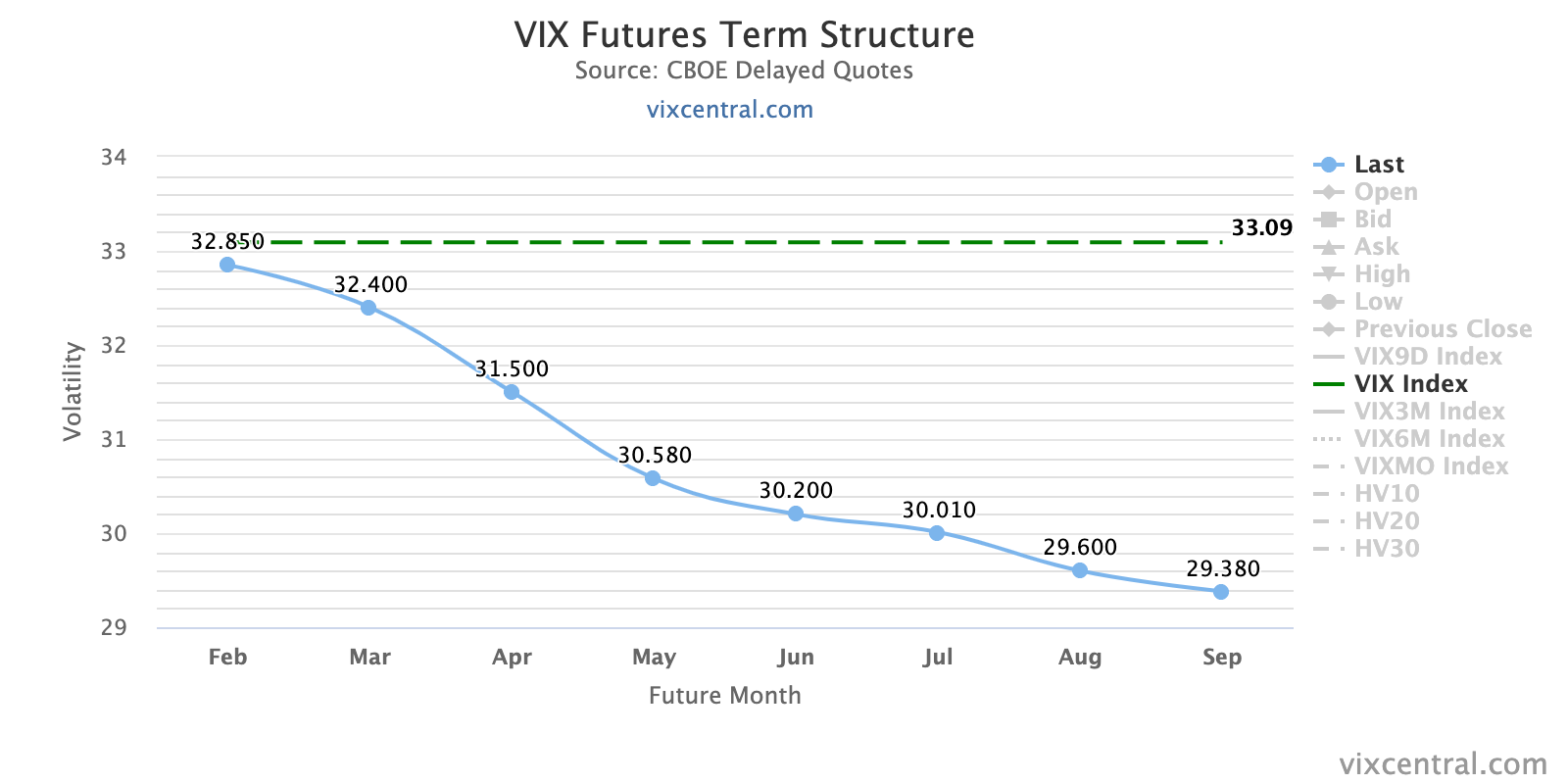

- VIX term structure inverts, outlier risk is on.

- Dips will present a favorable buy opportunity.

What Happened: Amid a volatile, news-heavy week, after a slew of earnings reports by heavily weighted index constituents, and an FOMC meeting that made no change to existing monetary policy, financial markets experienced a rapid de-risking, similar to what transpired prior to the sell-off in February 2020.

What Does It Mean: After extending the S&P 500’s rally, as well as establishing acceptance near the $3,850.00 price extension, an upside target, and excess (i.e., a proper end to price discovery), participants auctioned back into range, repairing poor structures left in the wake of initiative buying.

The action found acceptance below the $3,824.00 – $3,763.75 balance-area, invalidating the prior week’s break-out to new highs.

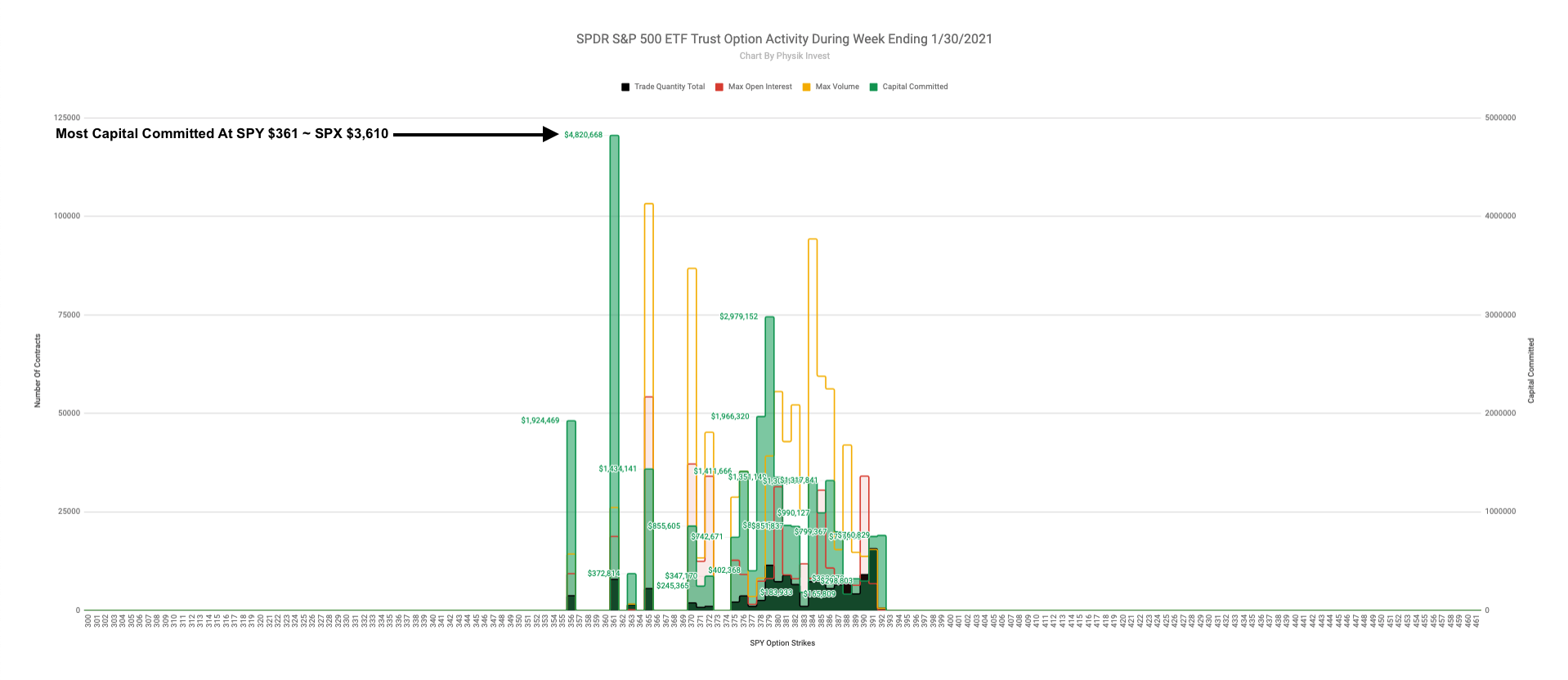

Since then, market participants were witness to violent two-sided trade, a result of the market transitioning into a short-gamma environment (Graphic 1).

In such case dealers hedge derivatives exposure by buying into strength and selling into weakness. This, will exacerbate volatility.

In a conversation for a Benzinga article to be released this coming week, I spoke with Kris Sidial, co-chief investment officer at The Ambrus Group, a volatility arbitrage fund, regarding GameStop Corporation (NYSE: GME) share price volatility, market microstructure, and regulation.

According to Sidial, the dynamics that transpired in GameStop can be traced back to factors like Federal Reserve stabilization efforts, and low rates, which incentivize risk taking (see Graphic 2).

“The growth of structured products, passive investing, the regulatory standpoint that’s been implemented with Dodd-Frank and dealers needing to hedge off their risk more frequently, than not,” are all part of a regime change that’s affected the stability of markets, Sidial notes.

“These dislocations happen quite frequently in small windows, and it offers the potential for large outlier events,” like the equity bust and boom during 2020. “Strength and fragility are two completely different components. The market could be strong, but fragile.”

The aforementioned regime change is one in which dealer exposure to direction and volatility promotes crash up and down dynamics. Last February, the market was heavily one-sided with participants, like target date funds (e.g., mutual funds), selling far out-of-the-money puts on the S&P 500 for passive yield, and investors buying-to-open put options in an increasing amount for downside exposure, thus exacerbating volatility.

Last week, per Graphic 4, the SPDR S&P 500 ETF Trust, the largest ETF that tracks the S&P 500, saw a rise in purchases of downside protection with time, which will likely lead to an increase in implied volatility and sensitivity of options to changes in underlying price.

These risks will be hedged off by dealers selling into weakness (see Graphic 3), thereby exacerbating downside volatility.

The activity was most concentrated in put options with a strike price of $361, corresponding with $3,610 in the cash-settled S&P 500 Index (INDEX: SPX). This, alongside the market’s entry into short gamma, and an inversion of the VIX futures term structure (see Graphic 5), in which longer-dated VIX expiries are less expensive, is a warning of elevated near-term risks for equity market stability.

What’s more? Aside from breaking technical trend (Graphic 6) is DIX, a proxy for buying derived from short sales (i.e., liquidity provision on the market making side) declining, and the presence of divergent speculative flows and delta (e.g., non-committed buying as measured by volume delta).

What To Expect: In light of the technical breakdown U.S. stock indexes are best positioned for downside discovery.

As a result, participants ought to zoom out, and look for valuable areas to transact.

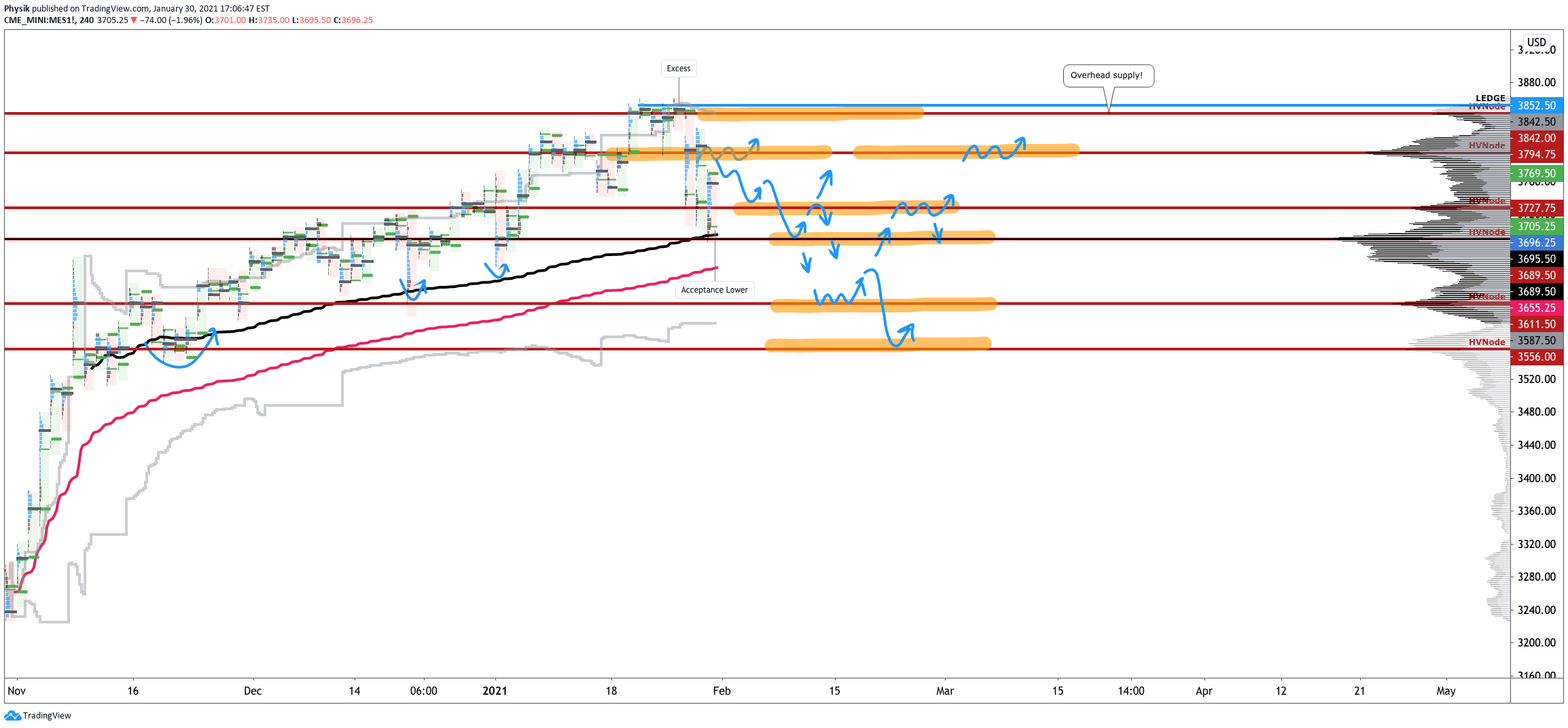

In Graphic 9, the highlighted zones denote high-volume areas (HVNodes), which can be thought of as building blocks.

A structurally sound market will build on past areas of high-volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low-volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low-volume, as they have in the week prior, then future discovery ought to be volatile and quick as participants look to areas of value for favorable entry or exit.

Additionally, it’s important to remember what the market’s long-term trajectory is: up.

Late last year, JPMorgan Chase & Co. (NYSE: JPM) strategist Marko Kolanovic suggested equities would rally short-term with the S&P 500 auctioning as high as $4,000 on the basis of low rates, improved fundamentals, buybacks, as well as systematic and hedge fund strategies. Since then, Kolanovic has downgraded growth and suggested the limited potential for further upside despite odds of a sustained economic recovery.

Note, Kolanovic has not called for an implosion in equity markets. Instead, the market is due for some downside discovery given a moderation in the recovery.

Given the above dynamics, the following frameworks apply for next week’s trade.

In the best case, the S&P 500 takes back Friday’s liquidation and auctions above the $3,727.75 HVNode. Expectations thereafter include continued balance.

In the worst case, any break that finds increased involvement (i.e., supportive flows and delta) below the $3,689.50 HVNode, would favor continuation as low as the $3,611.50 and $3,556.00 HVNodes. Note that the second to last HVNode corresponds with the $361 SPY put concentration, which may serve as a near-term target, or bottom, for this sell-off, given last week’s activity at that strike.

Conclusions: Participants ought to look for favorable areas to transact, such as those highlighted areas in the S&P 500, featured in Graphic 9.

Big picture, the sell-off ought to be bought, just not yet. Per Graphic 11, euphoria is still too high.

Levels Of Interest: $3,727.75, $3,689.50, $3,611.50 and $3,556.00 HVNodes.

5 replies on “Market Commentary For The Week Ahead: ‘The Flow Won’”

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]