Key Takeaways:

- Democrats are gaining traction in Georgia.

- Stricter lockdown restrictions on their way.

- Positioning – less volatility, room for higher.

- Higher-time frame breakouts remain intact.

What Happened: Coming into the extended holiday weekend, on tapering volumes, U.S. index futures balanced for four regular trading sessions (9:30 AM – 4:00 PM ET), before breaking out.

What To Expect: Thursday’s session found initiative buying surface above the $3,731.00 high-volume node (HVNode), the market’s most recent perception of value.

Given four-sessions worth of unchanged value, and the failure to fill the gap beneath a weak low (i.e., a visual level that attracts the business of short-term, technically-driven market participants) at $3,714.50, participants will come into Monday’s session knowing the following:

- Amid Thursday’s late-day buying, price diverged from value.

- The overnight rally high at $3,747.75 was recovered (i.e., based on historical trade, there were low odds that the overnight all-time high would end the upside discovery process).

- The multi-month upside breakout targeting S&P 500 prices as high as $4,000.00 remains intact.

In light of the above dynamics, the following frameworks apply for next week’s trade.

In the best case, the S&P 500 remains above its $3,731.00 HVNode. Expectations thereafter include continued balance, or a response followed by initiative buying to take out the price extension at $3,756.75.

In the worst case, the S&P 500 initiates below its $3,731.00 HVNode. Expectations thereafter include a test of the weak, minimal excess low at $3,714.50, and subsequent follow-through as low as the $3,691.00 break-point.

Noting: Excess forms after an auction has traveled too far in a particular direction and portends a sustained reversal. Absence of excess, in the case of a low, suggests minimal conviction; participants will cover (i.e., back off the low) and weaken the market, before following through.

Two go, no-go levels exist; trade that finds increased involvement above $3,752.75 and below $3,714.50 would suggest a change in conviction. Anything in-between favors responsive trade.

Conclusion: From an uneven recovery, stimulus, elections, trade, and the like, it helps to boil it down to what actually matters: price and value.

Though risks remain, markets are pricing in the odds of a continued rebound. All broad-market indices are in an uptrend. A break below $3,600.00 in the S&P 500 would denote a substantial change in tone.

Levels Of Interest: $3,752.75 rally-high, $3,714.50 weak low, $3,731.00 HVNode, $3,756.75 price extension, $3,691.00 break-point.

Bonus: Here is a look at some of the opportunities unfolding.

/6E

AAPL

ADBE

AMD

AMZN

AZO

BA

BABA

BKNG

BRK

CMG

FDX

GLD

GOOGL

MSFT

NDX

NFLX

NVDA

PLTR

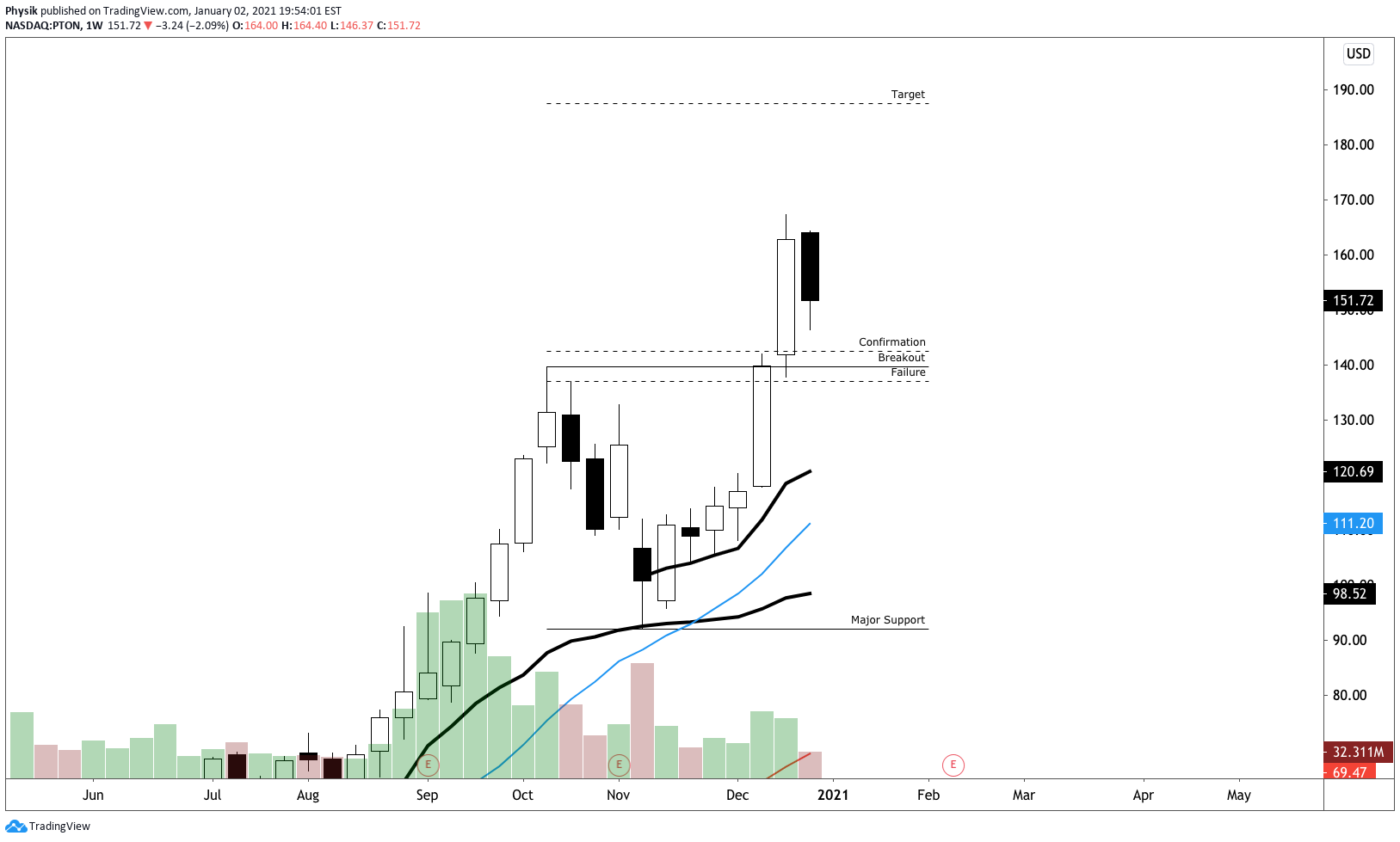

PTON

REGN

RUT

SHOP

SLV Weekly

SLV Monthly

SPOT

SPX

TSLA

TTD

ZM

Photo by Max Walter from Pexels.

5 replies on “Market Commentary For The Week Ahead: ‘Hello, Goodbye’”

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]

[…] Notice: To view this week’s big picture outlook, click here. […]